Having a probable career path and a plan to save for education can make a big difference

Despite concerns, only 35% take advantage of special education savings vehicles

The regulator is concerned that Bouji’s father, who has been banned, remains actively involved in the businesses

New StatsCan study finds RESPs are more concentrated in families with higher income, greater wealth and higher levels of parental education

The firm has created its own RESP account-opening process through Canadian ShareOwner after stopping support of the product soon after launching in 2014

The proposal would improve the consistency of the tax rules governing registered plans and won’t affect the vast majority of RESP and RDSP holders, the government argues

The review to assess operational practices began in November

Advisors can play a key role in ensuring clients understand and prepare for the costs related to their kids’ post-secondary education

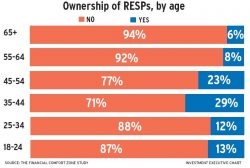

Few older Canadians contribute to RESPs, but they are gaining the attention of this group as a way to help grandchildren

$1,200 grant available to RESP beneficiaries