Astute stock selection was key to above-average mutual fund returns last year, with the five best-performing Canadian mutual fund families all following the practice of bottom-up stock-picking.

But substantial holdings of foreign stocks also boosted the performance of some mutual fund families. The drop in the Canadian dollar (C$) increased returns for non-Canadian stocks when those returns were translated into C$. This was true both for companies with large amounts of assets under management (AUM) held in foreign equity funds and for firms that allow portfolio managers of their Canadian equity funds to hold significant non-Canadian investments. (All companies are based in Toronto unless otherwise noted.)

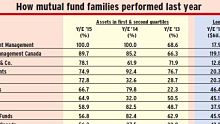

For example, Calgary-based Mawer Investment Management Ltd. led the pack in performance last year, according to Morningstar Canada data. Mawer had 100% of its long-term AUM in funds ranked in the top two performance quartiles for the year ended Dec. 31, 2015.

About 56% of Mawer’s long-term AUM was held in foreign equity funds and 17% in global balanced funds. That asset mix undoubtedly contributed to Mawer’s sterling performance last year.

Sentry Investments Inc. – No. 4 in the 2015 performance ranking, with 74.9% of its long-term AUM in above-average performing funds – benefited from holding non-Canadian stocks in Canadian equity funds. The firm’s flagship fund, Sentry Canadian Income Fund, had 42% of its AUM of $5.3 billion in U.S. securities as of Dec. 31, which boosted performance, says Sandy McIntyre, Sentry’s chief investment officer (CIO).

Morningstar’s industrywide statistics show substantially better performance for Canadian equity funds that can hold up to 50% of long-term AUM in non-Canadian stocks. On average, these funds were down by only 0.7% in 2015 vs a 6.2% drop for funds that are restricted to holding no more than 10% of AUM in foreign equities.

Other top performers include Fidelity Canada Asset Management ULC in the No. 2 spot, with 89.7% of its long-term AUM in funds with first or second performance quartile, followed by Beutel Goodman & Co. (No. 3) with 78.1%, and AGF Funds Inc. (No. 5) with 72.8%.

AGF’s performance is a surprise, given that the fund family suffered with weak performance for years. The percentage of AGF’s AUM in above- average performing funds averaged 30.4% in the seven years spanning 2008-14.

The improvement for AGF in 2015 came under the leadership of Kevin McCreadie, appointed president and CIO in mid-2014. After six months of intensive study, new processes and tools were put in place, portfolio-management teams were changed and more emphasis was placed on risk.

Those changes were a response to shifts in investor thinking about risk and volatility since the global financial crisis of 2008-09, says McCreadie: “Historically, AGF had a five-year philosophy and didn’t worry about short-term volatility.” These days, good stock-picking isn’t enough for investors; they also want less risk and volatility. “You now need the right parameters and you need to be disciplined.”

Executives at other top-performing fund companies agree that discipline is critical, although portfolio-management approaches differ.

“We look for high-quality, wealth-creating companies,” says Jeff Mo, portfolio manager, Canadian small-cap equities, at Mawer. Mo is referring to companies offering a return on capital that is higher than the cost of capital and that have a sustainable competitive advantage.

He cites three firms that meet these criteria: Stella Jones Inc. in Saint-Laurent, Que., which makes railway ties and utility poles, has the scale to purchase raw inputs more cheaply than competitors; Verisk Analytics Inc. in New Jersey is the dominant supplier of regulatory back-office services to the U.S. insurance industry; and Raging River Exploration Inc. is the lowest-cost producer of oil, making money even at US$30 a barrel.

Andrew Marchese, CIO at Fidelity Canada, says his firm’s focus is on constant analysis of companies in which Fidelity funds invest, including stress-testing future growth in such metrics as earnings and cash flow, and making sure that research drives stock selection.

Sentry also uses stress testing, looking for signs of declining cash flow, balance sheet risk and other factors that can cause distress if things go wrong, McIntyre says. Because of this emphasis on risk, Sentry favours companies that do well regardless of the economic climate. Two examples: waste-management firms Progressive Waste Solutions Ltd. in Toronto and Republic Services Inc. in Phoenix.

BMO Investments Inc., which was the sixth-best performing fund family, is another stock-picker but with an asset-allocation overlay, which was tilted globally in 2015.

“Stock selection is our backbone, but we feel good asset allocation is necessary to make sure investors are exposed to the right markets at the right time,” says Mark Raes, vice president and head of products for BMO Asset Management Inc.

Not surprising, fund families that don’t allow portfolio managers of Canadian equities much leeway to invest in foreign securities struggled. Three of Canada’s largest fund families – TD Asset Management Inc. (TDAM; 14th in performance), CI Investments Inc. (19th in performance) and Winnipeg-based Investors Group Inc. (21st) – were in this group. The reason these big firms had relatively weak performance last year is that they offer many relatively pure funds – that is, Canadian equity funds that hold few or no foreign equities.

“If clients want U.S. or global exposure, we offer other funds,” says Bruce Cooper, CIO at TDAM.

The strategy for these three fund providers is to allow unitholders to build portfolios with the desired exposure to particular geographical areas, but these funds’ restricted investment focus can mean less than stellar performance in comparison with funds having broader investment mandates.

Executives at TDAM, CI Investments and Investors Group point to large equity funds that didn’t benefit from the decline in the value of the C$ in 2015 as much as the funds against which they are ranked.

For example, the huge Investors Dividend Fund ($15.8 billion in AUM) has no foreign exposure, says Jeff Singer, executive vice president and CIO at Investors Group. But within the fund’s Canadian equity balanced category, Investors Dividend Fund is ranked against funds that hold up to 30% of AUM non- Canadian securities.

CI Income Fund ($7.1 billion in AUM) is a conservative fund aimed at providing steady monthly distributions; it hedges its currency exposure to reduce volatility. This fund is classified as a global fixed-income balanced fund and is ranked against funds that don’t hedge currency and thus they benefited from last year’s drop in the loonie.

This performance gap does not worry executives at Investors Group and CI. They say their funds delivered good performance, given their mandates. Indeed, both Investors Dividend Fund and CI Income Fund exceeded their internally set benchmarks.

TDAM has $15.2 billion in AUM held in a variety of Canadian equity funds; because none have foreign exposure exceeding 15% of AUM, most had below-average performance. Cooper notes that TDAM focuses on fund-of-funds products that incorporate asset allocation and rebalancing: “We add value by properly positioning asset classes.”

Thus, TDAM is not concerned if its stand-alone funds that are components in fund-of-funds products don’t rank highly in the individual funds’ categories.

© 2016 Investment Executive. All rights reserved.