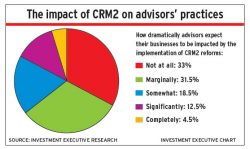

Advisors ready for CRM2 changes

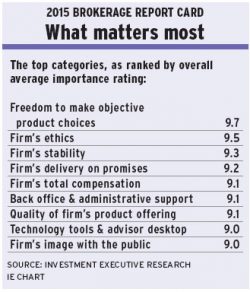

Not only do advisors want access to management, they also want their leaders to make changes based on advisors' suggestions

Most advisors favour having non-producing branch managers, but there are some who say the old approach still has value

Whether or not advisors are satisfied with their firms' offerings, several brokerages are bringing in more specialists and making major steps to improve the support that advisors receive in key wealth-management services

Many advisors say their firms can't always be counted on to follow through on their promises

Some advisors clamour for their firms to make greater efforts so that their brands become better known among the public

Technology woes continue

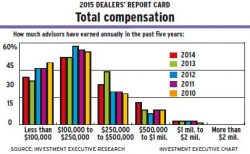

There are great differences among advisors regarding the changes their firms have made to their compensation structures

Advisors across the board have seen remarkable growth in their books of business, productivity, client assets and take-home pay. Beneath these headline numbers, there are notable shifts in advisors' sources of revenue and product asset mix

Although advisors reported some good news, in that their books of business rose to an all-time high yet again, they also want their firms to be doing more to meet growing expectations