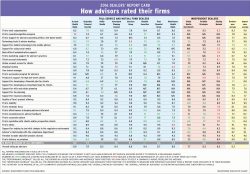

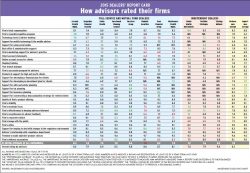

How advisors rated their firms

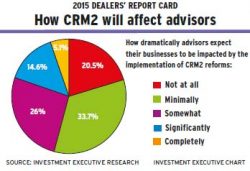

Many advisors hope the introduction of CRM2 will lead to clearer and better client account statements

Pablo Fuchs, senior editor with Investment Executive, and Fiona Collie, staff writer, discuss the results of the Dealers’ Report Card 2015, which reveal that the average book of business dropped for the first time since the financial crisis, despite healthy gains in mutual fund assets under management.

Advisors went out of their way to praise executives who take the time to develop and maintain personal relationships with them. Such efforts build trust and help to keep advisors in the loop about what's important

About half of the advisors who ply their trade with Canada's mutual fund and full-service dealers have a litany of concerns about the challenges that the implementation of CRM2 could mean for their businesses

With all but one firm seeing a drop in their rating for delivery on promises, it's clear that firms have to make a greater effort to keep their word to their advisors

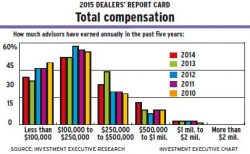

Advisors are taking home less in pay this year, but many still lauded their firms for maintaining fair payout structures

How advisors rated their firms

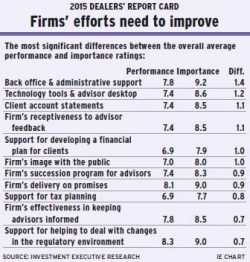

Although advisors are making significant efforts to get ahead in today's challenging environment, their AUM is dropping in value while their firms struggle to deliver in key areas

Advisors lauded firms that make an effort to let advisors know what's important in a variety of ways