Increased payments on mortgages and other debts could hit the economy as people have less disposable income to spend elsewhere

The results underscore the need for spending less and saving more every day, for emergencies and for retirement

However, the delinquency rate for non-mortgage consumer debt fell during the quarter

Canadian households were adding debt at the fastest pace since October 2011 in July, pushing total household debt to almost $2.1 trillion

The ratings agency will be closely watching Alberta and Saskatchewan for signs of increased delinquencies

Rising interest rates threaten to make it harder for Canadians to pay down their debt

But 50% of Canadians surveyed for a Natixis report believe an inheritance is an important part of retirement income and 45% expect to receive one

The changing labour market, which makes it difficult for many to project their earnings, has resulted in many falling behind on their savings, new TD report finds

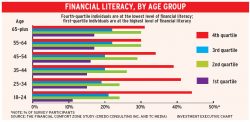

There is a lack of basic financial literacy skills among Canadians to understand and manage their debt

Financial planners and financial advisors can use behavioural psychology enabled by technology to help clients save more for retirement