Toronto-based Richardson Wealth Ltd. continues to chase aggressive growth goals following a relatively stagnant decade for the wealth management firm. Dave Kelly, who was hired as chief operating officer in January, will play a key role in pursuing those goals.

The appointment of Kelly, a 29-year veteran of the wealth management industry, has caught the Street’s attention.

“If you’re able to attract such a quality candidate — very experienced; 14 years at [Toronto-Dominion Bank]; he has a vast knowledge of the industry — it’s a good thing for the company. It adds value,” said Victor Adesanya, vice-president with Morningstar DBRS in Toronto.

Morningstar DBRS rates cumulative preferred shares of Richardson Wealth’s parent company, RF Capital Group Inc., as “high,” although the rating agency changed the trend on those shares to “stable” from “positive” in June 2023 due to a weaker macroeconomic outlook. Nonetheless, the agency cited RF Capital’s “solid wealth management franchise [and] continued progress in executing its strategic vision” in its rating.

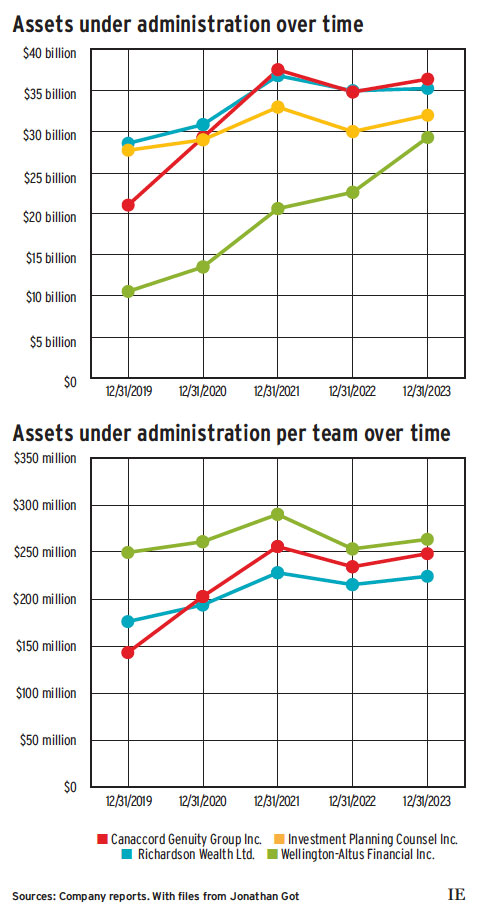

That strategic vision is what drew Kelly, 53, to Richardson Wealth. Kish Kapoor, president and CEO of RF Capital, set a goal in May 2021 to reach $100 billion in assets under administration (AUA) by 2026, and the firm revised that timeline to “the next three to five years” in its 2022 annual report. Richardson Wealth’s AUA was $35.2 billion as of Dec. 31, 2023.

“It’s a very ambitious goal,” Adesanya said, observing that Richardson Wealth needs to aggressively acquire firms and financial advisory teams to reach it. “So [we want] at least to see some movement this year that they’re progressing toward this goal.”

Kapoor has stated that 60% of the planned growth will come from acquisitions. And, Kelly said, Richardson Wealth is looking at two major areas: wealth management and asset management. “We’ll be incredibly picky on making sure [any acquisition] is accretive to the culture,” Kelly said, noting that asset-management assets would count toward Richardson Wealth’s $100-billion goal, give the firm new capabilities and contribute to revenue.

Richardson Wealth’s most recent acquisition occurred in September 2013, when it bought Macquarie Private Wealth Inc. and nearly doubled its AUA to $28 billion. The firm’s AUA at the end of 2023 represents a 26% increase over 10 years, with most of that growth coming after 2020. (See chart.)

The past decade was rocky. In 2019, parent company GMP Capital Inc. — now RF Capital Group — sold its capital markets business to Stifel Financial Corp. and acquired the shares of Richardson Wealth it didn’t already own. That transaction was beset by a dispute with minority shareholders that was resolved in 2020, when GMP Capital bought back $40 million in shares.

