Mutual fund families that employed solid stock-picking strategies enjoyed the best performance in 2014, according to data from Morningstar Canada. (All companies are based in Toronto unless otherwise noted.)

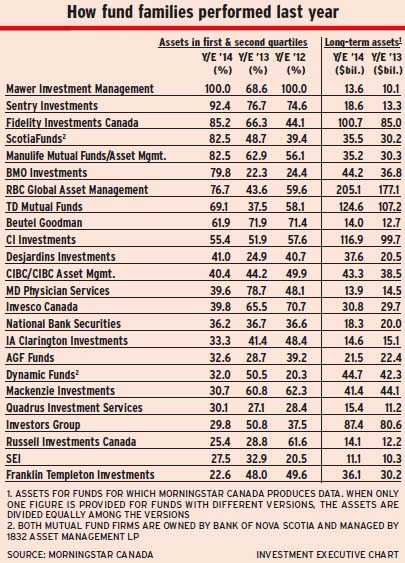

The year was marked by unusually wide differences, with mutual fund families performing either very strongly or very poorly. In fact, among the 24 fund families with at least $10 billion in assets under management (AUM), only seven were in the mid-range, with 35%-65% of long-term mutual fund AUM in the top two performance quartiles for the year ended Dec. 31, 2014. This is a notable drop from 12 fund families in this range in 2013 and 15 in 2012.

Last year was full of pitfalls for portfolio managers. Not only did the price of oil plunge in the last few months of 2014, but there was increased volatility due to concerns about: slowing economic growth in China; the risk of deflation in Europe; and the possibility that the U.S. Federal Reserve Board would make a mistake by raising interest rates too soon.

For Canada’s portfolio managers, the drop in oil prices made life particularly difficult, given the high weighting of oil and gas stocks in the S&P/TSX composite index. So, this scenario was ideal for good stock-pickers, such as Calgary-based Mawer Investment Management Ltd. and Sentry Investments Inc., which led last year’s mutual fund families’ performance with 100% and 92.4%, respectively, of long-term AUM in the top two performance quartiles.

In fact, portfolio managers at both firms pride themselves in finding stocks that do well regardless of the economic environment.

“We pick companies that are resilient and can deal with any outcomes,” says Vijay Viswanathan, director of research and portfolio manager with Mawer.

Mawer’s portfolio managers also find opportunities in stocks that aren’t held commonly or in an index. An example is Constellation Software Inc., a Toronto-based firm with a global reach that has done very well.

Sentry’s portfolio managers favour companies with very predictable long-term cash-flow generation, such as gas processors, telecommunications and waste-management firms, says Denis Mitchell, Sentry’s chief investment officer (CIO). The firm’s portfolio managers also prefer companies that are in an oligopoly-type situation, in which only a few firms dominate the market. One example is McKesson Corp., one of the three largest drug distributors in the U.S., which is now pushing into Europe and Latin America.

Although there’s a theory that having consistently strong performing families is much harder for bigger mutual fund firms because they offer a broad range of investing options, these companies can do very well. For example, Fidelity Investments Canada ULC ranked in the No. 3 spot, with 85.2% of the firm’s $100.5 billion in long-term AUM in the top two performance quartiles.

Still, much like Mawer or Sentry, Fidelity is a pure stock-picker – and the firm’s portfolio managers don’t make macroeconomic, sectoral or interest rate bets, says Craig Strachan, vice president and head of product with Fidelity.

Instead, Fidelity relies upon its competitive advantage in having portfolio managers and analysts all over the world who understand local supply chains and, as a result, know what stocks and corporate bonds are likely to do well or falter, says Strachan.

Manulife Asset Management Ltd. and RBC Global Asset Management Inc. (RBCGAM) emulate Fidelity’s approach of building teams that have a presence in most countries and regions to facilitate stock-picking – and both firms say that this is the reason for their funds’ strong performance in 2014.

“Our [portfolio] managers are aware of the macroeconomic environment, but are predominantly bottom-up stock-pickers,” says Derek Saliba, Manulife’s assistant vice president, mutual funds.

The firm’s portfolio managers also are given the flexibility to do what they do best. If, for example, a portfolio manager has the expertise to hedge against interest rates, he’s allowed to do so. (It’s also worth noting that Mawer is one of Manulife’s external portfolio managers, which provides another boost to performance.)

In contrast, RBCGAM portfolio managers put more weight on the macroeconomic environment. There are three layers to their strategy, says Dan Chornous, CIO with RBCGAM: getting the overall or strategic asset mix right; getting the regional allocations right; then picking the right companies in each region, country and sector.

Another firm that had success with stock-picking in 2014 is BMO Investments Inc., says its senior vice president and CIO, Kevin Gopaul. The firm also expanded its capabilities, with the equities research team quadrupling in size. As well, asset management now is centralized, but portfolio managers have been given more flexibility, which will result in more diverse investments.

On the other hand, Invesco Canada Ltd.‘s mutual fund family performance deteriorated in 2014, with only 39.8% of long-term AUM in the top two performance quartiles vs 65.5% in 2013. Invesco’s significant energy stocks holdings in several portfolios were the main culprit for this decline, says Jamie Kingston, senior vice president for product management and development.

In addition, some Invesco funds always hedge 50% of currency exposure, which meant that the firm’s mutual funds missed some of the boost to U.S. returns resulting from the falling Canadian dollar. As well, several Invesco funds also had a good deal of cash on hand after the long bull market made finding good investment opportunities difficult.

Nevertheless, Kingston notes, some of the energy stocks that did not do well in 2014 – such as Bonavista Energy Corp., Crew Energy Inc. and Ensign Energy Services Inc. – that are held in Invesco’s Trimark Canadian equity mutual funds have strong balance sheets and are able to survive this period of low prices. When these stocks recover, they will help to boost Invesco’s fund family’s overall performance.

Much like Invesco, Franklin Templeton Investments Corp. was hit hard by the drop in oil prices – and the impact this has had on Canadian dividend-paying energy stocks, in particular, says Philip Bensen, senior vice president and head of national sales for Canada with Franklin Templeton. That’s why this firm had the weakest mutual fund family performance, with just 22.6% of long-term AUM in the top two performance quartiles.

Still, Bensen notes, the yield on Franklin Templeton’s Canadian dividend mutual funds remains higher than the market average, as few of the stocks owned in the funds cut their dividends. As well, he anticipates a recovery in these funds when oil prices rise.

© 2015 Investment Executive. All rights reserved.