An increasing number of Canadians now are millionaires. And although these high-net worth individuals (HNWIs) may have extra money on hand, they don’t necessarily want to work with more than one financial expert.

This information comes from the 17th annual World Wealth Report, a joint venture of Paris-based global consulting firm Capgemini Service SAS and Royal Bank of Canada’s (RBC) wealth-management division. The report was released in June and covers 71 countries.

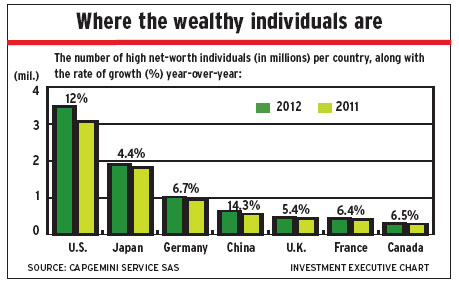

The World Wealth Report found that Canada’s HNWI population grew by 6.5% to 298,000 in 2012 while its overall wealth increased by 6.8% to US$897 billion – thanks, in large part, to strong equities markets and growth in both real estate markets and marginal gross domestic product. That said, those two growth averages are below those seen in North America and globally.

The survey for the report also found that 80% of Canadian HNWIs said they have a high degree of confidence in their wealth-management firms, an increase of nine percentage points from last year. Canadian millionaires are, in fact, far more trusting than their international counterparts: only 61.4% of HNWI globally said they trusted their wealth-management firms.

Along with that trust comes more assets to manage. The study found that Canadian HNWIs are more willing than their peers worldwide to work with only one management firm instead of multiple organizations: 54.5% of Canadian millionaires prefer to work with a single firm to manage their financial needs vs the global average of 41.1%. This compares with 13.4% of HNWIs in Canada who prefer to work with multiple organizations, which is in line with the global average of 14.4%.

Canadian HNWIs also prefer to have a single point of contact, such as a financial advisor, within that organization: 51.9% said they prefer to have a single contact, compared with 34% of HNWIs worldwide.

As well, Canadian HNWIs also were feeling more confident about their country’s regulatory bodies: 57.5% said they trusted those oversight organizations, up by two percentage points from 2012. This is significantly higher than the global average of 39.6% of HNWIs who said they trust their country’s regulatory bodies.

Canadian HNWIs also felt more secure about the financial markets: roughly 60% said they have a “somewhat high” to “very high” trust in the financial markets in early 2013. In contrast, the global average is 45.4%.

Canadian HNWIs are more willing to take on riskier investments: 34.4% said they were more focused on growth vs the 32.4% who were focused on asset preservation. Globally, 32.7% of HNWIs were focused on preservation while 26.3% were focused on growth.

In terms of where Canadian millionaires are putting their money, most have turned to the equities markets, although a strong bias remains toward cash/deposits. About 32% of HNWI portfolios in Canada were dedicated to equities vs approximately 26% worldwide.

The rest of the average Canadian HNWI portfolio in 2012 was divided as follows: cash/deposits, 21.7%; real estate, 19.3%; fixed-income, 15.5%; and alternative investments, consisting mostly of structured products, 11.6%.

According to the report, 87.4% of Canadian HNWIs are confident that their wealth will continue to grow. This is a big reason why wealth managers believe Canadian HNWIs will be dedicating more of their portfolios toward equities and away from cash.

“We continue to see more of our asset allocation going to equities – and going to the U.S. equities market vs the Canadian market,” says David Agnew, head of RBC’s wealth-management division in Toronto. “I’m very optimistic that we will have less cash next year.”

That comfort level with equities is well warranted, according to George Lewis, group head of RBC’s wealth-management and insurance divisions, despite recent market volatility and ongoing concern over the U.S. Federal Reserve Board’s (the Fed) bond tapering strategy.

It is appropriate for investors to be overweighted in equities, Lewis says, even when the possibility of an interest rate increase is taken into account. And although the situation requires close monitoring, Lewis does not believe the Fed or any other central bank will draw down their bond-buying programs until there’s a solid economic recovery underway.

“[Equities are] not without risk,” he says, “but with risk comes a return – and we think it’s a fairly priced return at the moment.”

Looking more broadly at the report’s findings, the total population of HNWIs in North America jumped by 11.5% in 2012 to 3.73 million after a slight decline of 1.1% in 2011. With this increase, North America overtook the Asia-Pacific region, which had the No. 1 spot in 2011 for the highest percentage of wealthy residents. The Asia-Pacific region had 3.68 million HNWI individuals in 2012.

North America has had a consistently higher total of investible wealth than the Asia-Pacific region, including in 2012, with North American HNWIs holding US$12.7 trillion of investible assets vs the US$12 trillion held by individuals in the Asia-Pacific region. However, the report does point out that the Asia-Pacific region is expected to overtake North America in 2014 in both population and wealth.

The increase in the HNWI population was not limited to North America; more people around the world now are classified as HNWI than ever before. The world’s HNWI population is now 12 million, up from 11 million in 2011.

“This year’s report shows that 2012 was a strong year of growth for the world’s HNWIs,” Lewis says. “We actually now have two million more HNWIs globally than before the [financial] crisis in 2008.”

Capgemini compiles the wealth report by estimating the size and growth of wealth in a region through a proprietary methodology developed during the 1980s. The method, which is updated on a regular basis, focuses on the estimation of total wealth by country and the distribution of wealth across the adult population in each country. The study defines a HNWI as “a person with US$1 million or more in investible assets, excluding primary residence, collectibles, consumables and consumer durables.”

This year’s report includes a new segment entitled the “Global High-Net Worth Insights Survey.” This survey was a collaboration between Capgemini, RBC and U.K.-based Scorpio Partnership. It was put together by surveying 4,400 HNWIs across 21 markets in North America, Latin America, Europe, the Asia-Pacific region, the Middle East and Africa.

Although the entire report breaks down the HNWI population and total investible wealth in each country, the new segment explores how HNWIs feel about their wealth-management firms and where they invest their money.

What HNW individuals want

As part of the 2013 World Wealth Report, Royal Bank of Canada, in partnership with global consulting firm Capgemini Service SAS of Paris and U.K.-based Scorpio Partnership, sponsored the “Global High Net Worth Insights Survey.”

This new part of the report, which was compiled from surveys of 4,400 high-net worth individuals (HNWIs) from 21 countries in five regions, highlights what HNWIs are looking for in an investment-management firm. (See story above for the definition of a HNWI.)

Some of the survey’s key findings include:

– Of all the HNWIs in North America, 52.8% prefer to work with a single firm, as opposed to multiple firms, compared with the global average of 41.4% of HNWIs.

– In addition, 50.9% of HNWIs in North America prefer to have a single point of contact, such as a financial advisor, within the wealth-management firm.

– Among all the HNWIs in North America, 43.4% said they were comfortable being offered in-house products vs 27.8% of HNWIs globally.

– In a breakdown of HNWIs’ attitude toward wealth, 27.7% of HNWIs in North America classified themselves as “wealth growers” vs 32.6% as “wealth preservers.” The remaining 39.7% said they had no set preference.

– Globally, 35% of HNWIs said they prefer to judge a portfolio’s success through absolute measures, such as achieving a goal such as retiring comfortably, as opposed to using a relative benchmark.

– About 40% of North American HNWIs said they prefer direct contact with wealth managers vs digital contact. Only 19.2% of North American HNWIs said they prefer digital contact, which is below the global average of 23.7%.

© 2013 Investment Executive. All rights reserved.