A new study published by the Futures Industry Association finds trading innovations do not appear to have affected the volatility of prices

New rules will come into force in stages over nine months

Report calls for assessing the impact of introducing a tax on high-frequency trading

Panther Energy to pay US$1.4 million civil penalty for ‘spoofing’

Thomson Reuters agrees to stop giving advance look to high frequency traders

Aequitas says it wants to level the playing field for all market participants

Regulator wants a third-party opinion on the effects of HFT on market quality and integrity

Australian Securities and Investments Commission report examines impact of dark liquidity and high-frequency trading

Dealers called on to implement policies to address, detect, prevent and report manipulative and deceptive activity

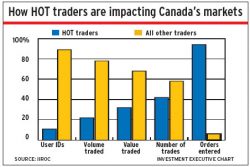

A new IIROC report is looking to provide a better understanding of high-frequency trading and its role in the market