Gearing for growth on a national scale

Leede Jones Gable expects to continue to add to its footprint, either through more amalgamations or organically

- By: Fiona Collie

- January 15, 2017 October 30, 2019

- 00:50

Leede Jones Gable expects to continue to add to its footprint, either through more amalgamations or organically

Although the industry is in favour of expanding investors' access to alternative investments, investor advocates are opposed

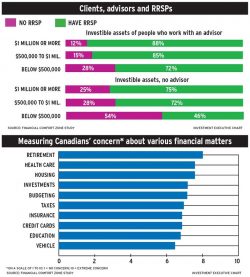

Some clients still are unclear about the rules regarding contribution limits, withdrawals and penalties

And less than half of Canadian investors say their advisor is trustworthy and honest

Uncertainties include Trump's promises to tear up trade agreements and household debt that continues to climb

The regulator pulled out all the stops to engage a wide range of contestants from the developer community, ranging from high-school students to a team…

FSCO found insufficient adoption of best practices

A taxpayer who over-contributed to his RRSP by mistake and gained no benefit from the error has failed to gain relief from the taxes that…

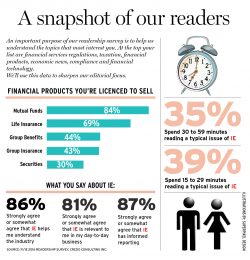

“Dear readers, I thank you for your participation in surveys for Investment Executive (IE) and Finance et Investissement (FI). Your answers will help us understand…

High-income individuals and their advisors also prefer mutual funds to stocks, seg funds or ETFs

Robo-advisors and blockchain tech will be drivers of change

More than a quarter-billion dollars have been returned to investors as a result of five-year-old enforcement policy

Guy Cormier must prepare Desjardins Group for change, while maintaining its special character as a co-operative

Regulators are guiding investment firms with sound principles, but putting them in place is a challenge

This year's IIAC Top Under 40 Award winner was inspired by her grandmother to protect older clients from bad advice

Portag3 Ventures has three large financial services firms backing it that want to get in on the ground floor of fintech's growth

Sales of PARNs are down by about 50% since the feds proposed altering the tax treatment of linked notes

A recent conference explored ways in which technology can help boost retail investor participation and shareholder rights

An error was made in the editing of a sentence in an article headlined “Insurance exemption deadline looms” in our Mid-October issue. The corrected sentence…

Other financial priorities make contributing to these accounts difficult for some clients

The investment industry is embracing and launching robo-advice platforms in one form or another

A new paper argues that active management can outperform by enough of a margin to justify its fees

The newly appointed CEO of Mackenzie Investments plans to use global strategies and product innovations to provide more options for retail clients

The CRA will require taxpayers who sell their home to report the sale in order to claim the principal residence exemption

Ensuring that clients have a sustainable stream of income during retirement has become more challenging for financial advisors. Uncertain equities markets and basement-low to negative…