Meagre returns in government debt are driving investors into equities, but bonds still serve a key purpose for some clients

Canadian dollar moves lower

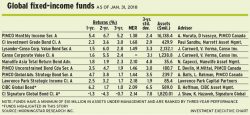

Portfolio managers of global fixed-income funds brace for more rate hikes amid optimism about global economic growth

Province raises money of infrastructure projects

Defaults are declining in the high-yield arena as corporate issuers enjoy rising profitability and strong balance sheets

2022 is now the peak year for companies’ maturities

Investors expect to increase their allocations to core fixed-income portfolios

Fidelity Investment Grade Total Bond Fund managed by veteran fixed income portfolio managers Jeff Moore and Michael Plage

The changes affect Series F, F5, EF and EF5

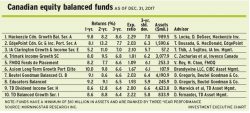

Canadian equity balanced funds have benefited from low interest rates and global growth. Portfolio managers are upbeat, but selective