fCanada’s struggling economic performance, which resulted in a drop in the country’s real gross domestic product in the second quarter (Q2) of 2016, had less of an impact on some financial services companies’ earnings than might have been expected.

That’s because the economy’s contraction was due primarily to a large drop in export volume while consumer spending and housing, important drivers of banks’ earnings, remained healthy. Indeed, all of the Big Six banks had higher net income than a year earlier.

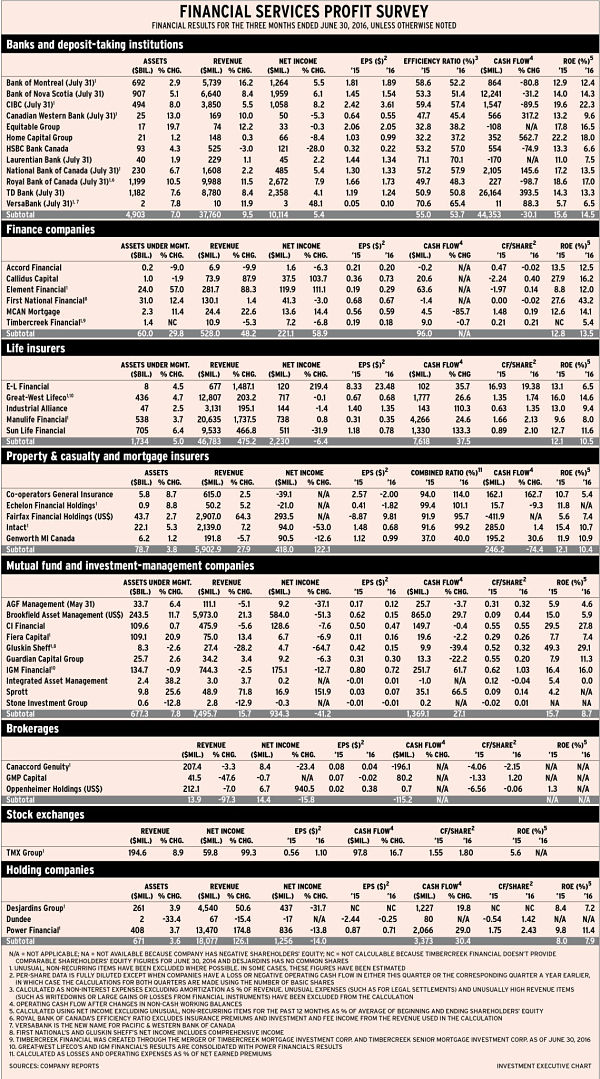

Still, the majority of the 43 firms in Investment Executive‘s (IE) quarterly profit survey had weaker results, with 20 reporting lower net income than a year earlier and five in a loss position. In contrast, 16 firms had higher earnings and two firms – Fairfax Financial Holdings Ltd. and Integrated Asset Management Corp. (IAM) – reported positive net income vs losses in Q2 2015. (These figures exclude Great-West Lifeco Inc. [GWL] and IGM Financial Inc., the results of which are consolidated in Power Financial Corp.’s earnings.)

A major factor that drove the downward trend in earnings is investors’ and businesses’ concern about global economic growth and when the U.S. Federal Reserve Board will raise interest rates. This concern affected the results for the brokerages in particular, but also pulled down results for mutual fund and investment-management companies. As well, the Fort McMurray, Alta., wildfires resulted in substantial underwriting losses for property and casualty (P&C) insurers.

There were just two dividend increases this quarter, and both came from big banks. Bank of Nova Scotia’s quarterly dividend rose to 74¢ from 72¢ and Royal Bank of Canada’s (RBC) increased to 83¢ from 81¢. These modest rises are in contrast with eight dividend increases in the previous quarter.

IE made a notable change to the profit survey this quarter with the addition of a “finance companies” subsector, which includes four firms not previously in the survey that are significant elements of Canada’s financial services landscape: Callidus Capital Corp., Element Financial Corp., MCAN Mortgage Corp. and Timbercreek Financial Corp. As well, Genworth MI Canada Inc. has been added to the P&C subsector.

Here’s a look at the subsectors in more detail:

– Banks. Eight of the 12 deposit-taking institutions had higher earnings, but Canadian Western Bank (CWB), Equitable Group Inc., Home Capital Group Inc. and HSBC Bank Canada had declines.

CWB’s drop isn’t surprising, as much of its business is in Alberta, where low oil prices are taking a toll, resulting in loan-loss provisions (LLPs) of $17.4 billion vs $8 billion a year earlier. On the plus side, CWB also operates in British Columbia’s healthy economy and has acquired two finance companies to diversify its operations.

