Changes at AGF

Incoming CEO Kevin McCreadie intends to stay the course

- By: Fiona Collie

- October 26, 2018 October 31, 2019

- 00:13

Incoming CEO Kevin McCreadie intends to stay the course

Ozy Camacho, Group Publisher, Investment & Advisor Groups, steps back

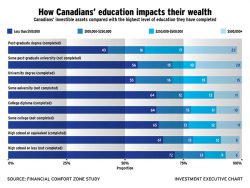

Charitable giving is more important for Canadians with higher levels of wealth - and there is much advisors can do to help

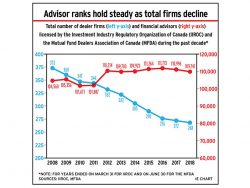

Advisors are serving fewer clients overall, but more wealthy clients since 2008 as they focus on providing specialized services

The new head of BMO Nesbitt Burns wants to help advisors grow their businesses by working with other experts at BMO

Money laundering and tax evasion are key concerns

OTC proposals are “too far-reaching,” some groups argue

Established market makes cannabis less speculative than blockchain

Stéphane Dulude will be drawing on his experience to help Peak Financial Group expand its footprint outside Quebec

If an appointment is challenged, a court is likely to strive to preserve the POA grantor's wishes

New government expresses concern about CSA’s proposals

Coin Capital is focused solely on emerging technologies

Escalation of U.S.-China trade war is a concern of economists

Six in 10 firms reported either higher earnings or positive income compared with a loss in the same quarter last year

Although 21% of clients rated their financial advice as "gold," that level of satisfaction is based on more than returns

CSA proposal would introduce post-trade transparency requirements for trading in government bonds

These ETFs are more likely to outperform, as they can deviate from their benchmarks and exploit market inefficiencies

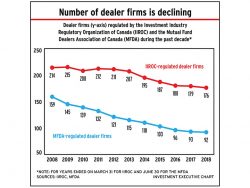

The pressure on firms to evolve, invest in new technologies and keep up with ever-increasing compliance costs were the key drivers of this trend

The new president of IDC Worldsource Insurance Network is focused on meeting the expanding needs of the MGA's advisors

Growing resistance to the MFDA’s plan to increase disclosure

NBF is making significant investments in Western Canada

Changes in CDIC coverage include new categories for RESPs and RDSPs

The low rate of RESP adoption is an opportunity for advisors to discuss the importance of education

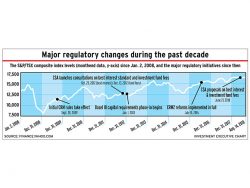

The global financial crisis led to an unprecedented response from regulators that remains a work in progress

CSA anticipates its proposals will add costs for the industry