Laura Paglia took the helm of the Investment Industry Association of Canada (IIAC) in August with an acute awareness of the challenges facing the investment industry.

Under her leadership as president and CEO, Paglia said the IIAC will continue to lead in influencing industry policy amid the “lightning fast” change that’s taking place.

Monitoring the use of financial-technology innovation is a big item on Paglia’s to-do list. The IIAC wants to see technology that offers “simple solutions” and provides benefits to businesses and investors, she said. “The industry is making a massive investment in technology to improve systems and client relationships.”

That investment comes from all types of firms, Paglia said. And the terms “innovation” and “fintech” can have different meanings in different contexts. “There’s a joke: ‘You tell me “fintech,” and then tell me what you mean.’ There are so many aspects to it. There’s the client-facing aspect, the [back-office] operations, everything involved in the onboarding process and in identification and [anti-money laundering].”

Technology adoption is receiving significant attention from industry participants, and it is the future, Paglia said. That is why the IIAC offers a forum through which members can share best practices, and the association is working with regulators to monitor evolving technology.

The other issue at the forefront concerns environmental, social and governance (ESG) disclosures, an area in which the IIAC plans to offer events and communications.

The IIAC’s institutional members are familiar with ESG, Paglia said, but the area is gaining a higher profile beyond industry professionals: “We’re reaching an inflection point where ESG factors are becoming relevant to retail investors.”

On the regulatory front, one crucial initiative for the IIAC is the reform of Canada’s self-regulatory organizations (SROs). The association’s submission to the Canadian Securities Administrators last month urged that group of regulators to act quickly. At the same time, however, the IIAC called for a statement of principles confirming the new SRO’s “commitment to adopting a risk-based, balanced approach to regulation” that would be applicable to all types of firms and investors.

That’s not an easy task, Paglia said. A new SRO should provide greater access to all types of advice and products, she said, while ensuring rules are “proportionate” to lessen firms’ administrative burden.

Amid all this change, clear communication to all IIAC members remains paramount. That means reaching a wide variety of members.

“In addition to wealth management, our members are in broad areas of the market,” Paglia said. “[They] provide a diverse array of portfolio-management services, advisory and non-advisory, and they operate in both Canadian and global markets. We are truly broad and happy to be so.”

Before Paglia succeeded longtime IIAC CEO Ian Russell, she worked as a securities lawyer for 20 years, representing institutional clients, compliance officers, CEOs and registered financial advisors. She began at Torys LLP, where she was a partner for 10 years. Then, she was a partner at Borden Ladner Gervais LLP for almost eight years. (Both law firms are based in Toronto.)

A major focus of Paglia’s practice was on high-stakes proceedings, but she also handled claims tied to initial public offerings, insider trading and supervision.

The breadth of her experience is a boon, Paglia said, as her background helps her “quickly recognize a key issue and the appropriate, informed response.”

“I enjoy working with regulators,” she added, “and I believe in the markets and the industry. I love my job [and] practising in this area.”

For the year ahead, as “relentless” regulatory change continues, Paglia said the pace at which dealers are expected to meet new requirements should be more balanced with less duplicative regulation. She would like to see regulators do a cost/benefit analysis of regulatory initiatives before adding to firms’ administrative burden.

“If we were to touch base again in a year, I would like to see a new SRO in place,” she said. “I think that’s important for investors. Plus, continued healthy growth in the market and with investors, and the continuation of investor engagement that we’re seeing.”

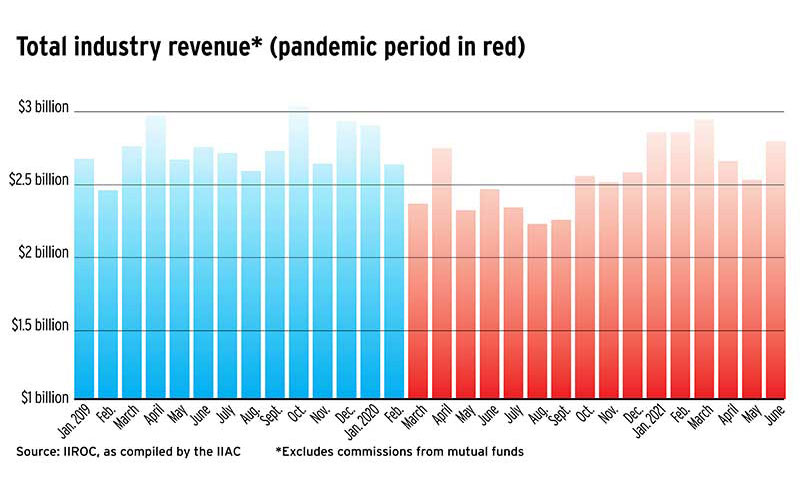

Growth in the IIAC’s membership isn’t one of Paglia’s targets, but the investment industry is experiencing massive growth, she said, with assets under administration among IIROC firms at an “all-time high” in 2021.

That’s due in part to more people “looking for ways to invest in the market. And investment today isn’t just for wealthy people, as the market has become more accessible to people across the board,” she said.

Alongside the intergenerational wealth transfer that’s underway from older to younger Canadians, women are controlling more of their families’ investable assets, Paglia said, “and that’s expected to continue.”

As investors become more diverse, Paglia added, firms and advisors will need to reflect those investors’ unique needs.

Workplace diversity in the industry is also on the IIAC’s watchlist. Although the organization doesn’t track industry diversity statistics, Paglia said, “What’s important to have and what the IIAC, along with its members, supports is an equitable and inclusive workplace.”

Click image for full-size chart