Although advisors at most firms say there is much work to be done, those with two banks report significant levels of satisfaction

Deposit-taking institutions need to do much better when it comes to advisors' compensation structures

There were lower ratings across the board - and for three banks, in particular.But there also were bright rays of light

Younger advisors are joining the business in greater numbers

Advisors praise their firms' efforts in providing comprehensive product shelves

The high standing of Canadian banks among their global peers is helping advisors attract clients and retain business

Strong branding initiatives were praised significantly by advisors, as were certain marketing support strategies

Financial advisors who work at deposit-taking institutions are increasingly of two minds when it comes to the leadership of their firms

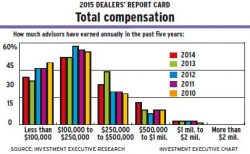

Firms are doing better than ever when it comes to compensation, but advisors still see much room for improvement

Financial advisors surveyed for the Report Card say they like the stability of their firms