CHANGE IS IN THE AIR, ALBEIT it’s gradual, for Canadian households, according to recently released data from the 2011 national census. Financial advisors should be taking notice.

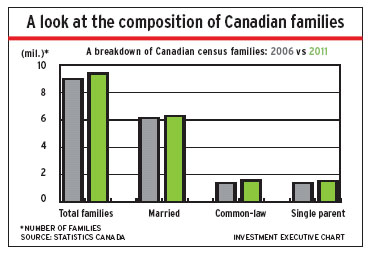

The census data from Statistics Canada (StatsCan) unveiled in September show changes to the traditional Canadian household, from common-law relationships to multiple-family households and seniors’ living arrangements. The 2011 census counted about 9.4 million census families, an increase of 5.5% from 2006.

“When we see [demographic changes] in black and white,” says Julie Littlechild, president of Advisor Impact Inc. in Toronto, “[as] we have with the census, it’s probably highlighting things that we should have been thinking about all along. It does remind us that advisors need not only be sensitive to these things but also restructure a business that reflects the reality of the current family.”

Here are some of the trends uncovered by the census data that practice-management experts say you should consider:

COMMON-LAW RELATIONSHIPS. Although married couples remain the mainstay of the average Canadian census family, the number of people in common-law relationships is growing at a faster pace, according to the 2011 census data.

(A “census family” includes: a married couple, with or without children; a couple living common-law, with or without children; or a single parent living with one or more children.)

Between 2006 and 2011, the number of common-law partnerships in Canada increased by 13.9% vs 3.1% for married couples. In total, common-law relationships make up 16.7% of all census couples.

This trend toward different family and household structures, says Bev Moir, senior wealth advisor with ScotiaMcLeod Inc. in Toronto, should be a reminder that you should never make assumptions when in meetings with a client. “We can’t assume that every family is traditional,” she says. “We need to be very open-minded and broad-minded, and watch the preconceived notions that we bring into a meeting or to a conversation.”

If your client is part of a married couple, it may be a good idea to remind him or her how the relationship is similar to that of a married couple for planning purposes. Canadian common-law couples share many of the same benefits as people who are married, says Tina Di Vito, head of the BMO Retirement Institute in Toronto, such as spousal RRSP contributions, which can help with income-splitting.

BLENDED FAMILIES. The 2011 census counted blended families for the first time. According to the data in the StatsCan press release, 87.4% of the 3.7 million Canadian couples with children are defined as “intact families,” meaning that all children in the household are either the biological or adopted children of both adults. The remaining 12.6% are identified as “stepfamilies,” indicating that at least one child is from a previous relationship.

As family situations become more complex, the planning issues you need to cover with your clients can become more sensitive. There may be some families in which each partner has children from previous relationships and then the couple has children together, says Di Vito. In these situations, it’s important 100000

for you to talk about what your clients want and whom they wish 80000 to provide for. For example, will your client fund the care and edu60000 cation of his or her stepchildren? Or, will the client provide for only h4i0s0o0r0her biological children?

Says Di Vito: “This can be one o2f0t0h0e0most complicated and the most emotionally draining conversat0ions for people to have.”

AGING AND LIVING ARRANGEMENTS FOR SENIORS. The 2011 census counted almost five million Canadians aged 65 years and older. Of those people, the majority – 56.4% – are part of a couple, an increase of 2.3% from 2001. Although this number dwindles as people age and partners or spouses die, fewer s e n i or wo men between ages 80 and 84 are living alone (40.2% of women were living alone in 2011, down from 46.1 in 2001), most likely because the life expectancy for men has increased faster than for women.

With more people living longer, it’s important that you talk with your clients about financing the care of an elderly relative or two. In fact, it’s not uncommon for a client to be responsible for more than one parent, says Di Vito. In years past, families were big enough that there were several siblings to look after an aging parent; now, there might only be one child in the picture.

Note that, for example, between your client and his or her spouse, there potentially are four parents – possibly more, if the parents had remarried, that need to be supported in their old age.

Providing for an aging parent may mean expensive renovations to a house or regular payments to an eldercare facility. According to the census, 56.5% of people in their 90s lived in private households – alone, with a partner or with children – in 2011, while the remainder lived in collective facilities such as nursing homes.

Your clients may need to be reminded to consider adding elderly parents to their will to ensure the parents continue to be provided for.

Typically, when crafting a will, the focus is on a spouse or children who will inherit the assets, says Di Vito. However, if your client suddenly becomes ill or is in an accident, there is a chance that the parent could survive your client and would need to be provided for, just like a spouse or child.

MULTIPLE-FAMILY HOUSEHOLDS. Although these still are a small percentage of the general population, more families are living under one roof in Canada, according to the 2011 census, which poses some unique opportunities and challenges for advisors.

The number of multiple-family households has increased slightly, to 2% in 2011 from 1.8% in 2001. Nunavut has the largest percentage of its population in multiple-family homes (10.6%). Other communities with significant numbers of multi-family households include: Brampton, Ont. (10.5%); Markham, Ont. (8.1%); Surrey, B. C. (7.6%); and Abbotsford, B. C. (6.1%).

StatsCan defines a multiple-family home as “a household in which two or more census families (with or without additional persons) occupy the same private dwelling.”

The decision to live in multiple-family homes often is based on cultural preferences, financial necessity or, in the case of Nunavut, housing shortages.

When these multiple families are generations of one family (for example, grandparents with grown, married children), it’s important for you to use the opportunity for “building bridges,” says Littlechild, and to decide who your clients are going to be. Is it an individual, or should you work with the family or even the extended family?

If you are working with an entire family, she says, it’s important to do an audit of the entire file of business for necessary changes. For example, will the discovery document need to be adjusted to account for more people in the plan? Or perhaps a larger meeting area is required to accommodate multiple-family meetings.

Whether there are multiple families living under one roof, fewer couples marrying or more complicated family structures, you will have to meet the needs of many different household structures, which could take time.

“The creation of a financial plan that’s meaningful for clients,” says Moir, “is being able to delve into their particular circumstances or what’s unique to them.”

To offer this level of service, Moir adds, it may not be possible to have large practices of, say, 1,200 clients.

Instead, you may need to consider trimming your practice in order to meet the specific needs of a Canadian household.

© 2012 Investment Executive. All rights reserved.