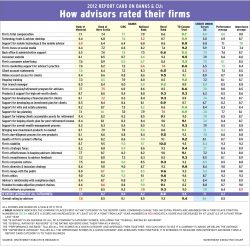

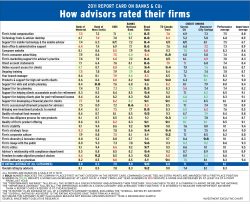

How advisors rated their firms

Advisors experience some steep declines in their productivity

Firms in the survey still have some gaps to close

Ratings for deposit-taking institutions continue to improve, as do the metrics for advisors’ businesses (includes main chart and one other)

Those with deposit-taking firms are becoming more competitive with the traditional retail investment industry (includes chart)

Although advisors are seeing their take-home pay increase, their satisfaction with compensation is not keeping pace

Advisors say that the banks and credit unions could be doing a lot better when it comes to tech tools and back-office support

As client and advisor dissatisfaction with account statements continues to mount, much praise emerges for clients’ online access

Banks and credit unions are putting serious efforts toward promoting diversity in the workplace

The two credit unions in this Report Card have seen dramatic improvements in a variety of areas over the past year