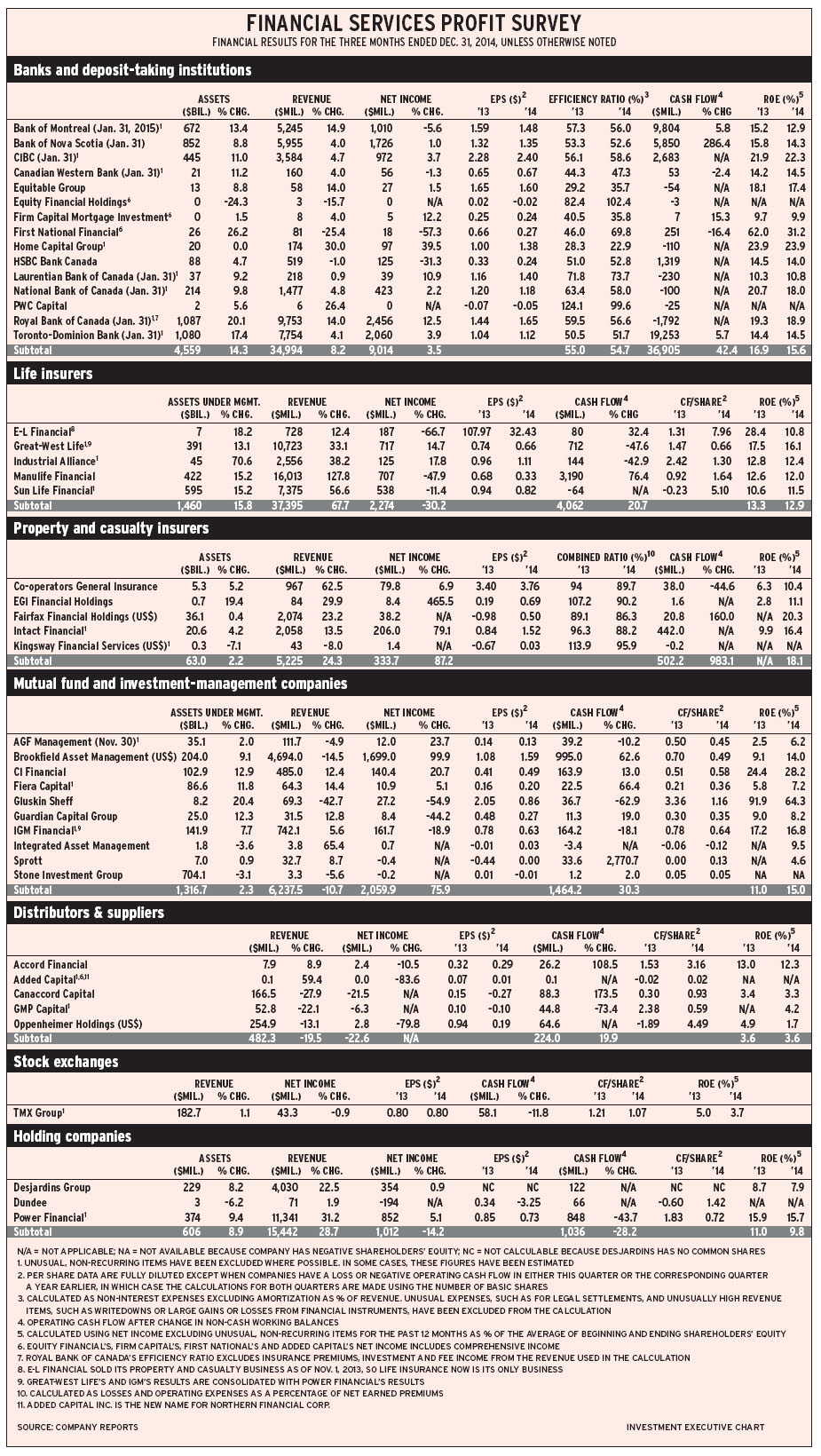

The substantial drop in oil prices that has taken place since last summer is taking its toll on the earnings of financial services companies. Almost half of the firms (20 of 42) in Investment Executive‘s quarterly profit survey reported lower net income or a loss in the fourth quarter (Q4) of 2014 compared with Q4 2013.

However, 19 firms had higher earnings and Fairfax Financial Holdings Ltd., Kingsway Financial Services Inc. and Integrated Asset Management Corp. (IAM) reported positive net income vs a loss. Furthermore, 12 companies increased their quarterly dividends, which indicates confidence about their future prospects. (These figures exclude Great-West Lifeco Inc. [GWL] and IGM Financial Inc., the results of which are consolidated in Power Financial Corp.’s figures.)

The sustained drop in oil prices is depressing economic activity in producing provinces, and this is only partially offset by the positive impact of lower gasoline prices on consumer spending in the rest of the country and increased demand for Canadian goods in the U.S.

Canadian banks will be feeling the hit through dampened loan demand, although there hasn’t yet been an overall increase in loan-loss provisions; meanwhile, brokerages are reeling from drops in investment-banking activity.

Still, five banks raised their quarterly dividends: Bank of Nova Scotia (Scotiabank), to 68¢ from 66¢; Canadian Imperial Bank of Commerce, to $1.06 from $1.03; Home Capital Group Inc., to 22¢ from 20¢; Royal Bank of Canada (RBC), to 77¢ from 75¢; and Toronto-Dominion Bank, to 51¢ from 47¢.

There also were four quarterly dividend increases among the mutual fund and investment-management firms: Brookfield Asset Management Inc., to 17¢ from 16¢; Fiera Capital Corp., to 13¢ from 12¢; Guardian Capital Group Ltd., to 7.5¢ from 7¢; and IGM, to 56.25¢ from 53.75¢.

