This article appears in the October 2023 issue of Investment Executive. Subscribe to the print edition, read the digital edition or read the articles online.

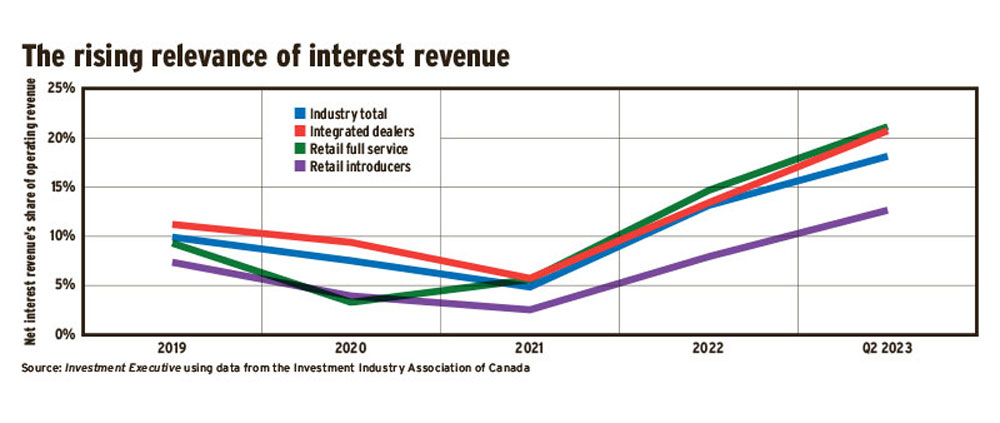

Inflation is inflicting its share of pain on borrowers, but higher interest rates have been a boon to investment dealers, according to data from the Investment Industry Association of Canada (IIAC).

Over the past five years, operating revenue for dealers rose by more than 40% and profits rose by about 65%, IIAC’s data shows.

Much of this growth came following the onset of the Covid-19 pandemic in early 2020, when central banks slashed interest rates and a flood of cheap money helped drive markets to new heights.

More recently, as policymakers unwound pandemic supports and interest rates rose rapidly to tame runaway inflation, most of the factors driving higher revenue and profits in the investment business also faded. Yet, investment dealers continued to thrive.

After the Bank of Canada began its interest rate-hiking cycle in March 2022, investment dealers’ net interest revenue soared, largely offsetting weaknesses in other parts of the business.

For example, when interest rates were near zero in the first quarter of 2021, the industry’s quarterly net interest revenue was $354 million. As rates began rising, so did quarterly revenue, which reached more than $1.50 billion by the end of 2022. For the second quarter of 2023, net interest revenue came in at $1.47 billion.

The growth in net interest revenue was led by the full-service retail dealers, which generated about 21% of their operating revenue from interest-based activity in Q2 2023 — up from just 3.3% when interest rates hit rock bottom in 2020.

The story is similar for the large, integrated dealers. But small retail introducer firms are trailing their bigger rivals with about 12.7% of operating revenue coming from interest-driven sources in Q2 2023 (although this is up significantly from 2.5% in 2021).

Over the past 18 months, however, client margin debt remained relatively stable. In Q2 2023, outstanding margin debt totalled $34.5 billion, up by about 5.0% on a quarter-over-quarter basis but still below its recent peak in 2021 of $39.2 billion.

According to IIAC data, margin debt grew by about 13.1% over the past five years — well below the growth rate for industry operating revenue and profit over the same period.

Yet clients’ cash holdings declined significantly in the past couple of years. Cash positions for Q2 2023 came in at $66.7 billion, down from $80.8 billion at the end of 2022 and down by more than one-third from where they were when the Bank of Canada began raising the interest in the first quarter of 2022 (around $104.5 billion).

The drop in cash holdings over the past 18 months suggests households have used some of their increased savings generated by the pandemic to weather the effects of inflation and rising debt costs, while potentially deploying some of those savings in the market.

Overall, the data indicates the investment industry has absorbed shifting financial conditions remarkably well. The recent surge in net interest revenue helped offset weakness in investment banking and the erosion in commissions that accompanied the market volatility over the past 18 months.

In 2022, investment-banking revenue was down by 37.9% on a year-over-year basis. Commissions declined by 15.7% over the same period, led by weaker mutual fund trading commissions. So far this year, commissions were trending modestly lower once again, while investment-banking revenue looked relatively flat, with weaker equity and debt issuance offset by stronger corporate advisory revenue.

At the same time, the industry’s fee revenue continued to grow. Fees were the one segment of industry revenue exempted from the large swings that tend to afflict the more market- and rate-sensitive parts of the business.

Over the past five years, total fee revenue rose by more than 50%, outpacing the increase in overall industry operating revenue. This upward trend remained unshaken through the first half of 2023, with fee revenue rising by another 3.3% in the second quarter to almost $3.2 billion (representing about 40% of operating revenue).

Overall operating revenue has stayed near record levels this year, hitting more than $8 billion on a quarterly basis. For Q2 2023, revenue rose by almost 20% from the same quarter last year. Profits also remained robust, topping $3.6 billion through the first half of this year.

These solid returns underpinned employment growth in the investment business, with head count rising by 20.7% over the past five years from less than 42,000 five years ago — and surpassing the 50,000 mark for the first time in Q2 2023.

Shifting financial conditions have been challenging for parts of the investment business, such as commissions, trading and investment banking. But the stabilizing effect of hefty fee income and the recent boost from interest-related revenue has enabled the investment industry to thrive.

Click image for full-size chart