Client conversations are going to change. Get in front of the process by being prepared

New rules usually bring penalties. Protect yourself

The research will cover activity from 2016 through 2019 and is expected to be completed by 2021

Don’t miss out. Registration closing soon.

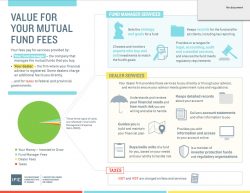

FAIR Canada has released videos while IFIC has put out an infographic aimed at explaining the enhanced disclosure coming into effect on Friday as part of CRM2

Advisors must inform clients of the fees they pay as a new survey finds that most Canadians don’t know their fees will be revealed in statements thanks to CRM2

Proposals include stronger protection for client assets, clarity for EMD activities and relief from certain CRM2 requirements

Information for dealers focuses on annual investor reports

Increasing pressure from clients and regulators means advisors will be well served to provide greater disclosure on insurance products and fees sooner rather than later

Document provides guidance on the new reports that dealers must start providing to clients