This article appears in the October 2023 issue of Investment Executive. Subscribe to the print edition, read the digital edition or read the articles online.

As interest rates have risen, the books of branch-based planners and advisors have contracted and asset mixes have taken a retro turn. Further, the average advisor in this year’s Report Card on Banks is more than two years younger and has less industry experience than the average advisor in last year’s Report Card.

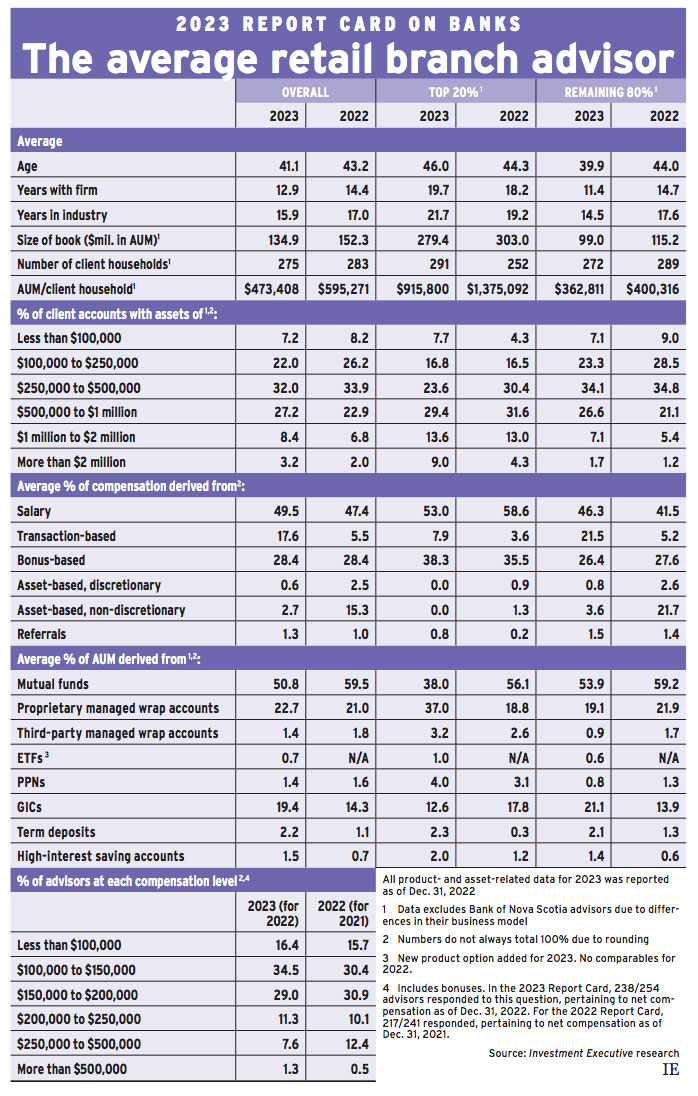

The average advisor in 2023 was 41.1 years old, down from 43.2 in 2022. The average amount of experience in the industry also was down by more than a year, and the advisor’s average tenure with their current bank fell to 12.9 years in 2023, from 14.4 years in 2022.

A shorter tenure in the banking industry often translates into fewer assets accumulated, as was the case in 2023.

Average assets under management (AUM) for the advisors in this year’s Report Card were down by about 11% from last year, dropping to $134.9 million from $152.3 million. (All AUM and client household data was reported as of Dec. 31 of the previous year; that data excludes Bank of Nova Scotia advisors due to the difference in their business model.)

However, these advisors’ books may have been shrinking irrespective of age and industry tenure. The top 20% of the industry’s advisors (as measured by AUM per client household) also saw their AUM decline, but there was an increase in the group’s average age and level of experience.

The average age of the top 20% of advisors in the Report Card rose to 46.0 in 2023 from 44.3 in 2022. Their average industry tenure rose to 21.7 years from 19.2.

Yet, average AUM for this segment of the advisor population dropped by 7.8% in this year’s Report Card to $279.4 million, from $303 million in 2022. The top 20% reported an increase in the average number of client households served over the same period, jumping to 291 from 252.

As a result, AUM per client household among the top 20% dropped to $915,800 in the 2023 Report Card, from $1.38 million last year.

This erosion suggests branch advisors’ books have been under increased competitive pressure, and that the overall decline in average AUM wasn’t just a function of this year’s Report Card capturing a younger, less experienced population.

The remaining 80% of advisors drove the overall industry decline in age and experience. For this group, average age dropped by more than four years, to 39.9 in 2023 from 44.0 in 2022. Average industry tenure dropped sharply over the same period by three full years, to 14.5 from 17.6.

This younger subset of advisors reported average AUM that was about 14% lower than the amount reported in last year’s research. They also served fewer clients than a year ago. As a result, average AUM per client household for the remaining 80% was about 9.4% lower year over year — not nearly as severe as the decline in productivity for the top 20% of advisors.

The decreases in productivity across this advisor population came alongside sharp increases in interest rates and inflation over the past year, which also were reflected in advisors’ asset mixes.

Overall, branch advisors reported that their allocations to mutual funds were slightly more than 50% in this year’s research, down from almost 60% last year. Among the top 20% of advisors, the drop was even more precipitous, with mutual fund allocations tumbling to 38.0% from 56.1% over the same period.

The decline in mutual fund usage echoed trends in the fund industry overall. In 2022, mutual fund net redemptions totalled $44.1 billion, representing the largest annual net redemptions on record in dollar terms, according to the Investment Funds Institute of Canada. At the same time, investors embraced money market funds, with that category being one of only two mutual fund categories with positive sales in 2022.

Alongside the shift to fixed-income assets in the fund sector, branch advisors’ allocations in GICs rose to 19.4% in this year’s Report Card, up from 14.3% last year. Advisors’ exposure to proprietary managed accounts rose to 22.7% from 21.0% over the same period.

The increase in the use of proprietary managed accounts was particularly evident among the top 20% of advisors, who reported that these products accounted for 37.0% of the average book in 2023. That was double the 18.8% portion reported a year ago — and put these accounts in a near tie with mutual funds as their top holding.

The same trend wasn’t evident in the rest of the industry. The move away from mutual funds by the other 80% of branch advisors appeared to primarily favour GICs, which accounted for 21.1% of the average book in this year’s research, up from 13.9% last year.

That is a stark reversal of the trend that built the mutual fund business in the 1990s, when equity funds were pitched as a superior investment for so-called “GIC refugees.” Today, rising interest rates and stock market uncertainty are driving clients back into the products.

Click image for full-size chart