Stock-picking worked very well for some mutual fund companies in 2017, even though growth stocks outperformed.

In the U.S., for example, growth-oriented funds’ total return was 21.9%, vs 6.5% for value-oriented funds, notes Todd Asman, executive vice president for products and planning with Investors Group Inc. in Winnipeg. (All other companies are based in Toronto unless otherwise noted.)

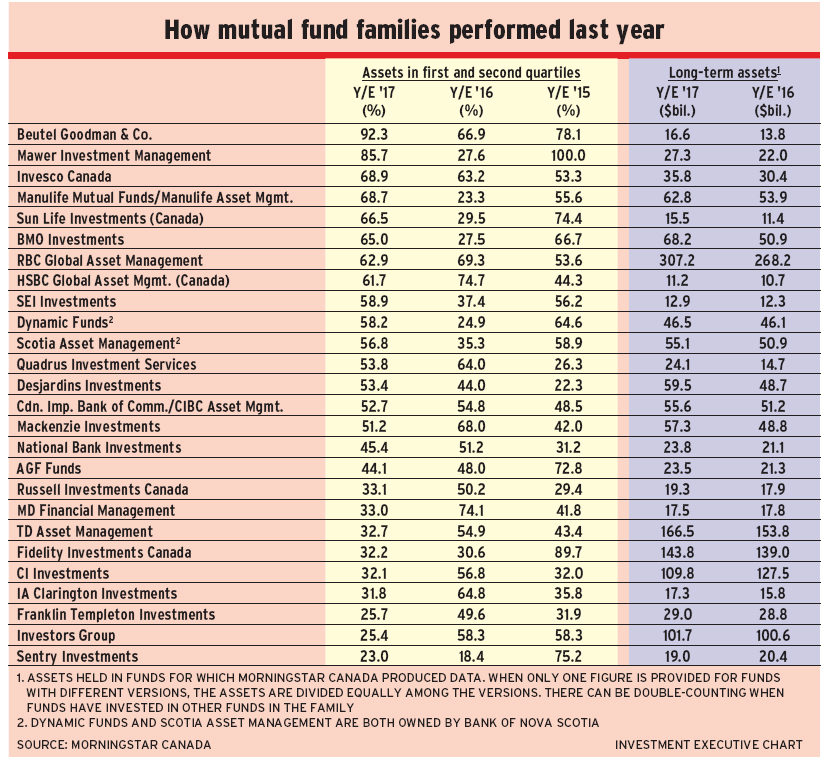

Nevertheless, Beutel Goodman & Co. Ltd. and Calgary-based Mawer Investment Management Ltd., both “deep value” investors, led Canadian mutual fund families in investment performance for the year ended Dec. 31, 2017. Both these fund families had a high percentage of long-term assets under management (AUM) ranked in the first or second performance quartile by Morningstar Canada (92.3% and 85.7%, respectively).

What’s even more impressive is that neither Beutel Goodman’s nor Mawer’s fund portfolio managers relied on the soaring stock price increases of the big “FANG” stocks – U.S.-based Facebook Inc., Amazon.com Inc., Netflix Inc. and Alphabet Inc. (formerly Google Inc.).

Beutel Goodman’s successful picks were mainly industrial companies, but also some financial and consumer discretionary stocks, says Mark Thomson, managing director, equities.

Mawer did well with tech stocks, but also held industrials, the share prices of which “started to do well,” says Paul Moroz, Mawer’s deputy chief investment officer (CIO).

However, stock-picking isn’t easy, and some stock-picking firms had relatively weak performance. These firms include Fidelity Investments Canada ULC, Franklin Templeton Investments Corp. and Sentry Investments Corp., all of which had less than 33% of long-term AUM in the top two performance quartiles.

Fidelity’s fund portfolio managers who had aggressive stock-picking mandates did well last year. However, the company also has many funds that are more defensive, aimed at retail investors who don’t want to run a lot of risk – and those funds didn’t have large holdings of soaring tech stocks, says Andrew Wells, Fidelity’s vice chairman.

Other factors that affected the relative returns of fund families included currency movements, relatively moderate returns for Canadian equities and weak returns for resources stocks, globally.

The 7% increase in the Canadian dollar relative to the U.S. dollar (US$) reduced returns for funds with unhedged US$ investments, says Christian Charest, editor of Morningstar.ca. In addition, the S&P 500 composite index’s total return rose by 21.8% in 2017 vs a rise of only 9.1% for the S&P/TSX composite index. This meant that Canadian equity funds in which fund portfolio managers can include significant amounts of U.S. stocks tended to do better than pure, 100% Canadian equity funds.

Resources stocks, which are so important in the Canadian market, also lagged. The total return for energy stocks dropped by 10.6% in 2017, while materials, mainly mining, rose by only 7.7%.

Looking ahead, 2018 could be a more volatile year. There still are stocks that are likely to rise in price, but fund portfolio managers are cautious. With valuations being high, they’re “taking money off the table in certain areas” in which they believe stocks are fully valued or more than fully valued, says Duane Green, Franklin Templeton’s president and CEO.

