At the dawn of a new decade, the Canadian investment industry is leaving behind a tumultuous period for the global economy and financial markets. The industry enters the coming decade in a position of strength, and with greater focus on retail investors.

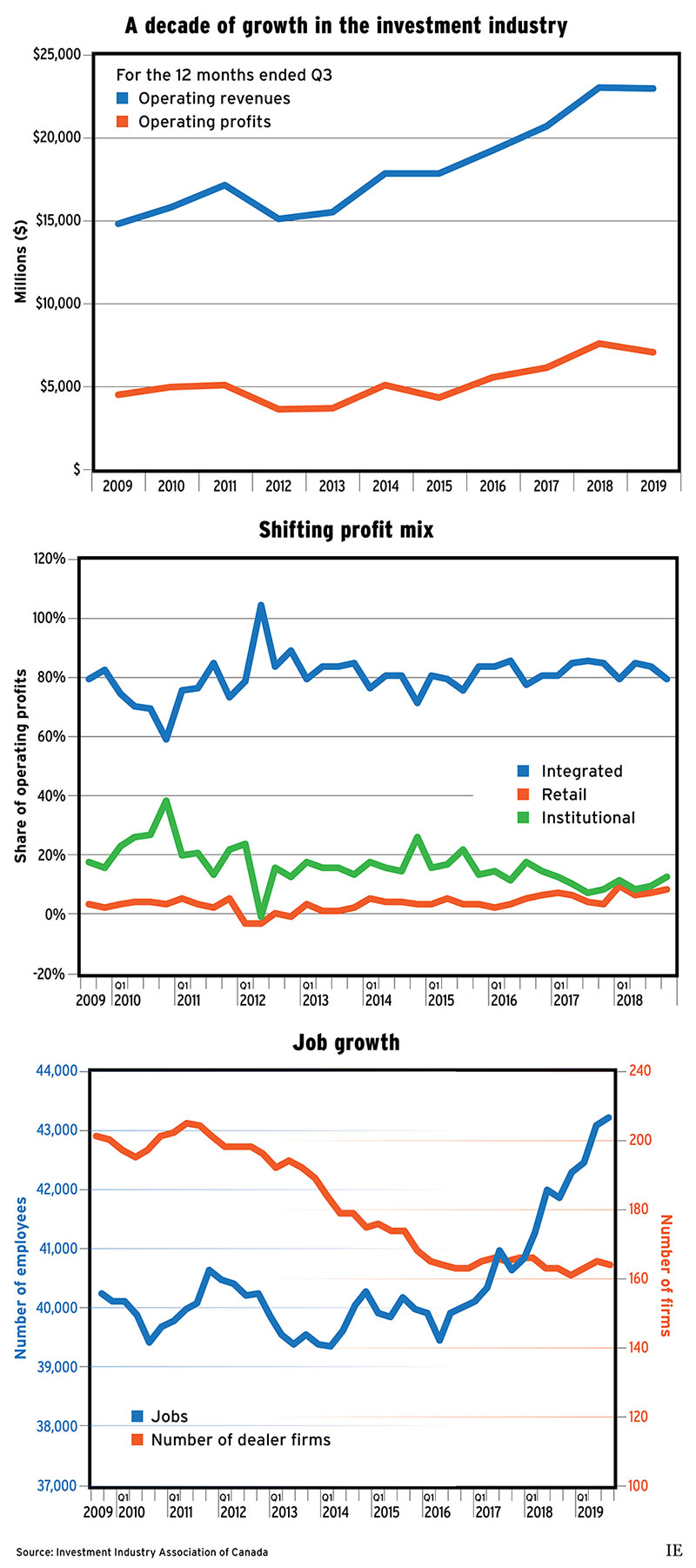

According to the latest data from the Investment Industry Association of Canada (IIAC), investment industry combined operating profits topped $7 billion for the 12 months ended Sept. 30, 2019, up by 40% from five years ago.

These record profits come on the heels of consistent revenue growth over the past decade. Total industry operating revenue is just shy of the $23-billion mark (for the year ended Sept. 30), up from less than $15 billion for the year ended Sept. 30, 2009.

In the immediate aftermath of the global financial crisis of 2008-09, industry revenue dipped, and it took several years to recover to pre-crisis levels. Since the industry regained that lost ground (in about 2014), top-line growth has continued steadily.

Against this backdrop of rising revenue and profit gains, the Canadian investment industry also has experienced significant contraction over the past decade.

For example, in 2009, there were more than 200 investment dealers operating in Canada.

