Philip Taller, senior vice president, investment management, and portfolio manager with Toronto-based Mackenzie Investments, is Investment Executive’s (IE) 2018 Mutual Fund Manager of the Year. He likes to say that “money is where the pain is.”

With that expression, Taller – who’s 57 years old, lead portfolio manager of the $2.6- billion Mackenzie U.S. Mid Cap Growth Class fund and head of Mackenzie’s growth team – alludes to both the challenges and benefits of buying stocks for the fund when temporary problems have depressed prices and most investors are steering clear.

“Buying stocks that are out of favour is hard to do,” says Taller, who manages the fund with associate portfolio manager Sonny Aggarwal and investment analyst John Lumbers. “I can’t say my team and I can totally remove emotion from our decision-making process, but we’re aware of its effects on stock prices and try to take advantage of it. The market tends to focus on the latest quarter or year. We look much further out.”

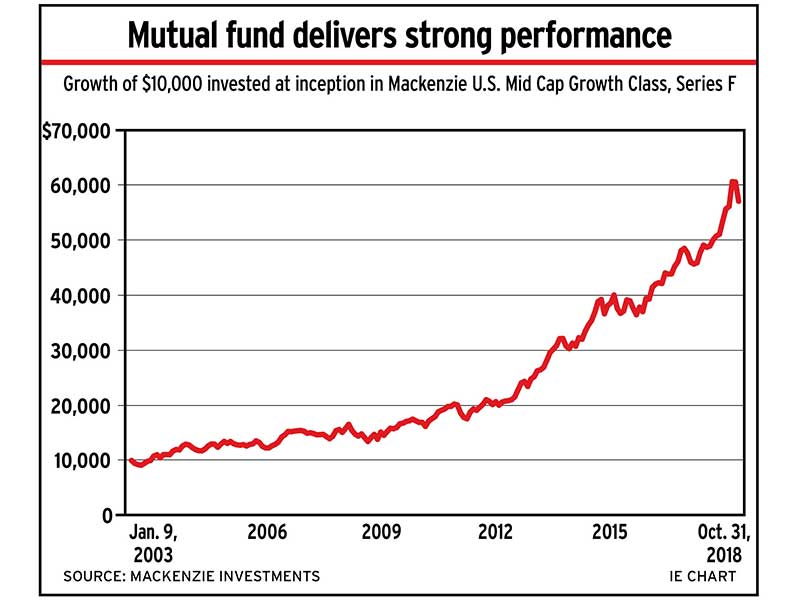

In choosing the Mutual Fund Manager of the Year, IE rates Canadian mutual funds’ 10-year records on a points-based scoring system. Points are awarded for each year of positive annual return, relative outperformance and quartile ranking. IE also assesses cumulative 10-year returns, management expense ratios and volatility. Mackenzie U.S. Mid Cap Growth Class, which Taller has managed since its inception in 2002, has shown superior performance.

As of Oct. 31, the Mackenzie fund’s F-class units had a 15-year average annual compounded return of 11.6% – surpassing the benchmark Russell 2500 total return index’s 9.3% average annual gain. The fund also beat its benchmark for shorter periods, with a five-year average annual gain of 15.1% vs 13.5% for the Russell index, and a three-year average gain of 15.4% vs 10.3% for the benchmark.

Aside from psychology, another contributor to the Mackenzie team’s edge is process, Taller says. That includes bottom-up analysis of financial metrics. Manageable debt and a healthy long-term forecast for free cash flow are key. The team also looks beyond current circumstances to form a vision of what prospective and current holdings will look like years out.

“A lot of our work centres on a company’s problems, and whether they’re fatal or just temporary,” Taller says. “Rather than buy [shares in] a company that appears to have no problems, we prefer to invest when problems are known to the market and reflected in the price, and when we’re satisfied those problems can be fixed.”

The Mackenzie fund has maintained an even keel during volatility in the stock market this year. Rising interest rates, fears of slowing global economic growth and potential trade wars between the U.S. and China spurred some investors to head for the sidelines, particularly in October, when stocks fell sharply. As of Oct. 31, Mackenzie U.S. Mid Cap Growth Class had a year-to-date gain of 17.1%, far ahead of the Russell index’s 3.9% gain.

Taller describes the Mackenzie fund’s investment universe as stocks with a market capitalization of US$2 billion-US$20 billion. But a stock that continues to thrive and trade at an attractive valuation may be held as it graduates beyond that range.

The Mackenzie fund runs a concentrated portfolio of about 40 names with an average market cap of about $8 billion. Stocks are sold if their prospects deteriorate or become too expensive relative to their worth.

U.S. mid-cap stocks are a particularly good place to find undervalued and innovative industry leaders, Taller says, and they’re in the sweet spot between the more stable large-cap and faster-growing small-cap stocks.

“U.S. mid-caps are one of the greatest hunting grounds for growth companies in the world,” Taller says. “The U.S. has a lot of advantages, including a culture that promotes entrepreneurialism, well-defined property rights, an education system that contains some of the finest universities in the world and available venture capital. It generates the farm team for the small-cap market, and those companies eventually end up in our space.”

The universe of small- and mid-cap companies tends to be sparsely covered by other portfolio managers and analysts compared with large-cap stocks, presenting more undervalued nuggets. Currently, the top sectors in the Mackenzie fund are information technology, industrials, health-care and consumer discretionary.

Taller and his team have been shifting the Mackenzie fund’s focus away from cyclical companies by cutting back on regional banks and reducing exposure to formerly high-flying semiconductor and other hardware firms, such as Silicon Laboratories Inc. and electron microscope-maker FEI Co.

These companies outperformed for several years and fuelled the Mackenzie fund’s performance, but Taller believes the rising interest rate trend that began in 2016 will hinder overall economic growth. Thus, he is preparing for tougher times with more resilient, “all weather” companies in the portfolio.

For example, in the tech sector, the Mackenzie fund is concentrated in software, data processing and service-oriented companies such as ExlService Holdings Inc. and Worldpay Inc., the stock prices of which haven’t reached the heights of some of the more exciting, growth-oriented companies.

In the financial services industry, Taller reduced the Mackenzie fund’s exposure, shifting to stable insurers vs banks. Health-care companies, which tend to be less cyclical, have increased as a percentage of the fund’s assets under management. Holdings include clinical trial outsourcers and makers of health-care supplies and equipment. Among the holdings are Syneos Health Inc., Dentsply Sirona Inc. and DexCom Inc.

“What we like about our portfolio is that many companies are providers of high-value services with a fair bit of pricing power,” Taller says.

Taller, a Montreal native who graduated from the University of Waterloo with a bachelor’s degree in mathematics and computer science in 1985, took a little time to find his niche in the investment world. He spent a few years working in the software business, but was plagued by the sense that he hadn’t found his true calling.

In 1989, Taller changed direction by pursuing an MBA at York University. After graduating, he found a position as a research assistant at Bunting Warburg Inc. in Toronto. He later earned the chartered financial analyst designation, and after a brief stint as an analyst at Jones Heward Investment Management Inc., he joined Trimark Investment Management Inc. in 1995 as portfolio manager for Canadian equities.

In 1998, Taller joined Toronto-based Bluewater Investment Management Inc., an independent subadvisor to Mackenzie at the time; in 2002, he took over the reins of a fund that would be renamed Mackenzie U.S. Mid Cap Growth Class. He left Bluewater to work at Mackenzie in 2011, continuing to manage the fund. (Mackenzie acquired Bluewater in 2016.)

“I love the intellectual challenge of the investment business,” Taller says. “There is never a day when I look at my watch and wonder when the workday will be over. Instead, there’s never enough time.”