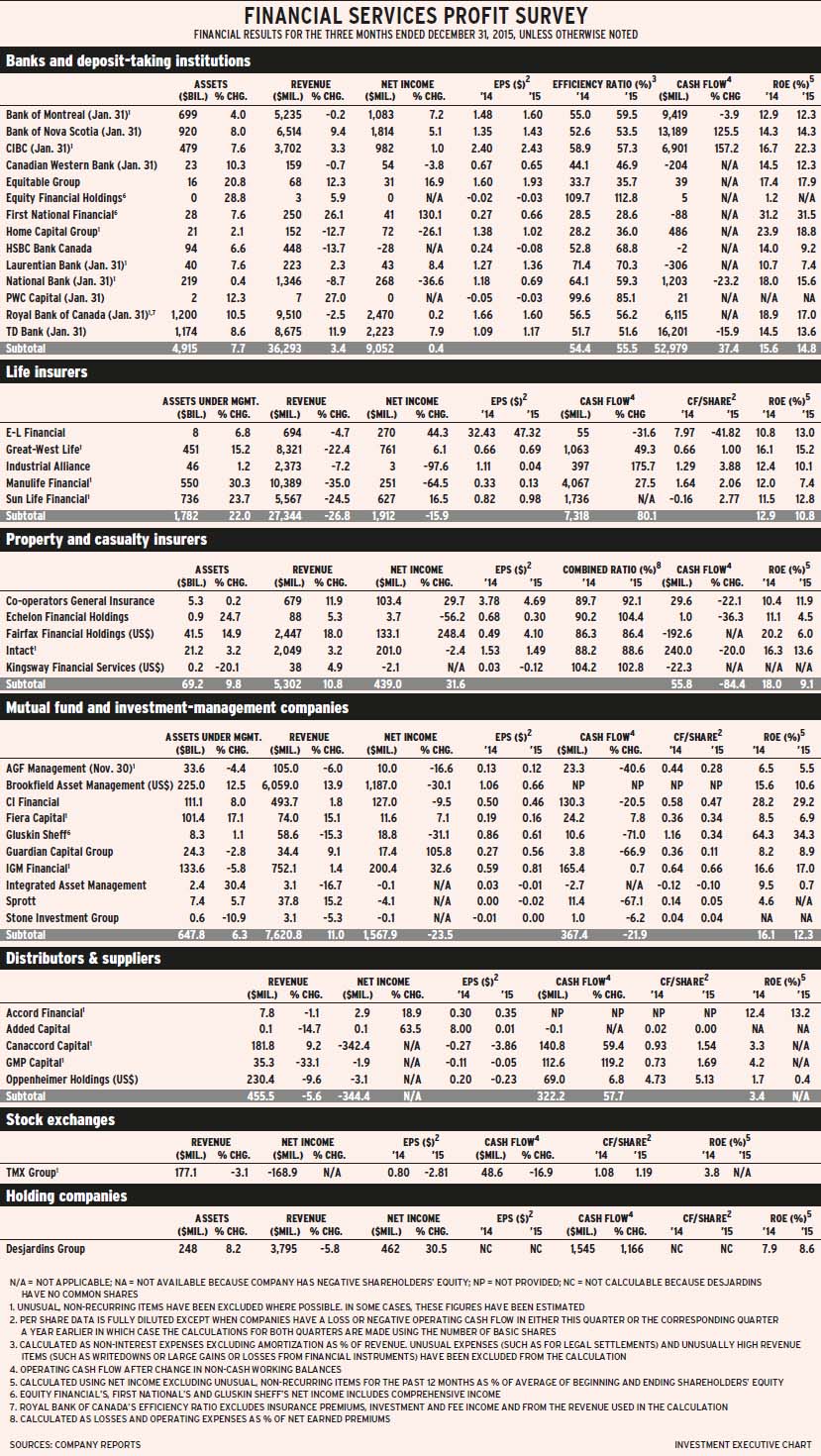

Although Canada’s financial services companies are feeling the impact of low oil prices, sluggish economic growth and stock market turmoil, the pain hasn’t been severe for most firms thus far. In fact, almost half of the 41 companies in Investment Executive’s quarterly profit survey reported higher earnings in the fourth quarter (Q4) of 2015 than a they did in Q4 2014 while 12 firms increased their quarterly dividends.

Overall, the 41 firms had an average drop in net income of 8.1%, as 19 companies had higher earnings, 11 reported lower earnings and 11 were in a loss position.

Nevertheless, cracks are beginning to show. Banks’ earnings as a group rose by just 0.4% and loan-loss provisions increased to $2.3 billion for the quarter ended Jan. 31, 2016, from $1.6 billion in the corresponding quarter in 2015.

Toronto-based credit-rating agency Moody’s Canada Inc. noted in a Feb. 22 report that, at best, low oil prices “will continue to strain bank profitability”; at worst, some banks might have to cut dividends or raise additional capital. The most vulnerable are Canadian Imperial Bank of Commerce (CIBC) and Bank of Nova Scotia, while Toronto-Dominion Bank (TD) is the least exposed to the energy sector and the oil-producing regions.

There also were a couple of big impairment charges related to the impact of low commodities prices and the uncertain economic and financial market outlook: Canaccord Genuity Group Inc. had a $321-million impairment charge reflecting the drop in the value of many of its capital-markets businesses around the world; and TMX Group Ltd. took a $215.8-million impairment charge because of the decreasing value in its trading and smaller-capitalization listings operations.

Canaccord and TMX Group are restructuring to align their operations appropriately in the current environment. GMP Capital Inc. also is restructuring, even though it hasn’t had impairment charges. As a result, Canaccord and GMP suffered losses in Q4 2015 and both suspended their dividends.

