There are glimmers of improvement in the U.S. housing market, but the situation is uneven across the country and there may be setbacks in some regions, according to a recent report from Toronto-Dominion Bank’s economics department in Toronto.

For example, prices have increased in both Arizona and Florida as a result of solid job growth and healthy demand from foreigners. Although the TD report says the gains in Arizona look like “the real deal,” it also warns that there will be renewed downward price pressure in Florida when the high level of foreclosures that are currently backlogged, either in the court system or the review process, hit the market and these homes start selling at their typical 20%-30% discount.

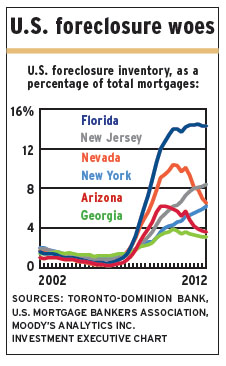

The foreclosure inventory – mortgages on properties in the foreclosure process as a percentage of total mortgages – was 14.3% in Florida vs 3.1% in Arizona as of March 31, 2012.

What matters in the near term for prices is the percentage of house sales attributed to foreclosures. In Florida, that share was almost 15 percentage points lower in the first quarter of 2012 than in the fourth quarter of 2010, but it obviously will increase when more foreclosures hit the market.

Georgia provides a vivid example of the impact of a sudden increase in sales of foreclosed properties. Its increase of almost 20 percentage points in sales of foreclosed homes is reflected in an 18% drop in Atlanta house prices for the year ended March 31. Fortunately for homeowners in Georgia, these price declines are probably temporary, given the state’s 3.1% foreclosure inventory.

As for Arizona, the TD economists don’t expect any adverse developments.

However, Florida and other states that have high inventories of foreclosed homes because of lengthy foreclosure procedures, such as New Jersey and New York, are likely to experience renewed downward price pressure.

© 2012 Investment Executive. All rights reserved.