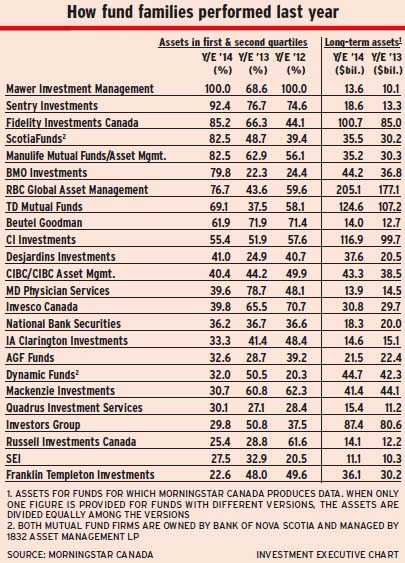

Mutual fund families with exposure to hot investment markets or sectors – or families that benefited from canny stock-picking – performed well last year, according to data from Toronto-based Morningstar Canada.

Having flexible investment mandates also helped. The mandates governing funds in some families – notably, those of the big banks – don’t allow portfolio managers much leeway to invest in better performing assets – and the performance of such families lagged. For example, the inability of those fund families’ bond funds to hold high-yield debt or their Canadian equity funds to hold foreign equities weakened returns.

The top-performing fund family was HSBC Global Asset Management (Canada) Ltd. (HSBCGAM), with 86.1% of its long-term mutual fund assets under management (AUM) in the top two performance quartiles for the year ended Dec. 31, 2013. (All companies are based in Toronto unless otherwise noted.)

HSBCGAM CEO Marc Cevey credits picking the right geographical areas and sectors for most of the firm’s fund family’s success in 2013: “The recovery varied greatly. We were overweighted in the U.S., central Europe, including Germany and Scandinavia, and Asian export-oriented countries, [such as] Taiwan, Singapore and Korea. In Canada, the funds were underweighted in materials and overweighted in consumer discretionary, industrials and technology.”

The No. 2 spot went to MD Physician Services Ltd., which had 78.7% of its long-term AUM in the top two performance quartiles. MD’s investment procedure was a major factor behind the performance, says the firm’s chief investment officer (CIO), Bill Horton.

MD uses multiple external portfolio managers and has developed a methodology that determines the right mix of portfolio managers “for different market realities,” says Horton. The idea is to get “not just the best managers, but the right mix of managers for each fund at any point in time.”

Rounding out the top five were Sentry Investments Inc., Beutel Goodman & Co. Ltd. and Calgary-based Mawer Investment Management Ltd. – all deep-value portfolio managers that benefited from astute stock-picking. No. 6, Fidelity Investments Canada ULC, also relies on stock-picking. And the Trimark lineup of funds at Invesco Canada Ltd., the No. 7 performer last year, are managed in a value style.

Finding oligopoly situations

One of the themes that has worked well for Sentry is finding oligopoly situations in which a few firms dominate a sector and the level of service becomes the differentiating factor for customers. In oligopolies, firms tend to have higher returns on invested capital and less debt, notes Sentry CIO Dennis Mitchell, than firms in sectors in which there are many competitors.

One such oligopoly is the U.S. pharmaceutical distribution industry, in which three companies have 85% of the market. Sentry funds were invested in one of those three firms, AmerisourceBergen Corp., the share price of which rose by 62.8% in 2013.

Discipline is important in value investing. Portfolio managers at Beutel Goodman, for example, invest in only companies, says Mark Thomson, managing director for equities, that “we believe will [have] a return of at least 50% over three years.”

Beutel Goodman puts both buy and sell targets in place. If a stock hits the sell target, it’s reviewed and, if still attractive, will continue to be held. Portfolio managers also are concerned about being caught by a sudden deterioration in a company, says portfolio manager Rui Cardoso, so they spend a lot of time “understanding the downside of a business.”

Sentry, Beutel Goodman and Mawer are relatively small fund families in terms of AUM and number of funds, which, as Sentry’s Mitchell points out, can make portfolio management less complicated and thus increase the chance for outperformance.

Small size can help performance, agrees Craig Strachan, head of product at Fidelity. But he also believes that the depth and breadth of Fidelity’s global asset-management expertise provides a big advantage. “You need people all over the world,’ he says, “who understand local conditions and the way each supply chain works.”

Dan Chornous, CIO with RBC Global Asset Management Inc., (RBCGAM) seconds Strachan’s point about global reach. He notes that RBCGAM is adding portfolio managers in London and rebuilding its Asian equities capacity.

Chornous and Strachan agree that locating portfolio managers in target markets is important. One reason, says Strachan, is because of the large number of analysts covering the U.S. large-cap market, for example, so it’s becoming more difficult to value stocks everyone else has missed.

What held back RBCGAM funds last year was the underperformance of the family’s “pure” Canadian equity and bond funds, which are measured against fund families that can enhance returns by increasing both the proportion of U.S. stocks in their Canadian equity funds and the high-yield bonds in their bond funds. (For example, the foreign content of Sentry’s Canadian Income Fund was increased to 49% of AUM from about 35% in the past year.)

RBCGAM believes in keeping fund mandates simple – almost all investments in Canadian equity funds are Canadian, for example. Thus, it’s up to the client and advisor to decide what type of investment is required.

The other major bank-own ed fund families follow a similar philosophy. Says Bruce Cooper, vice chairman with TD Asset Management Inc.: “If clients buy a Canadian equity fund, they want Canadian equity. If they want foreign equity, they buy it.”

Among the fund arms of the big banks, BMO Investments Inc. had the weakest results in 2013, with just 22.3% of its long-term AUM in the top two performance quartiles – the third year in a row of relatively weak performance.

Like the funds of other banks, BMO funds’ relative performance is affected by being measured against funds with more flexible mandates. For example, BMO SelectClass Security Portfolio, a large balanced fund ($4.6 billion in AUM as of Dec. 31), can’t hold more than 25% equity, says CIO Kevin Gopaul, while other funds in the same category can hold up to 40%.

© 2014 Investment Executive. All rights reserved.