There also could be some rotation into lagging sectors. Wells notes that the increase in the price of oil “will uncover value” in energy stocks.

Mark Raes, head of products for BMO Global Asset Management, agrees: “There’s still upside to oil.”

Other sectors in which equities could rise in value are consumer staples and pharmaceuticals. Thomson points to opportunities in Metro Inc. in Canada, Kellogg Co. of the U.S. and Roche Holding Ltd. of Switzerland.

On the other hand, Green believes that emerging-markets equities and fixed-income will do well. “Our [fund portfolio] managers think that emerging markets are in the early innings of a recovery,” he says.

Jamie Kingston, senior vice president of product management and development with Invesco Canada Ltd., agrees: “Our fundamental investment teams – particularly within global equities – have been increasing their exposure to emerging markets for several years.”

Here’s a look at some of the strong – and some relatively weak – performers in 2017:

– Beutel Goodman & Co. Ltd.‘s funds have very concentrated portfolios with fewer than 30 stocks, says Thomson.

Beutel Goodman fund portfolio managers look for equities of high-quality firms that generate free cash flow, are leaders in their industries and that issue stocks that can be purchased at enough of a discount to produce a return of 50% over three years. There’s a strict “sell” discipline that ensures Beutel Goodman funds don’t hold stocks that have prices rising to unreasonable levels.

– Mawer Investment Management Ltd.‘s fund portfolio managers “just try to keep finding value for our clients,” says Moroz.

A key factor is the people in the companies in which Mawer invests. Moroz points to U.K.-based Croda International PLC, a speciality chemical producer that makes the active ingredient in many anti-wrinkle creams.

Moroz views 2018 as a puzzle. Equities could continue to rise – possibly fed by offshore money returning to the U.S., as is being encouraged by the recent U.S. tax reform package. However, equally possible, markets could run out of gas – perhaps triggered, for example, by a crash in one of the glamour stocks, such as U.S.-based Bitcoin Investment Trust.

– Invesco Canada Ltd. is another stock-picking firm that looks for “high-quality businesses that are expected to grow, regardless of the economic environment,” says Kingston.

The firm’s PowerShares and Trimark funds did particularly well in 2017, with more than 80% of long-term AUM in the top two performance quartiles. PowerShares are ETFs; Trimark’s portfolio managers are stock-pickers who usually manage highly concentrated portfolios.

The Invesco-labelled funds didn’t do as well, but still had 55.5% of long-term AUM in the top two performance quartiles.

Overall, Invesco had 68.9% of its long-term AUM in the top two performance quartiles.

– BMO Investments Inc. The biggest contributor to the firm’s strong investment performance in 2017 (65% of long-term AUM in the first and second performance quartiles) was getting the asset allocation right, Raes says. This meant getting the right mix of equities vs fixed-income and the right geographical, sectoral and specific stock mix.

The firm’s funds were overweighted in equities and portfolio managers foresaw the rotation into international equities. BMO Investments’ funds remain overweighted in equities.

– RBC Global Asset Management Inc.‘s balanced funds benefited from being overweighted in stocks and the global and international equity funds had “superior security selection,” says Dan Chornous, the firm’s CIO.

The stock-picking environment could continue to improve in 2018, Chornous adds, noting that “the correlation among stocks has been falling in many markets.”

– CI Investments Inc. & Sentry Investments Corp. Neal Kerr, executive vice president for investment management with CI, says fund portfolio managers at both CI and Sentry, which CI’s parent acquired last October, “have been adopting more conservative positioning in asset allocation and securities selection.”

– TD Asset Management Inc. (TDAM) is known for its fixed-income expertise because fund portfolio managers emphasize quality securities. Returns in TDAM’s big bond funds lagged last year because, says Bruce Cooper, TDAM’s CEO and CIO: “In 2017, lower-quality fixed-income [was what] was rewarded.”

For 2018, TDAM’s equity funds generally are neutral in terms of equities, particularly for U.S. holdings. Says Cooper: “Strong corporate fundamentals are offset somewhat by the stretched valuations.”

– Fidelity Investments Canada ULC. Wells makes no apologies for the firm’s failure to take full advantage of the big increases in the FANG stocks. That’s because such high flyers come with significant downside risk and the mandates of most of Fidelity’s funds are more conservative and defensive. Those funds haven’t lost money; they just haven’t had huge returns.

Wells is comfortable with the funds’ positioning, as he believes risk will rise in 2018. As interest rates continue to increase, weaker firms will find raising money more difficult. As well, he believes quality companies will produce stronger performance. For retail investors, he says, “It’s a time for diversification and defensiveness.”

– Franklin Templeton Investments Corp. also doesn’t take “unnecessary risks,” says Green. The job of the firm’s fund portfolio managers is “to maintain their convictions and not change as the markets change.”

The rising interest rate environment is challenging, Green says, adding that it’s very difficult for investors to cope with, so active management is worth considering.

– Investors Group Inc. Asman is optimistic about near-term return prospects, given the support likely to come from U.S. tax reform and decent growth prospects in Japan, Europe and emerging markets.

Investors Group also anticipates integrating its investment management teams with those of sister firm Mackenzie Investments will benefit both firms.