Although the sum raised in initial public offerings (IPOs) in Canada’s capital markets last year remains well off the recent high reached just two years ago, $2.7 billion in IPOs were recorded as a result of investor demand for yield, particularly from real estate investment trusts (REITS), according to a recent report issued by Toronto-based PricewaterhouseCoopers LLP (PwC).

In fact, 2013 can be characterized as the year of big Bay Street public-financing deals. It took just 30 IPO deals on all public stock exchanges to reach the $2.7-billion threshold; in contrast, it took 62 IPOs to reach the final tally of $1.8 billion in 2012.

However, the results in both 2012 and 2013 were well off the almost $5.5 billion that Canadian IPOs raised in 2011, when mining firms were cashing in on the commodities supercycle being fuelled by torrid growth in the developing world. In comparison, the PwC report notes, mining companies basically sat on the IPO sidelines last year.

“The surprise story,” says Dean Braunsteiner, PwC’s national IPO services leader, “was really how the REITs did, as the real estate market was really what carried the IPOs in 2013.”

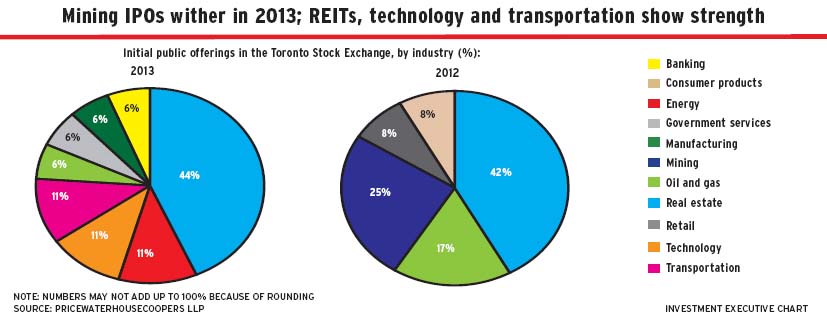

Real estate was far and away the most important sector in generating new listings, accounting for 44% of the IPOs last year, he adds: “It really was investors looking for something that provided them with capital preservation. And [that sector] gave them a bit of a yield that they’re not getting in other types of investments.”

Real estate led the way in both quantity and quality, with the biggest IPO of the year being Loblaw Cos. Ltd.’s spinoff of the majority of its real estate holdings into Choice Properties REIT, an IPO valued at $400 million. Other big real estate IPOs in the year included CT REIT ($263.5 million), Milestone Apartments REIT ($200 million) and Agellan Commercial REIT ($134.6 million).

Other large, non-real estate IPOs last year included the $262.3 million raised by transportation company BRP Inc.; $250.5 million for Oryx Petroleum Corp.’s IPO; $225 million for Cardinal Energy Ltd.’s IPO; and $200 million for TransAlta Renewables Inc.’s IPO.

Of the $2.65 billion raised on the Toronto Stock Exchange (TSX) through 18 IPOs, eight were from the real estate sector, accounting for $1.37 billion, or 52% of the value of IPOs raised on the TSX.

Beyond real estate, the busiest sectors with new listings in the TSX were technology, energy and transportation companies, each accounting for 11% of IPOs.

Mining firms missing in 2013

Mining firms, a major component of the 2011 tally, did not participate in the IPO market in 2013. In “strong” IPO years, this sector accounts for than 50% of IPO activity, Braunsteiner notes: “What was really missing in 2013 was mining IPOs, which Canada has really relied on [to] make or break the market. So, it’s kind of a ‘good news, bad news’ story. The good news is there were these other industries that were able to come along and help the market out. But, fundamentally, we do rely on those extractive industries.”

Braunsteiner is hopeful that mining, along with the energy and oil and gas sectors, can stage a comeback this year: “That is really kind of the dark horse for 2014. If we can get the mining sector going again, we will certainly see an uptick in the overall results and not quite get to where we would have been in 2011, but at least start on the road to recovery.”

The mining industry has been out of favour with investors because of slumping prices for the underlying commodities, Braunsteiner adds, as well as for unforced errors on their part: “The industry hasn’t done itself any favours, with lots of cost overruns, missing the mark in terms of production guidance, cost guidance.”

Thus, he explains, investors are avoiding mining companies until they prove they can get a handle on their costs and production in a period of lower worldwide demand. “We still think that China is going to have a huge demand for these commodities,” he says, but investors will remain wary “until [mining companies] can get their operations in order.”

It may take a rise in interest rates to shift the IPO market from its current focus on the real estate sector, Braunsteiner says: “As interest rates go up, the stock market seems to look like a bit of a better option” – and IPOs that have been shelved because of poor market conditions might be revived.

“In a market of rising expectations,” Braunsteiner says, “oil and gas, energy and, hopefully, mining [may be favoured again]. It’s hard to predict, but if you can get commodities prices settled, there’s still a need for the commodities.” The mining sector is also “starving for cash at the moment; there is no shortage of projects that need financing.”

The pipeline of IPOs seeking investor support right now is smaller than it was at the start of 2013, suggesting a weaker first quarter for IPOs. But the PwC report remains optimistic that a return to favour for commodities producers will result in a better year for IPOs in 2014.

© 2014 Investment Executive. All rights reserved.