Advisors are feeling unsettled as their firms go through major transitions related to ownership, management and technology. But there's hope things will begin to improve

How financial advisors rated their firms

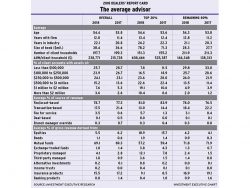

Although average assets under management and productivity rose year-over-year, there are signs the industry is evolving as advisors adopt fee-for-service arrangements and cater to clients with greater levels of investible assets

Most advisors surveyed for this year's Dealers' Report Card were strongly against regulators banning embedded commissions

Lower ratings for "firm's stability" arose from advisors' frustration with many of the major changes taking place

Advisors are pleased with the products their firms make available, as well as with the freedom to sell what they prefer

Issues with tech platforms and firms' lack of support for e-signatures were key reasons for advisors' dissatisfaction

An overabundance of information and the move away from consolidation of information has resulted in a surge of complaints

Dealer firms are failing to keep advisors informed, especially when there are significant changes taking place

Although there have been significant changes to the Report Card, advisors’ ratings, overall, have remained fairly stable since 2008