Equitable Group’s earnings decline was marginal, at 0.3%. Home Capital’s 8.4% drop in earnings comes from anticipated losses at CFF Bank, which Home Capital acquired in October 2015. HSBC Bank’s earnings were pulled down by energy-related loan losses.

Most of the major divisions of the Big Six banks reported higher net income. The exceptions were wealth management at Bank of Montreal (BMO) and Canadian Imperial Bank of Commerce; financial markets at National Bank of Canada; and treasury and investor services and insurance at RBC, excluding the $235-million net gain from the sale of RBC General Insurance Co. to Aviva Canada Inc. (IE’s quarterly profit survey excludes all such unusual and non-recurring items.)

All the Big Six, except for National Bank, had higher LLPs than a year earlier, although those provisions were lower than in the previous quarter for all but BMO. For the 12 deposit-taking institutions as a group, total LLPs were $2.1 billion this quarter vs $2.8 billion in the previous quarter and $1.6 billion a year earlier.

– Finance companies. Results were mixed for this subsector, as there were big increases in net income of more than 100% for Callidus and Element; a healthy 14.4% increase for MCAN; but drops for the other three firms.

Callidus is an alternative lender that provides bridge financing to commercial customers that can’t get adequate financing from traditional lenders. Thus, Callidus uses a lot of derivatives. In Q2 2016, the firm had a $32-million gain on these investments.

Element is a fleet-management and equipment-finance firm. Its large earnings gain is the result of the recent acquisition of GE Capital’s fleet-management operations in the U.S., Canada, Mexico, Australia and New Zealand. Element plans to reorganize into two publicly traded companies in early October.

First National Financial Corp., MCAN and Timbercreek are mortgage companies, while Accord Financial Corp. is an asset-based lending company. MCAN’s healthy net income gain reflects its strong increase in revenue.

– Life insurers. Revenue in this subsector is quite volatile because of the impact of the fair value of the large amount of assets the companies hold to back up their long-term liabilities. In Q2 2016, there were big gains in fair value, but those don’t increase net income for most of these firms. Indeed, three of the five lifecos reported a decline in net income, although GWL’s was miniscule, at 0.1%.

However, E-L Financial Corp. is a somewhat different firm, with a large investment portfolio that’s separate from its insurance operations. As a result, E-L’s significant earnings gain of 219.4% did come from increases in the fair value of investments. Notably, the situation was the opposite in Q1 2016, resulting in a loss of $87.9 million in Q1 vs net income of $337.2 million in Q2.

– Property & casualty and mortgage insurers. Co-operators General Insurance Co. and Echelon Financial Holdings Inc. suffered losses, while Intact Financial Corp.’s net income plunged by 53% in Q2 – all a result of the wildfires in Fort McMurray.

Fairfax was less affected by the wildfires because most of its operations are in the U.S. – and it also had a US$229.2-million increase in the fair value of assets vs a loss of US$661.2 million in Q2 2015.

Genworth, a mortgage insurer, wasn’t affected, either. Its net income was pulled down by unrealized losses on derivatives and foreign exchange.

– Mutual fund and investment-management companies. Only Sprott Inc. reported a gain in earnings in Q2 – and it was substantial, at 151.9%. This was a result of a big increase in the value of Sprott’s proprietary investments, most of which are in resources and precious metals. IAM did report positive net income vs a loss in Q2 2015, but the firm still hovers around the break-even mark.

Seven of the other eight companies had declines, while Stone Investment Group Ltd. remained in a loss position.

The three big mutual fund companies were in net redemptions in Q2 2016.

Notably, the 51.3% earnings decline at Brookfield Asset Management Inc. was because its net income in Q2 2015 was pushed up by a one-time deferred income tax recovery of US$464 million.

– Brokerages. The global economic environment is negative for these firms’ investment-banking activities. As a result, Canaccord Genuity Group Inc.’s net income was down by a substantial 27.9% and GMP Capital Inc. reported a loss. Oppenheimer Holdings Inc., which operates only in the U.S., had a whopping 940.5% increase in net income, thanks, in part, to very weak earnings in Q2 2015.

– Exchanges. TMX Group Ltd.’s significant 99.3% increase in earnings came partly from higher revenue and lower expenses, but also because net income in Q2 2015 was pulled down by a $5.9-million impairment charge.

– Holding companies. Desjardins Group’s drop in net income was the result of unusually high earnings in Q2 2015. Power Financial’s decline reflected the results of GWL and IGM.

Dundee Corp. remained in the red, but the loss was much smaller than in Q2 2015, at $17.3 million vs $149.9 million, reflecting some recovery in the firm’s resources investments.

© 2016 Investment Executive. All rights reserved.