Advisors have long complained about their client account statements. But a push to provide clients with comprehensive electronic statements, combined with regulatory changes requiring more information, could be the panacea

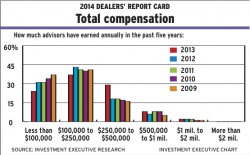

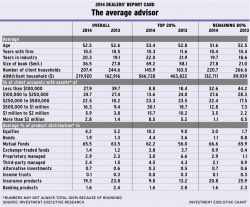

Books of business have risen significantly over the past year, and so has advisors' take-home pay. In turn, several advisors praised their firm for compensation regimes that are predominantly clear, transparent and fair

Most advisors say their firm's tech tools are outdated or obsolete and not user-friendly. Still, there are firms that are making efforts to tie together their front-office technology and their back office, and this is getting some praise

Advisors are using mobile devices more than ever before, but many say their firm either doesn't offer enough support for the technology or takes too long to implement changes. However, executives at the firms note that the technology is very complex

Thanks largely to strong equities markets, mutual funds are enjoying a resurgence. And for Canada’s mutual fund dealers, the growth has been even headier. Canadian mutual fund assets under management (AUM) topped $1 trillion for the first time earlier this year. And according to Investment Executive’s (IE) 2014 Dealers’ Report Card, mutual fund dealers are […]

How advisors rated their firms

Confusing corporate structures and, in certain cases, executives' dismissive attitudes can make it difficult to be heard

Investment Executive often is asked why the specific firms in the Dealers' Report Card are included, as some are one-stop shops that offer a plethora of support services while others offer a bare-bones platform. Here's a closer look

Steven Donald, president of Assante Wealth Management (Canada) Ltd., talks about the strategic changes that fueled Assante’s improvement in 32 out of 34 categories in the 2013 Dealers’ Report Card. He spoke with Clare O’Hara, staff reporter with Investment Executive, at the TMX Broadcast Centre in Toronto.

Pablo Fuchs, senior editor of Investment Executive, and Clare O’Hara, reporter, outline the key findings of the 2013 Dealers’ Report Card. They discuss the disparity between how advisors are performing in the post-recessionary world and how they feel about their firms. Fuchs and O’Hara spoke at the TMX Broadcast Centre in Toronto.