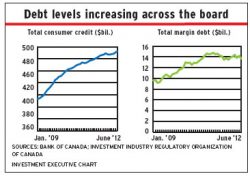

There's not much data about the state of leveraged investing in Canada, but some figures show troubling signs

Help clients navigate options such as home equity lines of credit, margin and no-margin loans

Advisors urged to ask more questions to ensure suitability requirements are being met

In part one of this two-part series, Talbot Stevens, author of Dispelling the myths of borrowing to invest, discusses the pros and cons of this controversial strategy. Stevens identifies seven main risks of leveraging and outlines the various elements of creating a successful borrowing strategy for clients. He spoke with Investment Executive senior reporter Jade Hemon at the TMX Broadcast Centre in Toronto.

Advisors must consider financial and behavioral factors when assessing the suitability of leverage

Draft guidance suggests best practices to help dealers to properly supervise client accounts that employ a strategy of borrowing to invest

Investors should fully understand what they are investing in

FAIR Canada wants better protection for investors who borrow

Borrowing to buy return of capital investments may not pay off

Yale professors say borrowing to invest early on in life is the key to long-term outperformance