With high stock valuations in attractive sectors and commodities in a slump, Canadian investors are treading carefully

Most portfolio managers have their eyes set on equities, but their enthusiasm is tempered by rich valuations for U.S. stocks and the potential that the Fed could start raising interest rates

What central bankers do in 2015 will affect your clients' portfolios

Most economists have predicted rate increases annually since 2009, but those predictions have not come true and rates have remained low. Once again, the consensus is that rates will rise in 2015, but not before mid-year

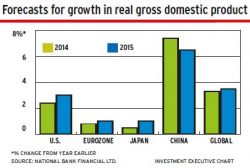

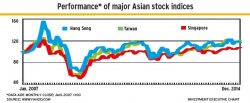

Growth in Asian countries (excluding China) is being driven by a healthy combination of external demand and rising domestic consumption. Potential tightening of global financial markets presents some downside risk

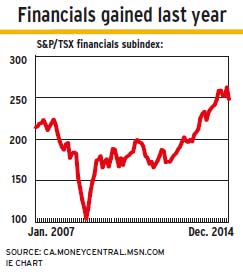

After a solid year, slower domestic growth and uncertainty in the energy sector are likely to mean a more muted performance for banks, insurers and investment firms in the year ahead

Given the weakness in the region's economies - plus the risks they face on several fronts - the overall sentiment on European equities is negative. Thus, many valuations are depressed

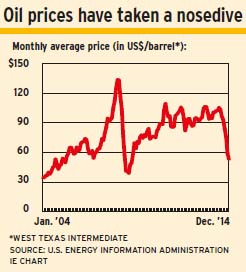

The U.S. is one of the brighter spots among world economies. But with a sharply rising currency and markets nervous over the effects of plummeting oil prices, much may depend on how the Fed fine tunes interest rates in the year ahead

Financial markets are worried about deflation, particularly in Europe but also elsewhere. In the U.S., the combination of steep drops in oil prices and a rising U.S. dollar (US$) lowers the cost of imports, keeping the rate of inflation low. However, global portfolio managers and strategists say these worries are exaggerated. Low inflation is not […]