It may be an arbitrary milestone, but the fact there have now been at least 100 securities-related class-action lawsuits filed in Canada shows that these lawsuits have become a significant source of private enforcement.

The shareholder class action is a familiar feature of the U.S. legal landscape; yet, in Canada, they still feel relatively novel. But a new report from National Economic Research Associates Inc. (NERA) indicates that Canadian class actions have now hit the century mark, with 100 such lawsuits filed since 1998, more than half of them (57%) within the past five years.

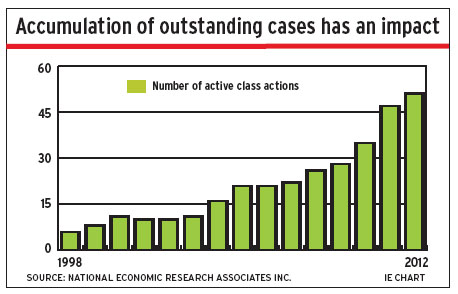

That said, there is hardly a stampede to the courts underway. The NERA report notes that there were just nine new securities-related class actions filed in Canada in 2012, down from 15 the year before, which is below the average of 12 cases a year over the past several years. Three cases were settled last year and two were dismissed, leaving 51 active cases (seeking more than $23 billion in total claims) as of the end of 2012. This accumulation of outstanding cases has grown steadily over the years as class actions have become a component of the Canadian legal and regulatory environment.

In late 2011, the Ontario Securities Commission (OSC) proposed a series of policy changes, including the possibility of introducing no-contest settlements, which would allow respondents in enforcement cases to settle the OSC’s allegations against them without admitting to any wrongdoing. One of the primary reasons cited for considering this policy change was to speed up enforcement settlements, as people facing regulatory action may be more inclined to settle more quickly if they didn’t have to admit to something that could later be used against them in a lawsuit.

That proposal sparked strong opinions, both pro and con. And, for now, it appears that the OSC is not going to go ahead with its plans to institute no-contest settlements – a prospect that, in general, was opposed by investor advocates and lawyers who often act on behalf of plaintiffs.

A paper published in late 2012 by a leading class-action law firm, London, Ont.-based Siskinds LLP, says that the fear that admissions made in regulatory settlements will then be used in class-action lawsuits is probably overblown. The paper’s authors examined the record of OSC settlements and securities-related class actions filed between the start of 2006 and late 2012 and found that regulatory enforcement and class-action lawsuits overlap in only a small number of cases. When they do overlap, the legal cases generally are concluded before the regulatory settlements are reached.

During the period in question, the OSC reached 159 settlements in 104 cases. (The number of settlements exceeds the number of cases because a case can involve more than one respondent.) Yet, there were only eight class actions that related to facts, or respondents, that also were facing enforcement action by the OSC. In six of those eight cases, the class actions were settled before the OSC settlements were reached. Only two class-action lawsuits were resolved after an OSC settlement was reached.

The Siskinds report also notes that there was a total of 47 class actions filed in Ontario during the period, so the portion of cases that involve concurrent OSC allegations represents a relatively small share of the overall class-action activity.

As a result, the Siskinds paper concludes that the idea that regulatory settlements based on admissions of wrongdoing are often used in private litigation, particularly class actions, is incorrect. The assumption that regulatory admissions increase the risk of a class action being filed also isn’t true.

Moreover, the Siskinds paper concludes that fear of class actions by itself isn’t delaying regulatory settlements: the research found that in cases in which the private litigation was settled first, it often takes years after that for the regulatory settlements to be reached.

Ultimately, the Siskinds paper concludes: “Our observations from this empirical study of the interaction between enforcement and investors’ proceedings strongly suggest that private actions have significantly complemented the regulators’ oversight and their enforcement proceedings, and that they have made invaluable contribution to achieve the objectives of [securities legislation].”

This conclusion echoes a recent study in the U.S. that compared class actions with enforcement investigations by the U.S. Securities and Exchange Commission (SEC). That study concluded that private enforcement, in terms of class-action lawsuits, provides “at least as much deterrent value, if not more, than public enforcement.”

Of course, class actions deal with just a small segment of the enforcement activity that regulators take on. The Canadian Securities Administrators (CSA) has just published the latest version of its annual report detailing the results of its enforcement efforts over the past year. That report shows that the regulators remained as busy as ever in a year in which the number of class actions dropped.

The CSA report indicates that the provincial regulators brought forward 145 new cases in 2012 – up from 126 in 2011, and more or less in line with the average over the previous four years.

The CSA also wrapped up a larger number of cases in 2012. Whether through settlement, decision or dismissal, the regulators closed 135 cases last year, up from 124 cases the previous year. Again, this total is close to the average over the previous four years.

Slightly less than 25% of the cases concluded by the CSA last year ended in a settlement. More than half (57%) resulted in a contested hearing before the regulators themselves; and another 20% were handled in provincial court.

The CSA’s enforcement efforts also resulted in significant monetary sanctions. Approximately $36.6 million in total fines and administrative penalties was ordered in 2012, down from $52.2 million in 2011 and $63.8 million in 2010. In addition, the CSA ordered restitution, disgorgement or other compensation of $120.6 million last year, more than the previous two years combined.

Naturally, the regulators cast a wide net; they must deal with a broad array of issues and must defend the public interest – not just try to recoup losses or even profit from litigation. The majority of the cases the regulators deal with involve so-called “illegal distributions,” such as small-scale Ponzi schemes and fraud.

Class actions tend to focus on a narrower set of problems, particularly disclosure violations. According to the NERA report, of the nine new cases that were brought forward in 2012, eight involve claims under the “civil liability for secondary-market disclosure” provisions of provincial securities laws – one of the primary grounds of such lawsuits.

Although the overall number of class actions dropped last year, the number of cases based on claims involving secondary-market disclosure is consistent with the past couple of years. Rather, it’s the other types of cases – involving alleged Ponzi schemes, for example – that tailed off last year, the NERA report suggests.

These secondary-market disclosure lawsuits dominate the class-action landscape in Canada. The NERA report indicates that 43 of these cases have been brought forward in Ontario since the end of 2005, when the enabling legislation took effect. Of that total, almost two-thirds (28 cases) remain active – and they represent the bulk of outstanding claims ($19 billion worth). Another 12 cases have been settled, while three have been dismissed.

By comparison, disclosure violations represent a relatively small part of the regulators’ work. Of the 145 cases the CSA brought forward in 2012, only 10 involve disclosure violations serious enough to merit enforcement action. In addition, disclosure cases account for a relatively small part of the total cases wrapped up in the past year, representing only about 4% of concluded proceedings.

Moreover, cases involving disclosure violations netted a mere $451,500 in monetary sanctions during the year, down from almost $2.4 million in 2011 and slightly less than $3.2 million in 2010. There was no restitution, disgorgement or other compensation ordered in these cases last year.

Class actions have been more lucrative where disclosure cases are concerned. The NERA report says that the average settlement amount for secondary-market civil liability cases is $10.5 million and the median settlement is $9.3 million. In cases with a parallel U.S. claim, the average settlement is $16.9 million and the median is $17.2 million. For cases limited to Canada, the average settlement is $7.4 million and the median is $5.4 million.

Of course, class actions face several constraints that regulators don’t: class actions have relatively tight time limitations and they have to make economic sense to pursue. There must be cases for which there’s the prospect of a decent monetary judgment and for which plaintiffs have the funds to pursue potentially costly litigation.

Nevertheless, it appears that class actions are contributing meaningfully to securities regulation enforcement.

© 2013 Investment Executive. All rights reserved.