The other firms that increased their quarterly dividends include GWL, to 32.6¢ from 30.75¢; Intact Financial Corp., to 53¢ from 48¢; and Power Financial, to 37.25¢ from 35¢.

The only firm that went the other way is AGF Management Ltd., which announced its intention to cut its quarterly dividend in 2015, to 8¢ from 27¢. Although a substantial cut, this is not surprising, as AGF has been struggling for several years. Its assets under management (AUM) has dropped to around $35 billion from more than $50 billion in 2007 following the departure of some key portfolio managers. AGF plans to invest in initiatives that have the potential to create greater shareholder value,such as accelerating product development and growing its “alternatives” platform.

Here’s a look at the industries in more detail:

– Banks. Nine of the deposit-taking institutions had higher net income vs only four with declines and two – Equity Financial Holdings Inc. and PWC Capital Inc. – in a loss position.

With the role of banks in financing economic activity, these firms tend to be weather vanes for earnings trends – and this groups’ average increase in net income of 3.4% was modest. However, the banks didn’t have to increase their provisions for loan losses, as these were down by about $200 million from the previous quarter, reaching a group total of $1.56 billion in Q4 2014 vs $1.75 billion in Q4 2013.

Banks with lower earnings included Bank of Montreal (BMO), Canadian Western Bank (CWB), First National Financial Corp. and HSBC Bank Canada.

BMO reports that its decline in net income reflects the impact of an unsettled environment in which there’s been “significant movement in oil prices, long-term interest rates and the Canadian dollar.”

The other big banks had increased earnings, ranging from 1% for Scotiabank and 12.5% for RBC.

CWB’s quarterly report notes a risk of a deterioration in residential real estate prices in Alberta and Saskatchewan as a result of the drop in oil prices, which could result in higher loan-loss provisions. CWB is streamlining its business with two sales: its property and casualty (P&C) business to Intact; and the assets of Valiant Trust, its stock transfer-business, to Computershare Ltd.

First National had increased expenses in anticipation of an agreement with a major Canadian bank to provide underwriting and fulfillment-processing services, which began on Jan. 1, 2015.

PWC continues to struggle to establish a viable business model.

The star among the smaller deposit-taking firms was Home Capital, with its strong 39.5% gain in earnings as the company continues to gain market share.

The only other double-digit increases in net income in this industry group were Laurentian Bank of Canada’s 10.9% rise and Firm Capital Mortgage Investment Corp.’s 12.2% rise.

– Life insurers. Only GWL and Industrial Alliance Insurance and Financial Services Inc. (IA) had increased earnings. In contrast, declines in earnings for E-L Financial Corp. and Manulife Financial Corp. were substantial, at 66.7% and 47.9%, respectively; even Sun Life Financial Inc.’s drop in earnings was significant, at 11.4%.

GWL had increased earnings in all three geographical areas in which it operates: Canada, the U.S. and Europe. IA experienced a pickup in individual insurance sales and continued improvement in segregated funds.

Manulife’s and Sun Life’s net income was pulled down by low long-term interest rates, which increased insurance contract liabilities. (It’s worth noting that Manulife acquired the Canadian operations of U.K.-based Standard Life PLC as of Jan. 30, 2015.)

A major factor in E-L’s lower earnings was a $266.4-million gain in Q4 2013 from the liquidation of the common-share portfolio of Dominion of Canada General Insurance Co., E-L’s P&C subsidiary prior to the Nov. 1, 2013, sale of Dominion.

– P&C insurers. All five companies had improved results, with higher earnings at Co-operators General Insurance Co., EGI Financial Holdings Inc. and Intact. Fairfax and Kingsway reported positive net income vs a loss in Q4 2013.

With no major weather-related events in Q4 2014, all the P&C companies had significantly higher underwriting profits, as indicated by the drops in their combined ratios.

– Mutual fund and investment-management companies. Even though only IAM and Stone Investment Group Ltd. had declines in AUM, just four firms had increased earnings and one, IAM, moved into positive income territory from a loss. Three other firms had declines, while Sprott Inc. and Stone suffered losses.

Among those companies with lower earnings, Gluskin Sheff + Associates Inc. saw performance fees halved from a year earlier; Guardian had smaller increases in the fair value of investments; Sprott had large losses on proprietary investments and loans; IGM’s expenses rose by more than its revenue; and Stone continues to struggle to create a viable business.

(Note that Fiera continues to expand, announcing the acquisition of New York-based Samson Capital Advisors LLC on Feb. 11.)

– Distributors and suppliers. Earnings were lower at Accord Financial Corp., Added Capital Inc. and Oppenheimer Holdings Inc., while Canaccord Genuity Group Inc. and GMP Capital Inc. reported losses.

Revenue fell by 27.9% at Canaccord and by 22.1% at GMP; in both cases, this was due mainly to lower investment-banking activity. Oppenheimer’s capital markets’ revenue held up better, but the division continued to have a pre-tax loss, at US$6.1 million in Q4 2014 vs US$1.8 million in Q4 2013.

Accord’s decline in net income was the result of withholding taxes paid on a cross-border dividend from the firm’s U.S. subsidiary.

Added Capital, a small firm involved in investment-banking and financial advisory services, continues to try to establish a viable business.

– Exchanges. TMX Group Ltd. had a modest 0.9% decline in net income.

– Holding companies. Modest increases in net income for Desjardins Group and Power Financial were more than offset by the large loss at Dundee Corp., which was a result of losses on investments.

© 2015 Investment Executive. All rights reserved.