As global financial regulators begin implementing new requirements, policy-makers are hammering out the details of these reforms and assessing the impact of measures already introduced

Low commodities prices, rising interest rates and political instability will hamper emerging markets outside Asia. But fund portfolio managers see upside in some industries

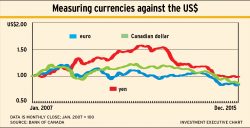

As we head into 2016, the U.S. dollar is likely to remain around current levels against most currencies. But that does not preclude some ups and downs

Health care, consumer discretionary and telecommunications services stand out as favourites on Wall Street for 2016. Information technology, financial services, industrials and consumer staples also are recommended

Corporate sector has benefited from "Abenomics," while quantitative easing has pushed down the yen vs the US$, making exports more profitable

As China's government faces several challenges, the world's second-largest economy is expected to grow by more than 6% this year. Investment opportunities are shifting from export-driven industries to a new domestic economy

Despite market volatility, the region exhibits encouraging signs for investment - especially among domestically focused companies - as the economy begins to pick up steam

India's economy, which is self-contained and has little reliance on exports, is also a major importer of oil. Some say it has tremendous long-term potential

Benjamin Tal, deputy chief economist at CIBC World Markets Inc., examines the crisis in China, discusses global trends and gives investors tips for getting lift-off during volatile and uncertain markets in a year of subdued economic growth.