But perhaps not so great for fixed-income

The current downward trend in gold bullion prices could continue, especially if the global economic recovery accelerates and political threats abate. But some pessimists expect bullion prices to rise due to concerns over unresolved issues in world markets

The bull market that ran rampant in the U.S. in 2013 will face some challenges in the year ahead, but U.S. stocks are expected to survive a mild correction this year and continue their upward surge in 2015

Recent figures show a healthier rate of economic growth than earlier last year, when a slowdown looked to be in the cards for the globe's second-largest economy

The Continent is still appealing, but portfolio managers caution that investors need to pick and choose, and that some countries still are struggling to extricate themselves from the debt crisis

Excess capacity, combined with high unemployment, is keeping the CPI in check in the industrialized world. Europe, meanwhile, is flirting with deflation

The government is confronting its long-standing deflation, with an aggressive tax policy and labour reform. Many portfolio managers are optimistic about the effects of the 2020 Olympics, predicting stock appreciation in some sectors

Some fund portfolio managers are focusing on stock selection in this tough environment. However, commodity prices should start to improve in 2015 as growth in the global economy gains steam

Financial services firms and their regulators will be working to finalize and implement major regulatory reforms rule-makers also will be assessing the impact of recently implemented changes

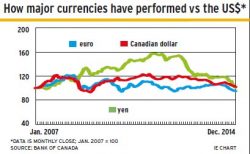

Canadian investors can benefit from the anticipated rise of the U.S. dollar this year. But the picture is murky if your clients have exposure to European securities