This article appears in the April 2021 issue of Investment Executive. Subscribe to the print edition, read the digital edition or read the articles online.

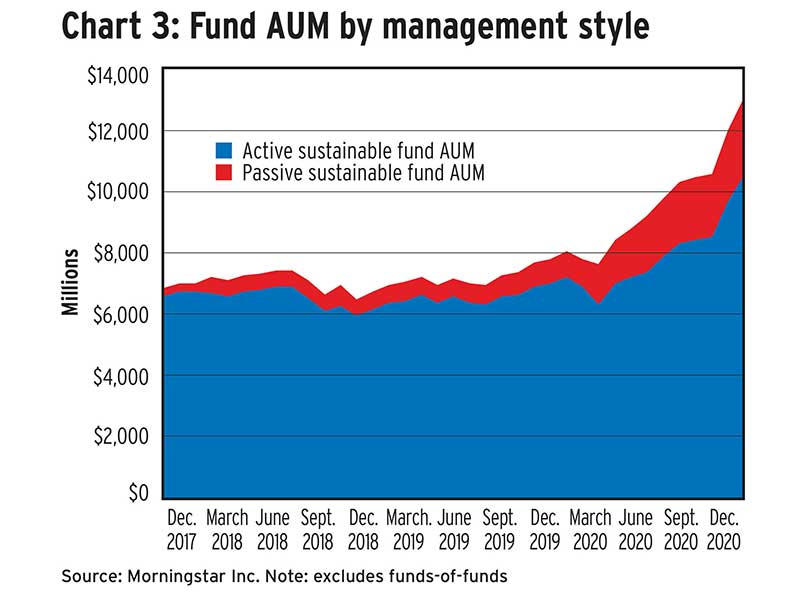

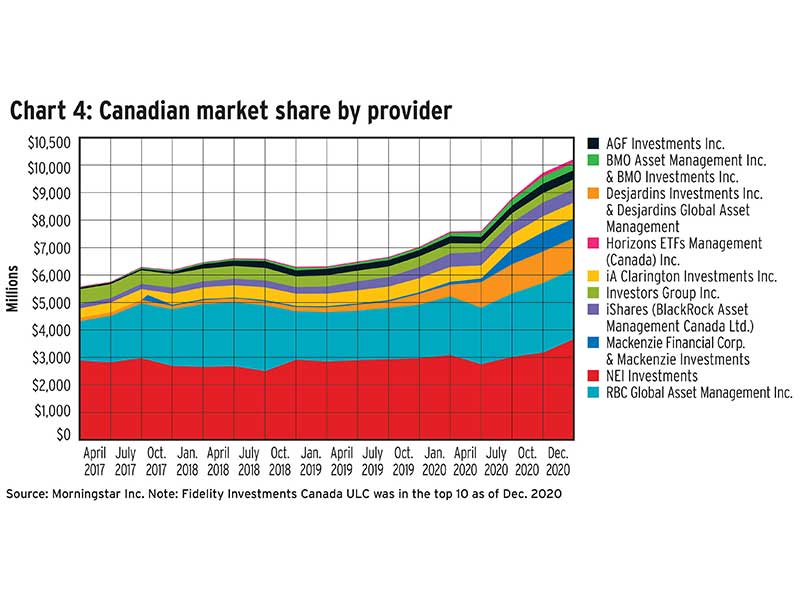

Sustainable mutual funds and ETFs have become more popular over the past decade. In 2020, assets invested in sustainable mutual funds and ETFs in Canada hit $13 billion, a 67% year-over-year increase, according to data from Chicago-based Morningstar Inc.

The events of last year — most notably the pandemic and the ongoing racial justice movement — led more investors to decide to “put their capital to work in a sustainable way,” said Ian Tam, director of investment research for Canada with Morningstar.

In particular, Tam said, investors were drawn to funds that focus on the social dimension of environmental, social and governance (ESG) issues. “Prior to last year, retail investors may have been more focused on the environmental and climate aspect,” he said.

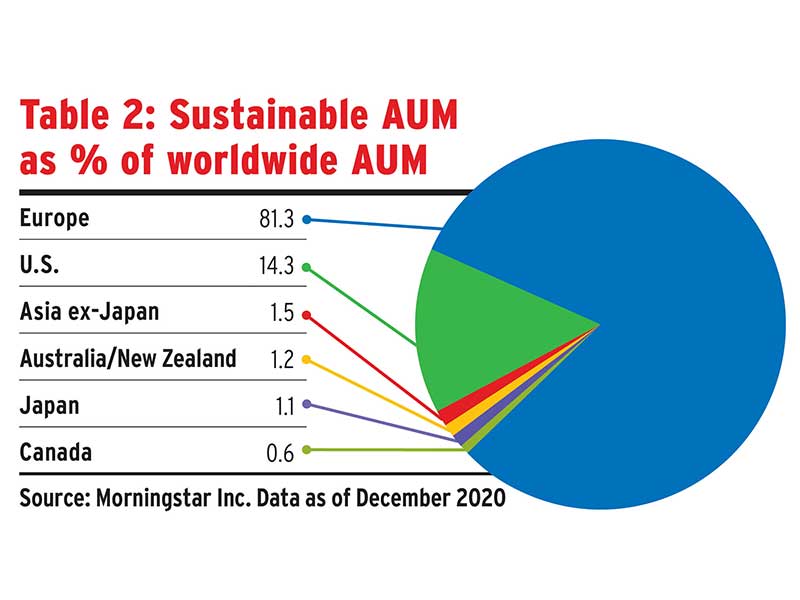

The number of sustainable funds in Canada, as well as their assets under management (AUM), will probably continue to rise in 2021, Tam said, as there’s room to grow: sustainable fund AUM was about 0.8% of total fund AUM (excluding funds-of-funds) as of the end of last year.

