A BCSC study finds Investors might be learning, but they don’t always seem to know what to do about it

Nearly half of those who have already inherited wish they had sought financial help

A new report finds that younger Americans are spending more on groceries, restaurants, coffee, alcohol or marijuana, while 37% are not saving anything toward retirement

Six principles aim to better engage millennials in investing

More than 75% of users surveyed say the service is “better” or “much better” than a traditional investment experience

Report offers insight into the decisions Ontario millennials are making when it comes to saving and investing

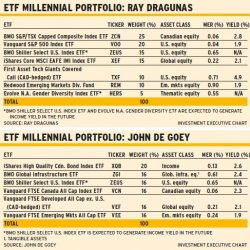

Millennial clients who begin a low-cost plan of saving for retirement now will reap the benefits over time. We asked two portfolio managers with ETF expertise to craft portfolios for a hypothetical millennial client who's investing for retirement

Investment results often more dependent on investor’s behaviour than on fund performance, report finds

For the most part, this demographic is not familiar with critical components of their policies, such as “rescission rights” and “coinsurance”

This generation is concerned with debt repayment as opposed to saving for retirement, even though they have concerns about affording retirement