There was one other significant impairment charge in Q4 2015, but it didn’t relate to energy. National Bank of Canada wrote down its entire equity interest in Maple Financial Group Inc. – $145 million after taxes – due to allegations of tax irregularities in Maple’s operations in Germany.

Interestingly, four firms with lower earnings raised their quarterly dividends, indicating confidence in their prospects.

These firms include Home Capital Group Inc., which increased its dividend to 24¢ from 22¢. (The firm’s Q4 2015 financial report stated that if a prepayment that pushed up earnings in Q4 2014 is excluded, its earnings in Q4 2015 dropped by just 0.9%.) Manulife Financial Corp. also increased its dividend to 18.5¢ from 17¢, noting in its Q4 2015 financial report that the 64.5% drop in earnings was mainly because of the impact of low oil prices on the firm’s investment portfolio and that “core” earnings rose by 20%. Intact Financial Corp.’s earnings dropped by only 2.4% and the firm raised its dividend to 58¢ from 53¢. Brookfield Asset Management Inc. increased its dividend to 13¢ from 12¢, thanks to a 4.5% increase in pre-tax operating earnings.

E-L Financial Corp.’s dividend increased tenfold to $1.25 from 12.5¢. After 20 years of no increases, E-L’s board reviewed their company’s financial cash-flow prospects and decided that a dividend of $1.25 is sustainable.

Among the other firms increasing their dividends were Scotiabank, to 72¢ from 70¢; CIBC, to $1.18 from $1.15; Royal Bank of Canada, to 81¢ from 79¢; TD, to 55¢ from 51¢; Great-West Lifeco Inc. (GWL), to 34.6¢ from 32.6¢; Fiera Capital Corp., to 15¢ from 14¢; and Guardian Capital Group Ltd., to 8.5¢ from 7.5¢.

Here’s a look at the industries:

– Banks. Eight of the 14 deposit-taking institutions had higher net income than they did in Q4 2014. This included the Big Five banks, for which personal and commercial banking continued to do well. With the exception of Bank of Montreal, earnings were down for all their capital-markets operations.

Among mid-sized banks, Laurentian Bank of Canada had higher earnings, HSBC Bank Canada had a loss as a result of loan impairment of energy-sector loans, while the smaller deposit-taking institutions had mixed results. Equitable Group Inc. and First National Financial Corp. had strong earnings increases. Canadian Western Bank held up well, with net income down by only 3.8% despite the bank’s heavy presence in Alberta.

– Life insurers. Results were mixed, with E-L Financial, GWL and Sun Life Financial Inc. reporting higher earnings while net income dropped substantially at Industrial Alliance Insurance and Financial Services Inc. (IA) and at Manulife.

Life insurers have long-term liabilities that must be backed up by assets. The amount of assets required depends on current interest rates and actuarial assumptions. Insurers review their assumptions at least once a year and make any needed adjustments to their reserves. IA’s review in Q4 2015 indicated the need for an additional $107.9 million in reserves, thus reducing its net income to a tiny $3 million.

In addition, life insurers have to include changes in the fair value of their assets in their revenue each quarter. This can result in volatile revenue figures. In Q4 2015, all the firms had lower revenue than a year earlier. How much this affects net income depends on how exposed an insurer is to financial markets. In Manulife’s case, this resulted in earnings of about $400 million less than in Q4 2014.

– Property and casualty insurers. Results were mixed in this sector as well. Co-operators General Insurance Co. and Fairfax Financial Holdings Ltd. had strong increases in net income. Intact had a small decline, Echelon Financial Holdings Inc. suffered a big drop in net income and Kingsway Financial Services Inc. reported a loss.

Echelon and Kingsway had underwriting losses in Q4 2015, while the insurance operations were profitable for the other three firms. Echelon’s losses are in its international operations and, as a result, the firm is reviewing its strategy. Kingsway, which operates in the U.S., has struggled for years.

Fairfax’s big increase in net income was primarily because it had a tax recovery of US$59 million in Q4 2015 vs taxes due of US$41.3 million in Q4 2014. Co-operators’ gain came from increases in the fair value of investments.

– Mutual fund and investment-management companies. Only Fiera, Guardian and IGM Financial Inc. had higher earnings. Fiera’s earnings rose because of continued expansion through acquisitions; Guardian’s rose due to gains on investments; and IGM’s rose only because its earnings in Q4 2014 were pulled down by unusual, one-time distribution costs.

In contrast, net income dropped at AGF Management Ltd., Brookfield, CI Financial Corp. and Gluskin Sheff + Associates Inc. while Integrated Asset Management Corp., Sprott Inc. and Stone Investment Group Ltd. reported losses.

AGF has been struggling for years because of weak investment performance. However, that finally turned around in 2015 under new president and chief investment officer Kevin McCreadie. If that trend continues this year, AGF could start generating net sales.

CI’s results in Q4 2015 included one-time expenses for fund remediation. Exclude these expenses, and earnings would be down by 2.6% rather than the reported 9.5% drop.

Gluskin Sheff’s drop in net income was due to more than $10 million less in performance fees, which are charged when returns exceed specified levels, vs Q4 2014.

At struggling gold specialist Sprott, the good news is revenue rose; the bad news is expenses rose by even more.

– Distributors and suppliers. Both Accord Financial Corp. and Added Capital Inc. had higher earnings, but they are small firms compared with the three big brokerages, which were hit hard by the drop in commodities prices and thus posted losses.

– Holding companies. Desjardins Group had a good quarter vs Q4 2014: net income rose by 30.5%, with all major business lines contributing.

© 2016 Investment Executive. All rights reserved.