Canadian cannabis stocks experienced significant growth over the past year, marked by dizzying periods of volatility fuelled largely by retail investors. But investors who held on to their cannabis stocks ended up better off than those who could not stomach the wild swings in stock prices.

“From a risk/reward perspective, gains made by investors substantially outweighed losses in the sector,” says Chad Larson, director of wealth management and portfolio manager in Calgary with Vancouver-based Canaccord Genuity Wealth Management. “The upside of cannabis stocks turned out to be a multiple of the downside.”

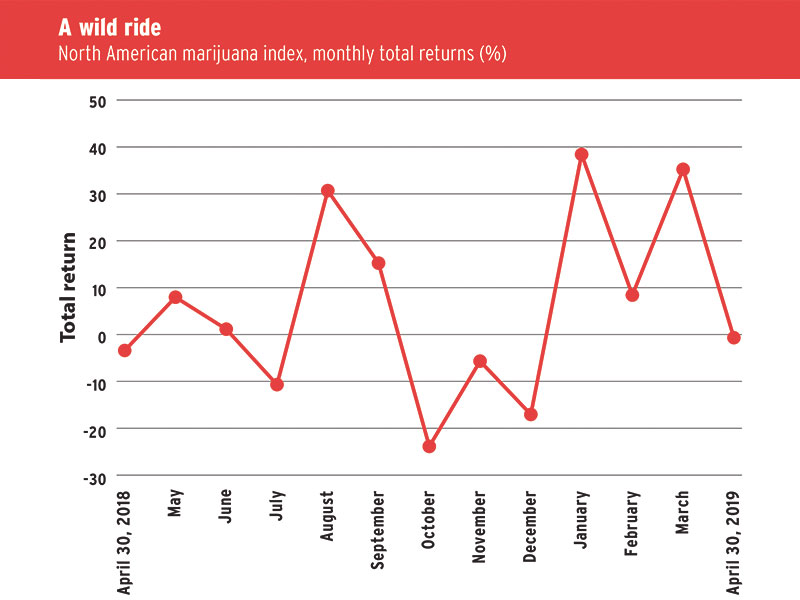

For the 12-month period ended March 29, 2019, the North American marijuana index was up 31.48%, with monthly returns during that period ranging from -23.6% in October 2018 to 38.45% in January 2019, highlighting the wild swings in stock prices.

Ironically, cannabis stocks experienced their worst loss in October 2018, following the federal government’s legalization of recreational marijuana. This steep decline in stock prices suggests the hype of “buying on mystery” came to an abrupt halt in the wake of a higher degree of certainty regarding where the sector might be heading.

“The retail client is mainly responsible for the big upswings we have seen,” says Michael Deane, managing director, wealth management, with Creation Wealth Capital Inc. in Toronto. “There are not many institutional investors involved in the space.”

Larson likens investors’ interest in cannabis to the Klondike gold rush. “Cannabis became a table-side discussion,” he says. “Everyone wanted a piece of the action in the ‘green rush’.”

There has been significant interest from investors from all demographic and psychographic segments over the past three years. People have been “buying on upside potential and expectations of hyperbolic growth,” Larson says.

Although the hype about making outsized gains in cannabis stocks appears to be over, Larson says, there still is a lot of room for growth in the sector.

Raj Lala, president and CEO of Evolve Funds Group Inc. in Toronto, shares that view. However, he says, some financial advisors feel they have missed the opportunity in the Canadian cannabis sector and are looking forward to taking advantage of opportunities in the much larger U.S. market. U.S.-based cannabis companies are more undervalued relative to Canadian companies. Plus, the regulatory environment is better in th U.S.

“Canadian companies have had a great run,” Lala says. “But the Canadian space is a little bit overdone.”

Canadian investors are beginning to focus on more established companies that have the potential to benefit from the forecasted wave of growth in the sector, according to Lala: “Valuations are realigning with fundamentals as investors become more interested in investing in actual operating businesses with real customers, brands and access to markets.”

Expansion of the sector also is expected to come from the manufacturing and sale of edible products infused with cannabis. Health Canada announced plans to approve new legislation that will allow for the sale of cannabis-infused consumer products beginning in October 2019.

Although cannabis still is illegal at the federal level in the U.S., medical marijuana use now is legal in 33 U.S. states and the District of Columbia. Recreational use of marijuana is legal in 10 states, with Michigan expected to become the 11th to legalize recreational use.

Several factors bode well for the U.S. cannabis sector. They include political pressure on the government to legalize marijuana, legislation that would prevent federal banking regulators from punishing banks for working with cannabis-related businesses and the legalization of hemp, a fibre that contains low levels of the psychoactive ingredient in marijuana.

As legalization of marijuana for both medical and recreational use gains increasing traction in the U.S. and elsewhere, the global cannabis industry could be worth as much as US$130 billion a decade from now, according to a report by New York-based investment bank Jefferies Group LLC.

The global market is important for the growth of Canadian companies, several of which are leveraging their “first mover” advantage to expand globally into the U.S., Europe and Latin America.

As well, as these companies seek to build economies of scale, the sector has experienced substantial merger and acquisition activity.

“The risk of investing in the sector will change with consolidation,” Deane says. “It is similar to the dot-com boom, [after which only] a few large corporations were left in the sector.”

For advisors who track the S&P/TSX composite index, avoiding top-performing cannabis stocks can be difficult. Canada’s two largest cannabis companies are constituents of the index: Smith Falls, Ont.-based Canopy Growth Corp. and Edmonton-based Aurora Cannabis Inc. Yet, cannabis stocks have not been sanctioned by many compliance departments, particularly those of the Canadian banks. However, Lala says, this is changing: bank-owned brokerages have begun to “place orders for cannabis ETFs.”

Says Larson: “If done properly, cannabis stocks can be great investments in a balanced portfolio.”

Prem Malik, financial advisor at Queensbury Strategies Inc. in Toronto, recommends ETFs for clients who want to invest in cannabis stocks.

However, he says, you must explain the risks inherent in the cannabis sector and ensure that such investments are in accordance with your client’s risk profile. “Otherwise,” he says, “compliance would reject such transactions.”

Deane tells his clients that cannabis companies pose more investment risk than traditional equities do. Like Malik, he recommends cannabis ETFs for clients interested in the sector. Examples include Purpose Marijuana Opportunities Fund and Horizons Marijuana Life Sciences Index ETF.