Mutual funds are finding favour with Canadians in a complex and unpredictable investment environment. Assets under management (AUM) topped $1 trillion in January for the first time in the industry’s 82-year history.

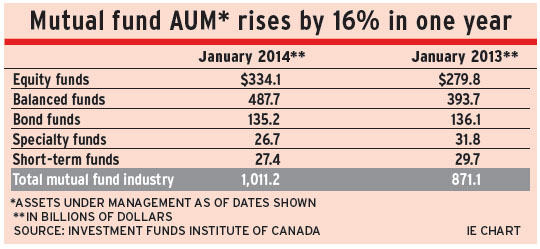

Statistics compiled by the Toronto-based Investment Funds Institute of Canada (IFIC) showed AUM of $1.01 trillion as of Jan. 31, a gain of 16.1% from a year earlier. Mutual funds actually showed a faster pace of growth than up-and-coming exchange-traded funds, the AUM of which grew by 11.5% to $62.9 billion during the same one-year period, according to the latest figures.

“A trillion dollars is an impressive number,” says Joanne De Laurentiis, IFIC’s president and CEO. “And it underlies the comfort level and trust that Canadians have in the product as a vehicle to invest in the capital markets.”

Of the $986-billion increase in mutual fund AUM since 1990, approximately 54% was generated by net sales; 46% came from market appreciation. During this period, mutual funds have taken market share away from traditional interest-paying deposits, cornering a bigger slice of household financial assets.

Research from Investor Economics Inc. of Toronto found that mutual funds have grown to 28% of household financial assets vs 6% in 1990, while deposits have shrunk to 38% of household financial assets from 68% in 1990.

A survey by Royal Bank of Canada found mutual funds to be the preferred investment for RRSPs this season, with 43% of RRSP accountholders picking mutual funds as their top RRSP choice, 22% picking savings accounts and 20% picking guaranteed investment certificates.

“Mutual funds are a great way for people to get exposure to financial markets,” Laurentiis says. “The product is professionally managed and highly regulated, and there are lots of investment options, including foreign and domestic, as well as stocks, bonds or balanced portfolios.”

The strong performance of equities markets in the past year may be spurring some Canadians to move off the sidelines, where they have been hiding in heavy cash holdings since being scalded by the global financial market collapse of 2008-09.

“The aftermath of the global financial crisis saw people skew toward conservative assets,” says David Richardson, vice president, enterprise sales and group financial services, with RBC Global Asset Management Inc. in Toronto. “But they’re slowly getting on board with more balance and diversification, and that’s reflected in higher fund sales.”

Richardson adds that last year’s growing appetite for funds continued in January, with record sales for RBC. The most popular products among RBC clients are portfolio solutions and balanced funds.

A few years ago, the top-selling portfolios were those classified as “very conservative,” Richardson says, but the preference shifted to “conservative” last year, then has swung even further to “balanced” so far this year.

Net sales for equity funds for the mutual fund industry as a whole were $7 billion in the year ended Jan. 31 – a big swing into the black from net redemptions of $12.8 billion in 2012.

The balanced fund category saw the lion’s share of net sales, with $41 billion – significantly higher than $29.6 billion a year earlier.

Bond funds fell into net redemptions of $6 billion for the 12-month period ended Jan. 31 – a reversal from net sales of $18 billion during the previous one-year period, when investors were wary of the stock market.

“Balanced funds and fund-of-funds portfolios are accounting for the bulk of net flows,” says Sandeep Gosal, associate consultant with Toronto-based Investor Economics Inc. “With those products, the asset allocation is left to the professionals and they decide where to direct new money. Investors don’t have to decide whether it’s a better time for stocks or bonds.”

Craig Strachan, vice president and head of product for Toronto-based Fidelity Investments Canada ULC, says investors are taking note of strong equities performance and the interest is perking up, particularly in U.S. and global mutual funds.

“Clients have been confused and concerned,” says Strachan, “but they’re paying attention to stock market returns and are venturing back into mutual funds.”

“When clients move from the Canadian to the global space, that’s good for the mutual fund industry,” he adds. “As an individual investor, it’s difficult to research and buy investments in Europe, Japan or even the U.S., or to access the kind of high-yield or floating-rate income securities that are popular now. People need to go through a professional fund [portfolio] manager.”

At the same time, Strachan says, the active management style delivered by mutual funds recently has been outperforming index returns, on average.

“A lot of active managers,” he says, “are adding value in asset classes that are hard for investors to purchase by themselves.

“Small- and mid-cap mandates,” he continues, “are also seeing tremendous flows – and that’s another opportunity for active managers. These stocks are not well-covered, and [that] provides opportunities for managers willing to do their own research.”

A report recently released by Toronto-based Russell Investments Canada Ltd. shows the median large-cap institutional equity fund portfolio manager achieved a return of more than six percentage points higher than the S&P/TSX composite index’s 13% gain in 2013.

© 2014 Investment Executive. All rights reserved.