The CRA has confirmed that Canadians can top up their TFSAs with the new $10,000 limit for 2015

New annual limit will be $10,000, double the amount of the TFSA’s original yearly contribution

Get clients thinking of the TFSA as an emergency fund

CRA interpretation bulletin is considered to be outdated

The IIAC wants to ensure certain penalties are borne by account holders, not institutions

Contributions expected to rise 34 per cent: BMO

Industry group urges government to consider contribution changes to RRSP, TFSA and tax incentives for startups

Survey finds 42% have no intention of opening one this year

Account holders remain confused about the investments they can hold in a TFSA

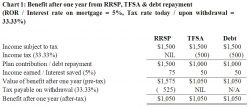

With interest rates low, does it still make sense to pay down debt? Or is contributing to an RRSP, or even a TFSA, a wiser choice? Jamie Golombek offers his advice.