Although the markets may be tempestuous, investment industry CEOs are optimistic about the business’s prospects for the year ahead – with the retail side expected to lead the way.

According to the Investment Industry Association of Canada‘s (IIAC) latest CEO survey, there’s a strong sense of optimism among the industry’s top executives. The survey, conducted this past December, found that investment dealer CEOs expect stronger markets, improving investor confidence and rising profits in 2015.

The outlook for the global markets is somewhat stronger than it is for Canada. The IIAC survey found that 48% of participants forecast an improving outlook for global markets this year while 35% foresee the global outlook remaining unchanged. For the Canadian market, 29% of survey participants expect a brighter outlook and 3% of those surveyed anticipate significant improvement. The majority of CEOs, 52%, expect the domestic outlook to stay the same this year.

Amid these forecasts, the industry’s CEOs also expect an uptick in investor confidence, as 73% of participants said their firm’s clients are “somewhat more likely” to participate in equities investing this year, with another 7% of survey participants saying that their clients are “much more likely” to invest in equities in the year ahead. Only 3% of those surveyed said that their clients are “less likely” to invest in equities; 17% of CEOs didn’t offer an opinion.

Although industry CEOs appear pretty bullish on clients’ willingness to embrace equities, survey participants were measured more on their views about whether they expect clients to put more of their cash to work in order to make those investments. In fact, 43% of survey participants said they expect clients to trim their cash holdings; just 3% of those surveyed foresee a significant move out of cash. Conversely, 40% of CEOs said they don’t expect clients to reduce their existing cash positions; and 13% of CEOs didn’t know what clients are likely to do with their cash.

Nevertheless, the bullish outlook for markets and investor confidence is expected to translate into stronger bottom lines. About three-quarters of industry CEOs (74%) are planning to hire more investment advisors in the year ahead. Furthermore, 77% of survey participants cited wealth management as one of the top three areas of growth for their firms in the year ahead.

The wealth-management business is by far the leading choice as a source of growth this year, with equities trading coming in a distant second, at 35%, followed by commissions, at 32%. A mere 6% of surveyed CEOs said they don’t see any growth opportunities.

Moreover, none of the CEOs surveyed said they expect to reduce the size of their advisory sales force. Among those firms that aren’t planning to hire, about half are purely institutional firms with no retail force; the other half expect to keep their advisor numbers unchanged.

At the same time, CEOs were optimistic about what this will mean to their businesses overall. More than two-thirds (69%) of CEOs surveyed expect their firms’ profitability to improve this year; another 3% are hoping for a significant jump in earnings. This optimism follows a year in which overall industry operating profits rose by about 32.4% year-over-year.

Among the gloomier CEOs, most expect their profits to remain unchanged this year. Just 10% of CEOs surveyed said profits are likely to decline this year, although none of those surveyed expect a significant drop-off. The rest, 18%, foresee their bottom lines remaining unchanged.

The top challenge to industry growth and profitability that CEOs foresee is regulation: 87% of survey participants identified the ongoing regulatory burden as one of the top three impediments to growth in 2015. This choice was more than double the next most popular – competing with large integrated dealers and the cost of technology, both of which were cited by 39% of CEOs as top challenges.

Interestingly, most of the obstacles to growth that CEOs foresee originate within the industry. The prevailing conditions in the markets are not widely foreseen as being a hindrance. Only 19% of CEOs surveyed said that investor reluctance represents a top three threat to growth; just 13% of CEOs pointed to a lack of access to capital; and a mere 3% of CEOs said that the reduction in business financing volume is a barrier to growth.

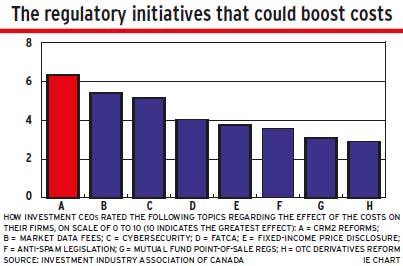

Among the numerous regulatory initiatives that are threatening firms’ growth prospects, the biggest threat is the client relationship model (CRM2) reforms. The survey asked CEOs to estimate the cost impact of various factors, on a scale of one to 10, with 10 indicating a major increase in costs. On that scale, the CRM2 reforms rank first overall, with an average score of 6.33 – almost a full point ahead of the next biggest cost items, market data fees (at 5.37) and cybersecurity (5.13).

The next regulatory issue on the list is compliance with the Foreign Account Tax Compliance Act, at 4.03. Other regulatory initiatives – such as new transparency requirements in fixed-income markets, point-of-sale disclosure for mutual funds and derivatives market reform – all came in at less than 4.0 on the scale.

The cost of compliance with the CRM2 requirements is one of the reasons why the IIAC is asking regulators to push back the deadlines for certain aspects of the reforms that are being phased in over the next couple of years. The IIAC has requested that the Canadian Securities Administrators (CSA) give firms until yearend to implement certain measures that are slated to take effect in July and, similarly, to extend the deadlines for reforms that are to be adopted in July 2016 to the end of that year.

It’s not clear if the industry is going to get that extension. The CSA indicates that its decision regarding that request won’t come until February at the earliest.

© 2015 Investment Executive. All rights reserved.