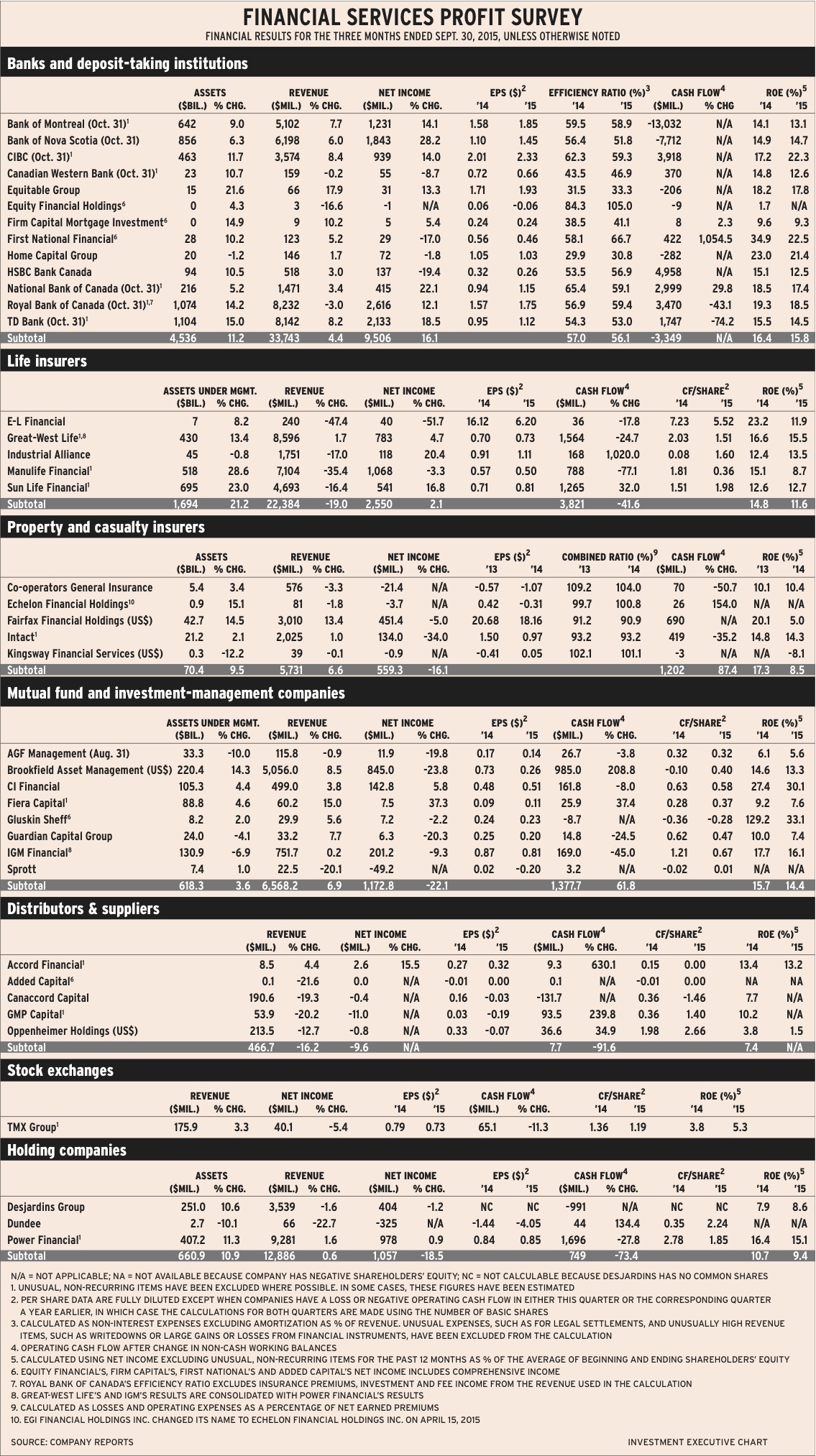

It would be difficult to decipher the sluggishness of the Canadian economy and the volatility of financial markets simply by looking at the Big Six banks’ earnings, which increased by 18.1% on average in the quarter ended Oct. 31, with three of those banks also increasing their dividends.

That sluggishness and volatility are more apparent in the results for the other 32 firms in Investment Executive’s quarterly profit survey of financial service companies. Only nine of these others improved their earnings: eight had higher net income and Added Capital Corp. reported net income vs a loss in the corresponding period a year earlier. Among the remaining 23 firms, 14 saw their net income decline, while nine were in a loss position. (These figures exclude Great-West Lifeco Inc. [GWL] and IGM Financial Inc., both of whose results are consolidated in Power Financial Corp.’s figures.)

Still, please note that the end of this quarter for the Big Six banks (Oct. 31) doesn’t match the end of the quarter for most of the other firms in this survey, which is Sept. 30. This certainly had an impact on the banks’ results, as the drop in global equities valuations in August and September mostly reversed in October.

That turmoil in equities had a big impact on brokerages, with the three in this survey all reporting losses as a result of big drops in investment banking revenue.

The volatile equities markets also affected mutual fund and investment-management firms and insurers. The fair value of investments is included in the calculation of net income for insurers – which are required to have large pools of assets to back up their liabilities.

But the different date for the end of the quarter isn’t the only thing that explains the good results for the big banks. Not only did their large personal and commercial banking operations continue to perform well but the banks’ capital markets and wealth-management divisions

Generally had higher earnings as well. Note that despite a lacklustre Canadian economy, the banks’ provisions for loan losses remained relatively unchanged for the group, at a total of $1.77 billion vs $1.75 billion a year earlier.

