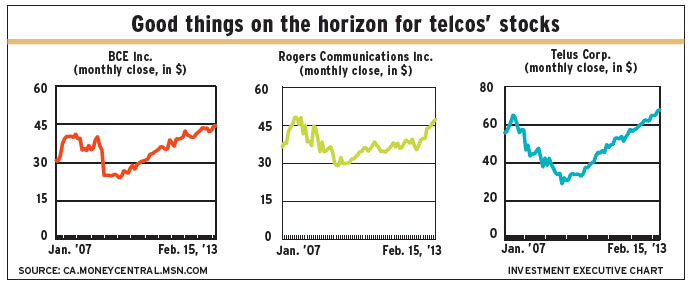

Although telecommunications services is a fast-changing sector, the Big Three Canadian providers – Montreal-based BCE Inc., Toronto-based Rogers Communications Inc. and Vancouver-based Telus Corp. – all benefit from the fact they are firmly entrenched, well managed and making the right moves. Add in their history of increasing dividends and you have three attractive investment opportunities.

These companies provide the same four basic services: land-line telephone services; wireless telephone and data services; Internet services; and television broadcast access services. The wireless segment is expected to be strong for all three, with land-line telephone businesses expected to suffer. That will mean moderate overall growth – although cost-cutting measures can protect and enhance margins.

Telus has the best prospects because it faces less competition in its Western Canada base, while BCE and Rogers compete in Central Canada. However, there is potential for upside surprises for both BCE and Rogers.

Analysts say that pricing for the four main services that these firms offer is rational – that is, without competitive price drops that destroy margins. All three firms offer price discounts for “bundling” services.

This approach not only lowers marketing costs, but customers who go for the full bundle are considered to be “sticky” and, thus, less likely to change provider, explains Troy Crandall, a telecom analyst with MacDougall MacDougall & MacTier Inc. in Montreal. In addition, all three telcos sweeten the pot by subsidizing the cost of the boxes required for TV viewing in order to get customers in the door. And as long as customers hang on to these devices for a few years, the firms make good money.

The strong prospects for wireless are based on expected increases in both penetration and transmission volumes. Furthermore, a few years ago, there were fears that new wireless entrants would take significant market share, but these concerns have dissipated as the newcomers have struggled.

Land-line services are in decline, but at manageable rates. Many young people have only cellphones, but older people aren’t ready to give up their land lines. And although a good deal of TV programming can be accessed through the Internet, consumers still need TV subscriptions to get current popular TV shows and live sports, which generally are not available online.

Another factor is that increased sourcing of TV programming uses up a lot of Internet capacity, which means the companies will get higher monthly fees from their Internet subscribers – and that will provide an offset to the lower revenue for land-line business, explains Ryan Crowther, vice president and portfolio manager in Calgary with Bissett Investment Management Ltd., a subsidiary of Franklin Templeton Investments Corp. in Toronto.

In addition, BCE and Rogers have been purchasing content-generating properties, so they will get revenue regardless of how viewers access TV programming. Both BCE and Rogers own radio and TV stations, and together bought a combined 75% stake in Maple Leaf Sports and Entertainment Ltd. – which owns the Toronto Maple Leafs, the Toronto Raptors and Toronto Football Club – and its sports channels last year. Rogers also owns the Toronto Blue Jays, while BCE has submitted a revised deal to purchase Astral Media Inc. to the CRTC. That is not, however, a route Telus plans to follow.

Both BCE and Telus have laid fibre-optic wire, which has much larger capacity for data transmission than cable does and requires less maintenance. Both these firms now are offering TV services through fibre-optic transmission, although Telus is ahead in this technology, both in finishing its fibre-optic network and in building a significant subscriber base.

Rogers’ cable network has had some success with technologies to increase cable capacity, says Crandall.

Here’s a look at the three companies in more detail:

– BCE inc. has the highest dividend yield – recently at 5.1% – of the three firms, but also has the least attractive business mix. A significant portion of Bell’s revenue comes from its land-line telephone business, while not much comes from TV. Bell also is less advanced on its fibre-optic network than Telus and will have to spend more money to complete it.

Crandall rates Bell stock as a “hold” because he expects the company to lag in growth, which “will limit dividend increases.”

Joe Mastrolonardo, portfolio manager with Mackenzie Financial Corp. in Toronto, believes Bell stock’s valuation is on the high side, but notes that Bell has been improving its margins in wireless, which were the lowest of the three firms; he expects this to continue.

An analyst report from Desjardins Securities Inc. in Toronto has a “buy” rating on the stock: “The market is underestimating the potential free cash flow growth that BCE can generate.”

According to that report, 5% earnings per share (EPS) growth a year is sustainable and the dividend should continue rising by 5% annually – and that’s without the Astral deal, which is expected to provide further upside. The report has a price target of $47.50 a share on the stock while Crandall’s target is $44 a share. The 775 million outstanding shares closed at $44.53 on Feb. 15.

Net income for the year ended Dec. 31, 2012, was $3.1 billion on revenue of $20 billion, up from net income of $2.6 billion on revenue of $19.5 billion in 2011.

– Rogers Communications Inc.‘s higher exposure to the wireless business gives it the best business mix, says Stephen Groff, portfolio manager with Cambridge Advisors, a unit of CI Financial Corp. in Toronto.

That said, Rogers has struggled in the past few years. It had the best wireless technology for years, but the others have caught up; this has resulted in Rogers having to lower prices while still losing market share. However, Crandall thinks that period of adjustment has ended and that Rogers’ margins will start improving.

Rogers president and CEO Nadir Mohamed has just announced that he will be retiring in January 2014. Most analysts don’t think this is negative for the stock. Says Crowther: “Rogers will have a strong lineup of candidates for this role and shouldn’t be challenged to fill the seat within the time frame.”

Crandall has a “buy” rating on the stock; it’s also Mastrolonardo’s favourite among the three firms.

However, a report from Desjardins sees “limited upside in the stock at this time,” given the expectation that Rogers will continue to underperform Telus and Bell in adding wireless subscribers, as well as uncertainty about who will succeed Mohamed and the stock’s premium valuation vs Telus and BCE.

The Desjardins report’s 12-month target price is $47.50 a share while Crandall’s is $51 a share. The 520 million outstanding shares closed at $47.32 on Feb. 15.

Net income for the year ended Dec. 31 was $1.7 billion on revenue of $12.5 billion, up from net income of $1.6 billion on revenue of $12.3 billion in 2011.

– Telus Corp. is in the best competitive position because it has a stranglehold in the fastest-growing market in the country, Western Canada. As well, its main competitor in this region, Calgary-based Shaw Communications Inc., is struggling. Crandall, who has a “buy” rating on Telus stock, notes that Shaw tried to launch a wireless service but it wasn’t successful.

Telus already has good market share in fibre-optic TV, and that’s growing. In addition, thanks to a partnership with Redmond Wash.-based Microsoft Corp., Crandall notes, Telus subscribers can use an Xbox 360 gaming console to access Telus programing, which means Telus has to subsidize boxes only for those without an Xbox.

The Desjardins report also has a “buy” rating on the stock, and notes: “Telus should continue to generate strong dividend growth as a result of organic growth and cost-cutting initiatives.”

The Desjardins report has a price target of $74; the 327 million outstanding shares closed at $67.81 on Feb. 15. Crandall’s price target also is $72.

Net income for the year ended Dec. 31 was $1.3 billion on revenue of $10.9 billion, up from net income of $1.2 billion on revenue of $10.4 billion in 2011.

© 2013 Investment Executive. All rights reserved.