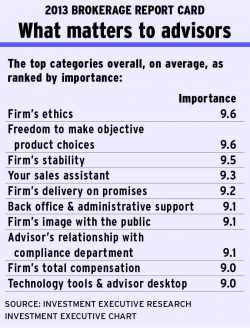

Despite many changes taking place within the economy and in the investment industry itself, advisors are still dissatisfied with their firms' technology tools, as well as with the back office and administrative support

In past years, firms either were prohibiting their advisors from using social media or just beginning to explore its use. Now, most firms have policies in place and are offering training and other services

How advisors rated their firms

Some of the firms that have tweaked their compensation programs were punished, while those that maintained a steady grid were praised

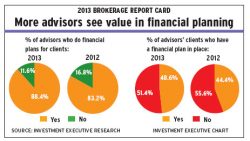

Brokerage firms and their advisors are putting a greater emphasis on making sure that their clients have financial plans. One advisor says financial planning is becoming a “requirement’”

Six brokerages in this year's Report Card have experienced a shift in their fortunes year-over-year

Compiling the 2013 Brokerage Report Card

Financial advisors at 13 brokerages say that they and their firms are no longer in a state of recovery they are already seeing significant increases in some key metrics

Although the road back from the financial crisis has been long and slow for Canada's brokers, they finally are seeing their books of business surpass the levels they had attained before the crisis, which pummelled their AUM

Pablo Fuchs, senior editor of Investment Executive, and Olivia Li, staff writer, discuss the results of the 2012 survey. Bigger books of business and improved advisor compensation haven’t translated into better ratings for dealers. The verdict: Firms still have some work to do. They spoke at the TSX Broadcast Centre in Toronto.