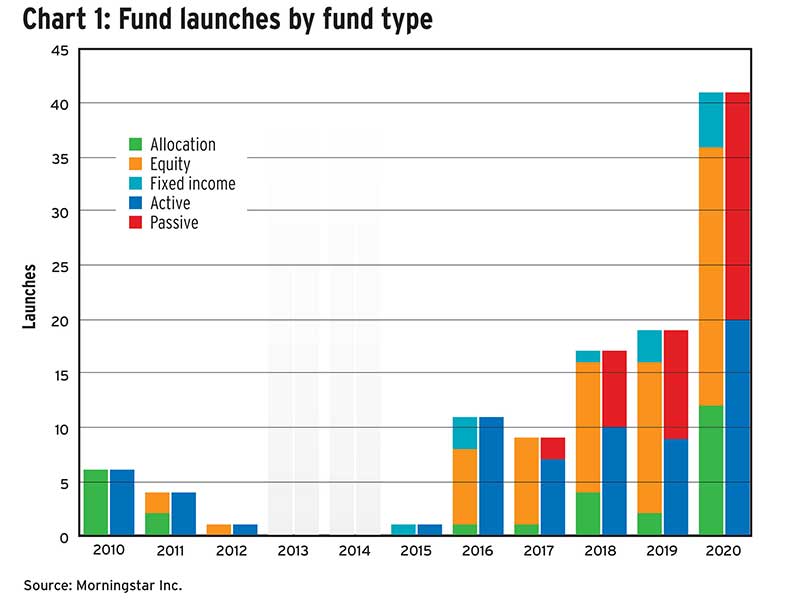

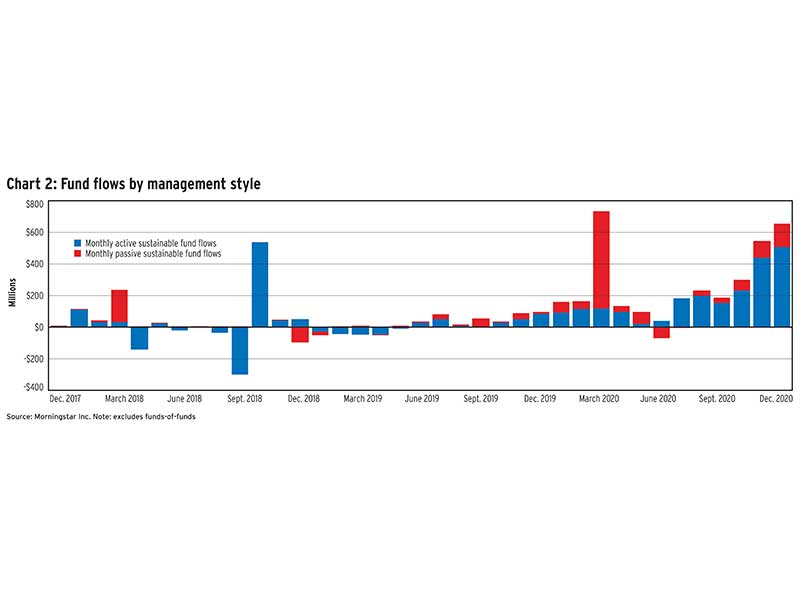

Tam said the sustainable market is likely to continue to shift toward passive products, mirroring the broader trend across all funds. “As issuers are required to disclose more material items with regard to ESG, that will enable research houses and index providers to create more robust and specific indexes,” he said. “That will help create better-quality passive products.”

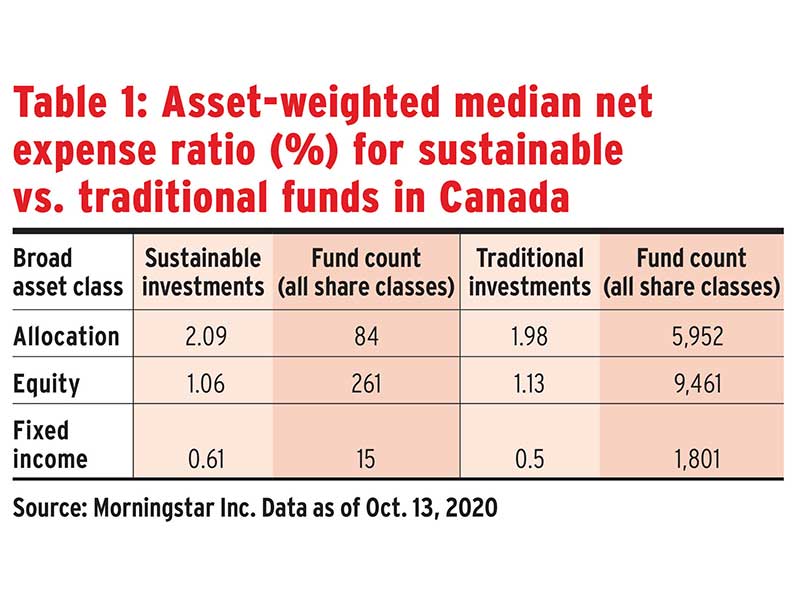

Management expense ratios for sustainable products — which are comparable to those of traditional funds (see Table 1) — are likely to continue to drop due to competitive pressures, in line with the overall industry trend, Tam said. However, he cautioned against drawing broad conclusions, given Canada’s small sample of sustainable funds.

Tam said “very few” sustainable funds have closed in recent years, and the closures typically have been due to performance. According to Morningstar, only eight sustainable funds in Canada have closed since 2016, with assets from several of those funds moved into other products. Over the same period, 97 sustainable funds were launched. “The only true [sustainable] fund that was shut down was the Evolve North American Gender Diversity Index ETF,” Tam said.