How advisors rated their firms

As social media gains prominence as a marketing tool for advisors, access is more critical than ever. The firms that provide access to the online platform along with support are praised, while firms that restrict the use of social media are criticized

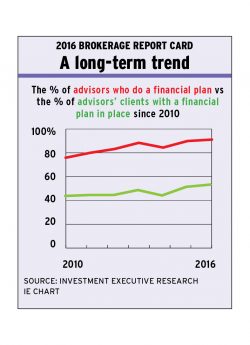

Advisors consider financial planning to be more important than ever, and more advisors are creating financial plans with their clients. However, challenges remain in getting clients on board with the process

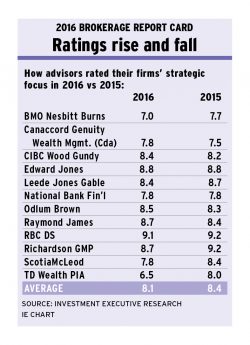

With strategic focus becoming more important for advisors, many are questioning their firm's efforts to attract and serve high net-worth clients while other advisors praise their firm's focus on expanding geographically

Quick response times, consistency, reliability and a client- and advisor-focused approach by back office staff are critical

Firms' greater focus on operating within a fee-based compensation model makes the transition easier for advisors

Firms have adjusted their pay structures to reward advisors with larger or faster-growing books at the expense of advisors with modest-sized books, many of whom are being forced out of the business

The emergence of online financial services isn't a threat to most advisors' businesses because their clients prefer a personal touch

Terry Hetherington, executive vice president and head of Raymond James’ private client group, discusses the firm’s wealth-management support for advisors, an area that saw a significant increase in advisor satisfaction in the 2015 Brokerage Report Card.

Pablo Fuchs, senior editor with Investment Executive, and Fiona Collie, staff writer, discuss the results of the 2015 Brokerage Report Card. This year's Report Card reveals two distinct themes: advisors report a new record high average book of business yet voiced disappointment with their firms in several key areas.