Battle lines are being drawn for an upcoming debate about whether securities regulators should pay prospective whistleblowers for tips that result in successful enforcement actions.

The financial services sector is digging in against the concept, and investors are calling for bigger bounties.

On June 9, the Ontario Securities Commission (OSC) will host a roundtable discussion to examine a range of issues raised by the regulator’s proposed new whistleblower program, which is modelled on a similar program that has been in place for several years now at the U.S. Securities and Exchange Commission (SEC). The OSC’s proposed program would pay tipsters up to $1.5 million for original information about regulatory violations that results in significant enforcement action.

The basic concept is that by offering a financial incentive to report wrongdoing, regulators can encourage tipsters to come forward by offsetting some of the negative consequences that typically befall people who turn in people at their own firms.

The OSC is looking at introducing the program as a way to enhance enforcement by, hopefully, uncovering misdeeds that probably wouldn’t come to light otherwise and to encourage firms to self-report possible misconduct, given the greater likelihood of a whistleblower exposing regulatory violations.

However, the idea raises a host of challenging issues. Chiefly, there’s the question of whether creating an incentive to report violations to regulators undermines internal accountability mechanisms. After all, why would employees report misconduct to their superiors when they potentially can earn a payday for going straight to the regulators?

There also are questions about: the size of awards that should be paid; how they should be funded; the eligibility criteria for claiming an award; and the sort of anti- retaliation protections that should be in place to protect whistleblowers. These are the issues that the OSC is planning to explore at its upcoming roundtable.

In the meantime, the comments submitted on the proposal, which was unveiled in early February after a couple of years of deliberation by the OSC, suggest that fairly clear lines are being drawn, with corporate Canada against the whistleblower concept and investor and shareholder advocates in favour.

Although there appears to be general support for the concept of some type of whistleblower program, there is a good deal of unease within the corporate community about the idea of regulators paying people for information about misconduct. This same sentiment was revealed earlier this year in research by Investment Executive (IE), which found that about two-thirds of industry chief compliance officers surveyed by IE are opposed to the idea of paying whistleblowers. (The IE survey was carried out before the details of the OSC’s proposed program became known.)

The Canadian Bankers Association’s (CBA) states in its comment on the OSC’s proposals that the CBA is worried that a system of financial incentives for regulatory reporting could weaken the banks’ internal compliance systems.

That same concern is echoed by Vanguard Investments Canada Inc. That comment cautions that the firm’s compliance systems won’t work properly if employees don’t report potential violations to internal compliance personnel.

Moreover, Vanguard argues in its comment, the firm’s culture of compliance will be “undermined” if the firm doesn’t have the opportunity to prove that it will punish conduct that’s offside because employees are taking their concerns to the regulators rather than reporting that conduct to the firm.

This concern about the possible impact of the proposed whistleblower program on existing compliance systems was anticipated in the OSC’s initial consultation paper. This concern is one of the central criticisms of the idea of providing a financial incentive for employees to take information to regulators.

The CBA also suggests that the prospect of a monetary reward that encourages employees to avoid reporting misdeeds to their employer is worrisome because a potentially systemic issue could continue to grow unchecked before the firm is alerted to that issue. The CBA comment also warns that this possibility of avoiding detection could inspire employees to violate other rules, such as privacy rules, in order to collect information on possible regulatory violations.

In addition to concerns about perverse incentives that could be created by a whistleblower program that pays for tips, industry advocates have other worries. For example, the mining industry trade group, the Prospectors and Developers Association of Canada (PDAC), also warns that a whistleblower program could generate a flood of tips that overwhelms the regulator and could lead to higher compliance costs generally, as firms become increasingly averse to regulatory risk in an environment in which employees stand to enjoy a financial gain for revealing misconduct.

“Reporting of fraud should be a moral obligation and not driven by financial incentives,” the PDAC states in its comment.

Weighing in against all of this concern about the proposals are an assortment of investor and shareholder advocates, who generally view the prospect of a program that pays rewards to whistleblowers as a good way to help root out and deter misconduct.

For example, the OSC’s Investor Advisory Panel (IAP) – an independent creation of the OSC that provides the regulator with an investor perspective on policy issues – argues in its comment that the notion that people should report misconduct because it’s the “right thing to do” is a nice idea that doesn’t necessarily work in practice: “In reality, when faced with the potential loss of financial security or career, many will put their own interests first.”

The IAP comment states that the panel believes that paying tipsters could help to correct that issue by “align[ing] self-interest and self-preservation with the wish to ‘do the right thing’ by offering confidentiality, whistleblower protection and a monetary incentive.”

However, the IAP comment also suggests that the OSC’s proposed program is too timid. The comment states that the planned $1.5-million cap on whistleblower awards should be scrapped and that there should be a two-stage system – monetary rewards that are paid regardless of whether a penalty actually is collected in a particular case (as currently envisioned in the OSC model); and an opportunity for enhanced compensation in cases in which additional penalties are collected from violators.

The IAP’s support for the OSC’s proposed program is reinforced by various other investor advocacy groups, including the Canadian Coalition for Good Governance, the Canadian Foundation for Advancement of Investor Rights (a.k.a. FAIR Canada), and the Small Investors Protection Association, along with a couple of law firms that often act for investors and shareholders in cases against securities firms and issuers.

The comment from one of those law firms, Ottawa-based McBride Bond Christian LLP (MBC), echoes the IAP’s call to do away with a cap on whistleblower awards and to offer greater payouts in cases in which more funds are recovered from wrongdoers. MBC’s comment also argues that regulators should be open to rewarding people who were involved with the misconduct in the first place – if they ultimately do the right thing and report violations to regulators. Rewarding wrongdoing whistleblowers, MBC’s comment states, is “just a necessary cost of accomplishing the more important goal of investor protection and market integrity. Prevention and disclosure of misconduct (consumer protection) must take precedence.”

Comments from other supporters of the OSC’s proposed program, such as the Canadian Advocacy Council for Canadian CFA Institute Societies (CAC), argue that the regulator will have to do more than planned to protect the anonymity of prospective whistleblowers: “We believe that confidentiality for participants in the program will be the key to its success” and adds that the OSC’s proposed model does not go far enough to ensure tipsters’ privacy.

Although the debate over the concept of paying whistleblowers and the details of a plan to do so is just getting started in Canada, the SEC has several years of experience with its program. And SEC chairwoman Mary Jo White is a staunch defender of the model.

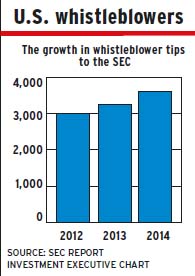

In a recent speech to the Northwestern University School of Law, White said that the SEC’s whistleblower program “has proven to be a game-changer.” She added that the number and quality of the tips the SEC has received through its program has been higher than expected.

© 2015 Investment Executive. All rights reserved.