Nine banks accessing BoC's new liquidity option, CBA says

The Canadian Bankers Association presented an award at an annual police conference

The CRTA has welcomed three strategic advisors

Over the next five years, consumers expect to increase their use of tap-and-pay, e-transfer and mobile banking

Fraudsters are increasingly taking advantage of the cryptocurrency hype

Federal action needed to address regulatory roadblocks that could hamper the adoption of digital IDs, CBA report states

Newsmaker: The CBA, long viewed as an excessively cautious group, is altering its approach to meet a shifting banking landscape

Emerging financial technology needs oversight, particularly when it comes to protecting customers’ privacy and security

Neil Parmenter succeeds Terry Campbell

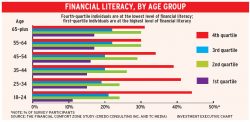

The “financial literacy outcome evaluation tool” consists of evidence-based financial literacy outcomes and indicators against which organizations can compare their programs