Your small-business owner clients might be advised to draw out earnings from their corporations in the form of dividends for the 2015 taxation year, as opposed to waiting to do so over the next few years.

The tax rate on non-eligible dividends will be rising due to the federal government’s proposed phased-in reduction of the small-business tax rate, which could change the tax-planning picture for small-business owners.

“If you already have income that was taxed in a prior year in your corporation and you want to get it out, you will be stuck with higher rates starting next year,” says Jamie Golombek, managing director of tax and estate planning with Canadian Imperial Bank of Commerce’s wealth advisory services division in Toronto.

“If you need the cash from your business in the next year or two,” he says, “maybe you want to take it out this year instead of taking it out [later], when the rate is going to be higher.”

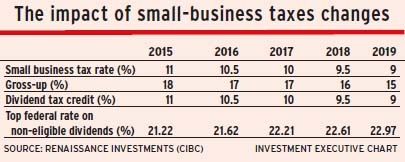

As part of this year’s federal budget, the government proposed lowering the small-business tax rate, known as the small-business deduction, to 9% from 11%, phased in by increments of 0.5% a year starting in 2016 and ending in 2019. The small-business tax rate, as opposed to the higher general corporate rate, applies to the first $500,000 of qualifying active income earned by Canadian-controlled private corporations (CCPCs).

In tandem with the proposed reduction in the small-business tax rate, the government proposes to lower the gross-up percentage and the dividend tax credit (DTC) associated with non-eligible dividends – generally, dividends that are received from CCPCs. The reduction in the gross-up and the DTC also would be phased in over the next four tax years.

“The result will be an increase in personal taxes that will apply to those non-eligible dividends,” says Aurèle Courcelles, director of tax and estate planning with Investors Group Inc. in Winnipeg. “Yes, your [small business] corporate rate is coming down. But, correspondingly, your personal rate is going up when the dividends are flowed out to you.”

The top rate on non-eligible dividends at the federal level is 21.22%. By 2019, once all the changes to the small-business deduction are phased in and the gross-up and the DTC fully implemented, the top federal rate will be 22.97% – an increase of 1.75 percentage points. Leaving earnings in a corporation now and drawing on those earnings in subsequent years in the form of non-eligible dividends will mean a slightly higher tax bill.

On one hand, the reduction in the small-business tax rate means that the opportunity for tax deferral by leaving earnings within the corporation increases.

“My personal tax rate is not changing, but my small-business tax rate is going down, so there’s going to be a deferral,” Courcelles says. “Every year [of the four-year transition period], there’s going to be a little bit more deferral.”

The decision by a business owner regarding whether to draw out earnings – or how much to draw out – from the business in the form of dividends in 2015 as opposed to in a future tax year ultimately will depend on a variety of factors: the business owner’s personal cash-flow needs; the small-business tax rate and dividend tax credits at the provincial level; and how earnings are being deployed in the corporation now.

“If the money is just sitting there [in the corporation], earning 0% in a chequing account, I would say pull it out now, save the taxes and invest it personally,” Golombek says. “But if the money is fully invested, why pay the taxes now versus later? There’s an opportunity cost [to drawing out dividends now] even though there’s an absolute cost [to waiting].”

Your small-business owner clients should consult with their accountant to determine whether to leave earnings in the corporation or have them flow out in the form of dividends.

This reduction in the small-business rate, proposed in the federal budget tabled in April, is the second reduction of corporate taxes on small businesses by the government. In 2006, the feds announced a reduction in that tax rate to 11% from 12% by 2009, while increasing the amount eligible for the small-business rate in stages to $500,000 from $300,000 of eligible active business income.

© 2015 Investment Executive. All rights reserved.