For the most part, firms are on the ball in helping their advisors deal with the major regulatory changes that are taking place in the financial advisory business by providing information and training in what advisors will need to do

It's been a great year for advisors, as they are enjoying an all-time high in the average book of business while their firms continue to deliver in the categories that matter most

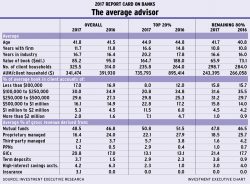

Powered by surging stock markets, advisors see gains in key metrics

Advisors across all channels of the financial services sector are adamant that their firms are providing independence, a positive work environment and stability. Yet, these firms need to improve their technology, advertising and compensation

Advisors expect their branch managers to be supportive, knowledgeable and resourceful leaders who can be relied upon

Financial advisors across all channels of the financial services sector look to their firms to provide the necessary training to keep advisors’ knowledge and skills up to date. Yet, the results of this year’s Report Card series were mixed: although some firms are doing a standup job, other firms are having difficulty meeting the expectations […]

Support for mobile technology and for using social media rose in importance - and it's the younger advisors driving this trend

Not only is recognition a poor substitute for better pay, many advisors say, but it's just the top advisors who are rewarded

As the glut of baby-boomer advisors continues to get older, succession programs are becoming more and more important

Pablo Fuchs, senior editor at Investment Executive, and Clare O’Hara, staff writer, discuss key themes from the 2013 Advisors’ Report Card. Despite seeing growth in their books of business, client numbers and satisfaction levels, advisors also report hurdles in dealing with the back office, technology and communication. They spoke at the TMX Broadcast Centre in Toronto.