Since then, that number has dwindled to 164.

The drop in the number of dealers is a result of firms leaving the business for a variety of reasons. Some firms fled the highly regulated investment dealer sector for the fast-growing exempt-market sector, while other dealers simply failed. Several dealers also have disappeared via acquisitions.

At the same time, there have been new companies entering the business, with the emergence of fintechs (such as robo-advisors) somewhat offsetting the decline in the number of traditional dealers.

The IIAC reports that more than 100 dealers have left the investment industry over the past 10 years, but the fact that the overall dealer firm population has dropped by less than 40 highlights the fact that dozens of firms have popped up.

So, while the dealer population may have thinned over the past decade, the industry is not in decline. Instead, it’s a business that’s evolving, particularly on the retail side.

At the beginning of the decade, stand-alone retail brokers (both full-service dealers and introducing brokers) accounted for about 13%-14% of industry revenue and 3%-4% of combined profits. Fast-forward to today and their share of revenue is about 18%, and they now account for 9%-10% of combined industry profits.

Overall, the IIAC estimates, almost two-thirds of industry revenue now comes from the wealth-management side of the business. Further, the IIAC’s report states, wealth-management revenue has more than doubled since 2009 to about $15 billion per year.

The large, integrated firms continue to dominate the investment business. And, while retail boutiques are gaining ground, foreign-based and domestic institutional boutiques’ share of industry revenue and profit have declined over the past 10 years.

Amid this shift to retail clients, industry employment is ramping up, too. Since 2009, the industry’s total head count has grown from slightly more than 40,000 to more than 43,000, according to the latest IIAC data.

About one-third of industry employment is accounted for by stand-alone retail firms; another 61% are located at the large integrated dealers; and just 5% of industry jobs are now at institutional boutiques.

At the same time, average productivity – as measured by revenue per employee – has grown, with robust revenue growth accompanying the rise in jobs.

At the beginning of the decade, the IIAC reported average productivity of slightly less than $400,000. This amount has climbed to more than $550,000 in the past year or so (although the number since pulled back slightly to $520,000 by the end of the third quarter of 2019).

Productivity has grown despite rising operating expenses in the industry. Annual operating expenses have stubbornly increased over the past decade, rising from a combined $6.6 billion in 2009 to more than $9.4 billion (the latter for the 12 months ended Sept. 30, 2019).

Rising regulatory demands and growing technology costs often are blamed for the increase in expenses, which include firms’ operating costs, but not the compensation paid to brokers. Yet, the steady rise in the industry’s running costs still are being outpaced by revenue gains.

This revenue is increasingly composed of fees, which have surpassed commissions as the industry’s single largest revenue source over the past decade. According to the latest IIAC data, about one-third of total revenue now comes from fees, vs about 23% from commissions (including mutual fund commissions, which are about 10% of overall revenue).

IIAC data indicate that commissions have largely remained flat over the past decade, whereas annual fee revenue has more than tripled to more than $8 billion per year over the same period.

The relatively stable, recurring nature of fees has helped the industry curb some of the market-driven volatility in revenue, which continues to affect certain segments of the business, such as investment banking and equities and fixed-income trading.

This growth in fee revenue reflects both a shift toward fee-based accounts and impressive growth in wealth-management assets over the past 10 years.

For example, mutual fund assets under management (AUM) have more than doubled since 2009 to more than $1.6 trillion as of Nov. 30, 2019. ETF AUM has grown even faster, albeit from a much lower starting point, jumping to more than $200 billion as of Nov. 30, 2019, from around $30 billion in 2009. Alongside the jump in fee revenue, net interest revenue also more than doubled over the past decade, rising to more than $2.2 billion in 2018 from less than $1 billion in 2009.

In addition, client margin debt has surged substantially over the past decade. While high household debt levels have long been a concern for the Bank of Canada and other policy-makers, the rise in Canadians’ indebtedness is not just a function of an inflated housing market; borrowing to invest jumped to more than $30 billion in late 2018 (before subsiding a bit in 2019) from slightly more than $11 billion as of the end of 2009.

In sum, the past decade has been transformative for the investment industry. While the number of firms has declined over the past 10 years, industry revenue has climbed, profits and employment are up, and the industry is continuing its shift toward serving retail investors.

Back in 2009, the global economy was emerging from an historic recession, prompted by a crisis that threatened to topple the financial services industry. At the beginning of this new decade, the investment industry is looking much different from the way it did 10 years ago – and much stronger.