Indeed, confidence is so high at the banks that six of them raised their dividends. Quarterly dividends increased at Bank of Montreal, to 84¢ from 82¢; Canadian Imperial Bank of Commerce, to $1.15 from $1.12; Canadian Western Bank (CWB), to 23¢ from 22¢; Equitable Group Inc., to 20¢ from 18¢; and National Bank of Canada, to 54¢ from 52¢. In addition, First National Financial Corp. raised its monthly dividend to 12.9¢ from 12.5¢.

Not surprising, there were few dividend increases in other industries. However, quarterly dividends did increase at Sun Life Financial Inc., to 39¢ from 38¢; and at Echelon Financial Holdings Inc., to 12¢ from 11¢.

Here’s a closer look at the groups:

– Banks. Of the 13 deposit-taking institutions in the survey, eight had higher earnings, four had declines and Equity Financial Holdings Inc. reported a loss vs positive net income a year earlier.

The decline at Home Capital Group Inc. was small, at 1.8%, and CWB’s 8.7% decrease is relatively modest, given the impact of the plunge in the price of oil on Western Canada.

The declines in net income for First National and HSBC Bank Canada were more severe, at 17% and 19.4%, respectively. However, First National isn’t worried, as its decline was due to drops in the fair value of investments; the bank’s operations are growing.

In contrast, HSBC is struggling with low interest rates, which has compressed margins, and the sluggish economy, which has caused HSBC to increase its loan-loss provisions substantially to $31 million from $17 million in the corresponding quarter the year prior.

As for Equity Financial, it’s in transition. It sold its transfer agent and corporate trust business in 2013 and is focused on building its alternative mortgage business.

– Life insurers. Results were mixed for this group, with GWL, Industrial Alliance Insurance and Financial Services Inc. (IA) and Sun Life reporting higher earnings, while E-L Financial Corp.’s and Manulife Financial Corp.’s net income dropped. (E-L’s drop, at 51.7%, was quite sharp.)

All the life insurers were affected negatively by declines in the fair value of investments, but for GWL, IA and Sun Life, this was offset by strength in their underlying insurance and wealth-management businesses.

In contrast, Manulife had lower earnings in both Asia and the U.S., while net income at E-L’s subsidiary, Empire Life Insurance Co., fell due to “experience losses” and the need to strengthen its reserves after a downgrade in the Province of Ontario-issued debt that it holds.

– Property and casualty insurers. Co-operators General Insurance Co., Echelon Financial Holdings Inc. and Kingsway Financial Services Inc. all had losses, while earnings were lower at Fairfax Financial Services Ltd. and Intact Financial Corp.

The losses at Co-operators, Echelon and Kingsway came from a combination of negative changes in the fair value of investments and underwriting losses, as indicated by their combined ratios being higher than 100.

Fairfax and Intact also saw the fair value of their investments decline, but had good underwriting results. Thus, Intact’s combined ratio was unchanged at 93.2%, whereas Fairfax’s declined slightly to 90.9% from 91.2%.

– Mutual fund and investment-management firms. Only CI Financial Corp. and Fiera Capital Corp. had higher earnings.

Assets under management (AUM) were down at AGF Management Ltd., Guardian Capital Group Ltd. and IGM. There isn’t great concern about this for Guardian or IGM, as neither drop constitutes a trend.

However, AGF has been in net redemptions for years. The hope is that Kevin McCreadie, AGF’s president and chief investment officer (CIO) since 2014, will turn things around.

AUM rose for the other three firms, even though earnings were either down or, in the case of Sprott Inc., there was a loss.

Brookfield Asset Management Inc. is a strong company in the fast-growing arena of managing hard assets, while Gluskin Sheff + Associates Inc. has a good high net-worth business and should continue to do well if its transition to new CIOs goes well.

Sprott is a gold specialist, but is expanding its offerings of other types of mutual funds. The loss that Sprott suffered this quarter was the result of impairment charges mainly related to goodwill resulting from the 2011 acquisition of three U.S.-based firms specializing in the management of resources investments.

– Distributors and suppliers. Although Accord Financial Corp. had a 15.5% increase in net income, the three big brokerage firms in this group all reported losses, while tiny Added Capital is still trying to create a viable business.

“The sharp decline in global capital markets activity during the quarter impacted performance negatively in many areas of our business,” says Dan Daviau, president and CEO of Canaccord Genuity Group Inc., in the company’s quarterly financial report.

Canaccord is using this period to “focus on improving alignment across our global operations to enhance operating efficiencies.”

GMP Capital Inc.’s quarterly report states that the firm continues “to view commodity price volatility as a major restraint to client capital spending.” However, the report adds, increased merger and acquisition activity in Canada, a result of strength in the U.S. economy and a depreciating Canadian dollar vs the U.S. dollar, could offset the volatility.

– Exchanges. TMX Group Ltd. had a 5.4% decline in net income due to increased volatility in equities markets, in general, during this quarter vs the first half of 2015. However, TMX’s report notes this was somewhat offset in Canada because of the decrease in trading volumes for resources stocks.

– Holding companies. This was a lacklustre quarter for Desjardins Group and Power Financial, while Dundee Corp.’s big loss came from its resources investments.

© 2016 Investment Executive. All rights reserved.