There’s pressure on advisors’ AUM at some firms, which is impacting their compensation negatively and also often affecting advisors’ views of their dealers

Pablo Fuchs, senior editor with Investment Executive, and Fiona Collie, staff writer, discuss why survey participants believe their dealer firms are failing to meet expectations in some key categories.

With ratings declining in some key areas and fewer advisors prepared to recommend their firms, advisors believe their firms could be doing a lot more to keep them satisfied

How advisors rated their firms

Many advisors bemoan their firms not standing up to the regulators or offering enough support to deal with regulatory changes, and firms struggle to be in compliance

Getting things right in handling advisors' feedback can be a challenge for firms even when they put significant efforts in place to accept and respond to that feedback

Having skilled, experienced and helpful staff with long tenure in the firm goes a long way toward ensuring advisors are satisfied with their dealer firm's back-office department

Much praise was given to dealer firms that have an extensive mutual fund offering and provide access to other products that cater to specific clients

Almost nine in 10 advisors said their dealer firms don't encourage advisors to drop the smallest clients from their books of business. Advisor independence and the need to take care of growing clients' needs were cited as key reasons

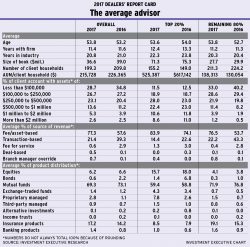

The emergence of new competitors, such as robo-advisors, combined with the impact of increased regulation and shifts at both the client level and within the advisor population, have led to a drop in average AUM and productivity