Richardson Wealth also fended off takeover bids from TD Bank in 2016 and from Canaccord Genuity Inc. in 2021.

Kelly was part of the group at TD that assessed Richardson Wealth, and “the progress [at Richardson Wealth] since that time is beyond impressive,” he said.

Specifically, Kelly praised the firm’s investments in back-office technology from Envestnet Inc. and Fidelity Clearing Canada ULC. “We’ve now put the blocks in place where the business scales very quickly,” he said, “and so you don’t have to add a lot of cost as you bring on new [financial] advisors.”

Many of those new advisors will be women. Another Richardson Wealth goal, announced in Q1 2022, is to reach 50% female advisors by 2027. As of November 2023, 17% of the firm’s advisors were women, two percentage points above the industry average.

Kelly acknowledged this goal, like the $100-billion one, is ambitious for a firm that has historically recruited experienced advisors.

“You’ll have to go after the established teams of women, but the math doesn’t work unless you also grow the number of women who are in the industry,” he said. “I do think we need to be open to bringing on advisors earlier in their career to achieve that goal. That doesn’t mean they’re new to the industry, but maybe they’re not in the $250,000 [to] $500,000 [AUA] range either.”

Bringing on less experienced advisors also will require tailoring the firm’s practice-management support and training, he said.

Kelly said another key tool is supporting newer advisors in purchasing equity from established advisors: “That’s where we need to go — making sure we get that equity transfer a little earlier.”

In 2023, Richardson Wealth launched a $25-million internal financing program that allows buyers to spread payments over seven years and pause payments if the buyer goes on leave. As of February, the program has financed nine transitions, with four of those involving parties who were women.

In his role as COO, Kelly is responsible for three main areas: advisor growth and experience; digital strategies and operations; and products and services.

“Having led a number of businesses as either the president or CEO, the COO role was appealing at this stage of my career,” Kelly said. “You are contributing to the strategy but you don’t have to own the strategy. I can really focus on the parts of the business I love to work with.”

Kelly also feels his new position combines the best of his two most recent roles, which were head of Toronto-based Gluskin Sheff + Associates Inc. from 2022 to 2023 and head of private wealth with TD from 2019 to 2022.

“One of the things I bring from the Gluskin side,” he said, “is a really clear understanding of what firms need to have in place to grow from a great boutique business into a business at scale.” And from TD, he said, he brings experience managing ample resources, infrastructure and process.

Kelly’s appointment comes a few months after the expiration of the three-year vesting period on retention shares issued to advisors in October 2020, when RF Capital completed its acquisition of Richardson Wealth.

On Feb. 29, the firm announced it would grant cash awards to advisors who were with Richardson Wealth in 2020 and remain with the firm until at least November 2026.

Nonetheless, Kelly said the firm is primarily focused on retaining advisors through its culture and support. “This is about creating an experience that advisors value. My view is that the monetary awards help some, but, ultimately, advisors are looking for the best place where they can serve their clients well, be successful and be proud of where they work,” he said. “To me, this is an experience journey more than a monetary journey.”

Kelly’s own financial services journey began in 1994, when he joined Morneau Coopers & Lybrand in Toronto; he moved to that firm’s Vancouver office just six weeks later. He’s done stints at three of the Big Five banks, the lengthiest of which was at TD.

Kelly was born in Toronto and lived in Surrey, U.K., from ages four to eight. His wife, Kim, volunteers with the Compass, a food bank and outreach centre in Mississauga, Ont. The Kellys’ two children, Caden and Autumn, both play hockey. Kelly, a former minor hockey and rugby player himself, enjoys skiing and riding motorbikes.

Richardson Wealth advisors have greeted Kelly enthusiastically, he said, with 200 people attending his recent welcome lunch. “The mood is optimistic. I think teams are looking forward to success, and it’s our job to put some wins on the board,” he said.

Kelly also values the constructive criticism he’s received from advisors. “Our focus is really trying to make sure we understand what advisors and their teams need to be successful,” he said. “Rightly, they challenge us to continue to be better versions of what we are today.”

This article appears in the March issue of Investment Executive. Subscribe to the print edition, read the digital edition or read the articles online.